BRICS Southeast Asia Expansion Hype Leaves Unanswered Questions

Plus Kremlin drills; subsea cable inroads; climate regression fears; nuclear caution; China divergence; giant mining gaps; big brands race and much, much more.

Greetings to new readers and welcome all to the latest edition of the weekly ASEAN Wonk BulletBrief! If you haven’t already, you can upgrade to a paid subscription for $5 a month/$50 a year below to receive full posts by inserting your email address and then selecting an annual or monthly option. You can visit this page for more on pricing for institutions, groups as well as discounts. For current paid subscribers, please make sure you’re hitting the “view entire message” prompt if it comes up at the end of a post to see the full version.

For this iteration of ASEAN Wonk BulletBrief, we are looking at:

Assessing the geopolitical and geoeconomic significance of the just-concluded BRICS Summit expansion hype and Southeast Asia’s place in it amid trends like Global South discontent and intensifying major power competition;

Mapping of regional developments, such as Kremlin drills; storm relief and new leadership pillar spotlight;

Charting evolving geopolitical, geoeconomic and security trends such as subsea cable inroads; climate regression fears and giant brand race;

Tracking and analysis of industry developments and quantitative indicators including nuclear caution; giant mining gaps; China divergence(s) and more;

And much more! ICYMI, check out our review of a new book by an ambassador and ex-premier on Xi Jinping’s centrality to China’s future foreign policy outlook and implications for Beijing’s Southeast Asia strategy.

This Week’s WonkCount: 2,168 words (~10 minutes)

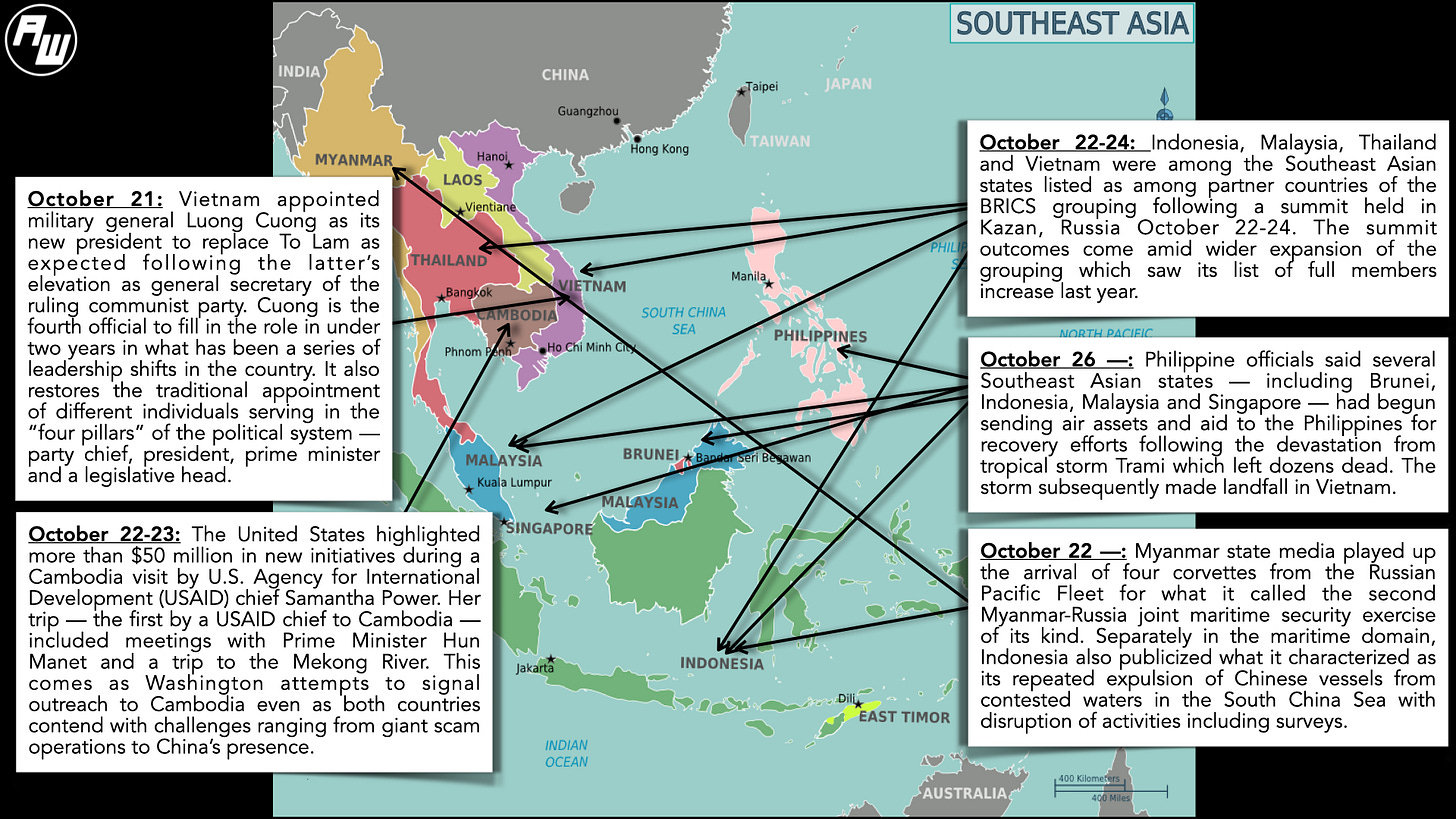

Storm Relief; Kremlin Drills; New Pillar Spotlight & More

Global Geoeconomic Futures; Navigating Multilateral Headwinds & Shifting Trade Prospects

“With global growth slowing down, what we observe is that actually ASEAN is outperforming trade in the rest of the world, “ IMF Managing Director Kristalina Georgieva noted in a press conference during the release of the Fund’s Global Policy Agenda 2024 amid the IMF and World Bank annual meetings. The latest iteration of the IMF’s World Economic Outlook has the “ASEAN 5” economies — Indonesia, Malaysia, the Philippines, Singapore and Thailand — growing at 4.5 percent in 2024 and 2025, which remains above the global projection of 3.2 percent for both 2024 and 2025 (see below). (link).

Overview of the IMF World Economic Outlook Projections (Percent Change)

“Looking ahead, under the leadership of President Prabowo Subianto, we look forward to Indonesia’s continued proactive role in navigating ASEAN through the complexities of a fragmented global economy,” notes a new op-ed by ASEAN Secretary-General Kao Kim Hourn in The Jakarta Post. The piece frames Indonesia’s leadership in the regional grouping within the context of four objectives to create a more integrated and resilient ASEAN: strengthening intra-ASEAN trade and investment; diversifying supply chains; embracing the digital and sustainable economy and preserving centrality and open regionalism (link).

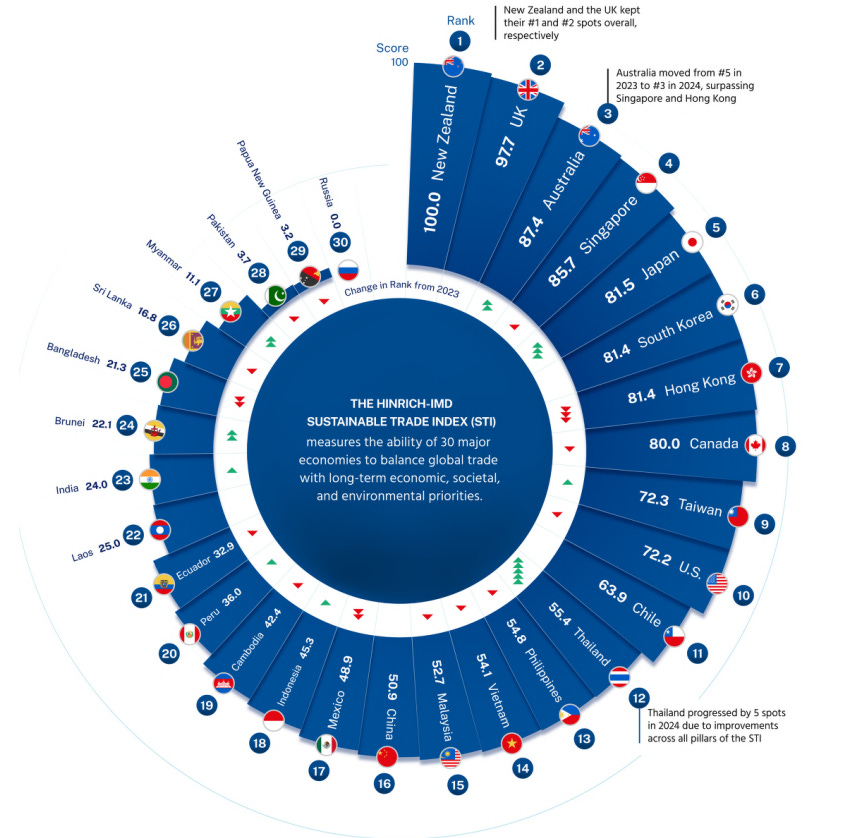

“[T]hailand gained three spots in the Sustainable Trade Index from 2022 to reach 12th place this year, Vietnam recorded a six-place rise,” notes the third iteration of the Sustainable Trade Index by the Hinrich Foundation and International Institute for Management Development which measures how trade contributes to economic, social and environmental outcomes for 30 economies. The top five economies are New Zealand, the United Kingdom, Australia, Singapore and Japan (link).

Graphical Depiction of Country Scores in the 2024 Sustainable Trade Index

BRICS Southeast Asia Expansion Hype Leaves Unanswered Questions

What’s Behind It

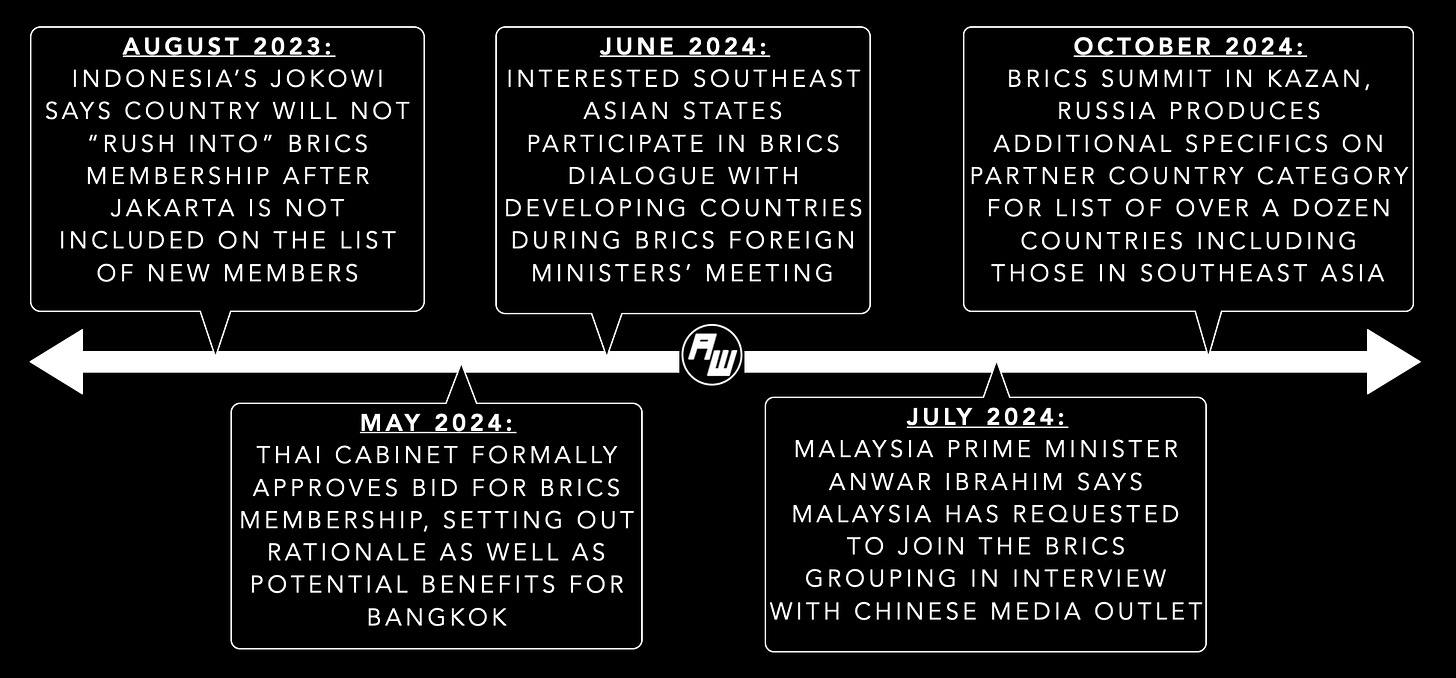

Southeast Asian states were on the list of partners following a summit of the BRICS grouping named after its initial members Brazil, Russia, India, China and South Africa1. ASEAN Wonk understands from officials that regional BRICS interest remains varied and greater than just the four key ASEAN states in focus at the recent BRICS summit in Kazan, Russia October 22-24 — Indonesia, Malaysia, Thailand and Vietnam — with a publicized case in point being Laos’ attendance2. BRICS membership is part of a broader story of a diverse region engaging across institutions. For instance, during the 2023-2024 period, Indonesia put in a bid to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership; the Philippines entered a trilateral with Japan and the United States; Thailand signaled efforts to join the Organization for Economic Cooperation and Development; and Laos applied for dialogue partner status in the Shanghai Cooperation Organization awarded to Myanmar and sought by Cambodia. But BRICS has received attention given that its cited weight is over a third of global GDP; China and Russia are both in it amid Global South discontent and U.S.-China competition; and Moscow is attempting to offset its Ukraine war isolation3.

Select Key Recent Developments Related to the BRICS Grouping and Southeast Asian States

The membership hype also spotlighted the complex expansion dynamics within BRICS itself. Officially, Russia, which hosted the BRICS summit as the grouping’s chair, was unsurprisingly long on the intersection between the BRICS agenda and Global South discontent but short on specifics such as the criteria for partner states and how admission was likely to proceed for specific countries4. ASEAN Wonk understands from officials familiar with the deliberations that this reflects behind-the-scenes maneuvering among existing group members, the evolving approach to institution management within BRICS and the differing approaches by individual aspirants. These messier realities are often masked by more caricatured pictures in other institutional contexts as well. A case in point is suggestions of Sino-Russian unity on the non-issuance of an East Asia Summit joint statement at the recent round of ASEAN summitry in Laos, which obscures the question of which culprit was truly blocking consensus.

Why It Matters

The BRICS Summit also highlighted positions of individual ASEAN states on membership as well as some of the key datapoints at play in the grouping amid regional and global developments (see originally generated ASEAN Wonk table below on future inroads to watch on areas and outcomes, as well as additional details on membership positions. Paying subscribers can also read on for more on what to expect and future implications in the rest of the “Why It Matters” and “Where It’s Headed” sections, along with remaining paid-only sections of the newsletter as usual)