ASEAN 2025 Agenda Launch in Laos Amid Malaysia Vision 2045 Quest

Plus new upgrades; drill networking; coming economic pact; new defense law; Cold War divisions; 5G rollout chatter; AI inroads and much, much more.

Greetings to new readers and welcome all to the latest edition of the weekly ASEAN Wonk BulletBrief! If you haven’t already, you can upgrade to a paid subscription for $5 a month/$50 a year below to receive full posts by inserting your email address and then selecting an annual or monthly option. You can visit this page for more on pricing for institutions, groups as well as discounts. For current paid subscribers, please make sure you’re hitting the “view entire message” prompt if it comes up at the end of a post to see the full version.

For this iteration of ASEAN Wonk BulletBrief, we are looking at:

Assessing the geopolitical and geoeconomic significance of ASEAN’s new 2025 agenda and major power inroads during just-concluded summit talks;

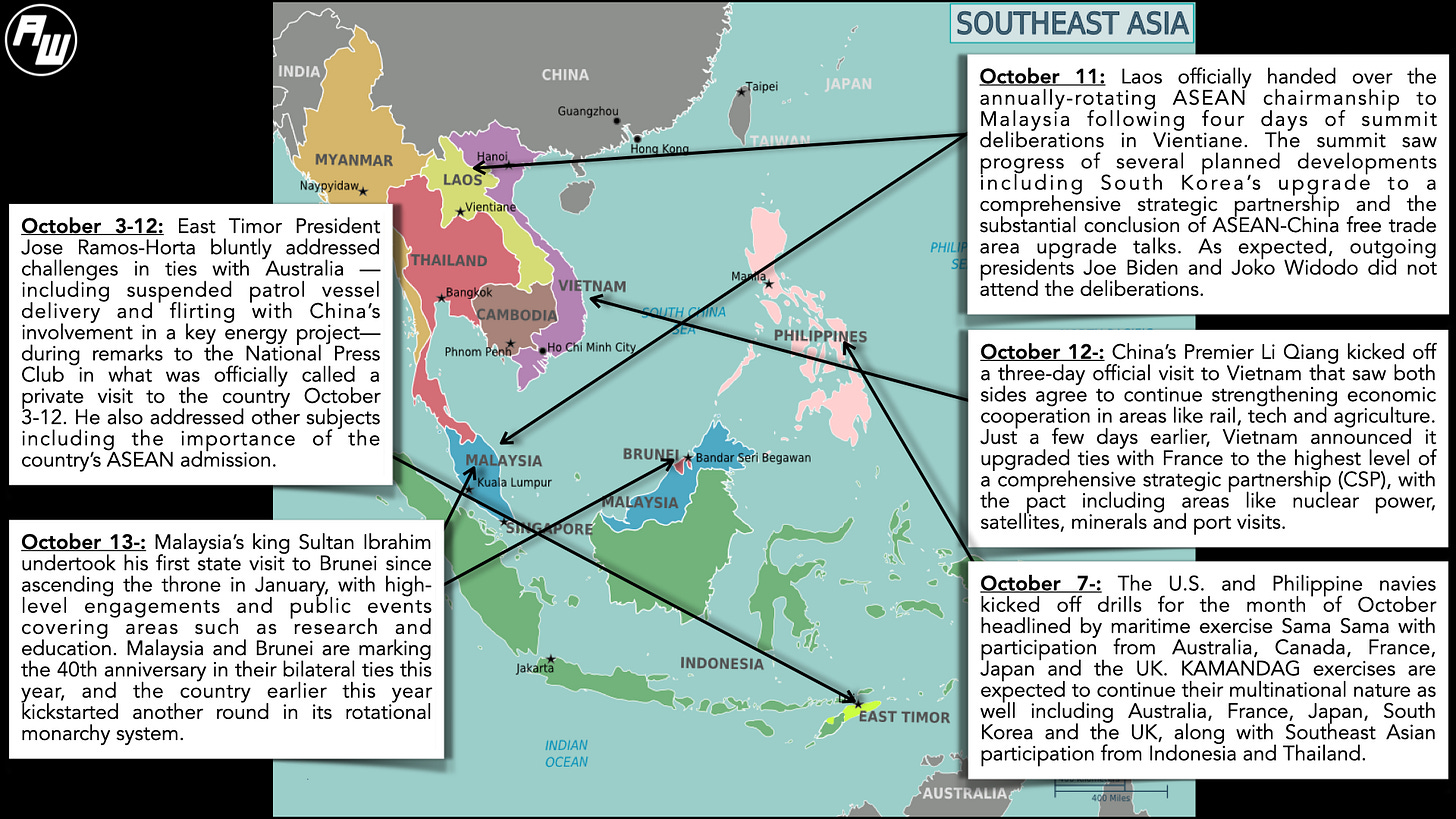

Mapping of regional developments, such as new partnership upgrades; drill networking and engagement management;

Charting evolving geopolitical, geoeconomic and security trends such as coming economic pact; new defense law; expanded coast guard and more;

Tracking and analysis of industry developments and quantitative indicators including 5G rollout chatter; fresh AI inroads; Cold War divisions and more;

And much more! ICYMI, check out our new ASEAN Wonk Podcast episode featuring a top government advisor on Japan’s Indo-Pacific engagement amid hype around an “Asian NATO” and its election cycle.

This Week’s WonkCount: 2,236 words (~10 minutes)

New Upgrades; Drill Networking; Major Power Management & More

New Investment Inroads; Global “Connector” Demise Talk & “Three Zeros” Competition Stakes

“Against the decline in global FDI inflows…among developing regions, ASEAN remained the largest recipient of FDI,” according to the newly-released 2024 ASEAN Investment Report. According to the report, ASEAN alone accounted for 17 percent of overall global inflows, up from 16.5 percent in 2022. Flows from the United States more than doubled to $74 billion, representing a third of all regional FDI, while China’s FDI inflows were growing as well especially in manufacturing, with an annual growth rate of 33 percent since 2020 (link).

Global vs. ASEAN Foreign Direct Investment Flows, 2021-2023 (In Billions of Dollars and Percentages)

“Countries like Vietnam have benefited from “connecting” major trading partners as global tensions rose, but the scope for playing such a role may be shrinking,” warns a new update from the World Bank on the role of connector countries amid intensifying major power competition. The report argues that the application of more stringent rules of origin may limit even a “one-way connector role” for economies, and that deep trade agreements with large partners may act as a more effective shield against the negative effects of restrictive trade and industrial policies (link).

Investment Inflows into Vietnam, Distribution by Select Sectors and Total Projects

“China can…consider implementing “three zeros” (zero tariffs, zero barriers, zero subsidies) for certain ASEAN countries,” suggests the China chapter in a new Asia Foundation report on how the United States, China and Southeast Asia can navigate challenges and capitalize on opportunities for regional cooperation. The report explores a series of areas on wider triangular collaboration that attempt to move beyond the “competition” paradigm (link).

ASEAN 2025 Agenda Launch in Laos Amid Malaysia Vision 2045 Quest

What’s Behind It

The latest ASEAN summit chaired by Laos saw the grouping try to make progress on tangible issues amid a challenging strategic environment. Malaysia’s Prime Minister Anwar Ibrahim, who chairs ASEAN in 2025, signaled a future-looking agenda ASEAN Wonk has noted around “inclusiveness and sustainability” that included broadening partnerships with regions like the Middle East and incorporating East Timor in the grouping’s first expansion since the 1990s1. One Malaysian diplomat told ASEAN Wonk the country’s approach next year would be “unapologetic” on both consistent principles and flexible opportunism2. Expected inroads were also made, such as South Korea’s expected upgrade to ASEAN’s highest partnership tier and firming up of the next phase of community-building Vision 2045 acknowledging new country initiatives like Vietnam’s Future Forum launched earlier this year3. Yet deliberations were also testament to deep challenges officials say Laos has been handling as best it can with quiet partner capacity-building during its 2024 chairmanship, despite some issues around optics and statement language4. Russia’s anti-Western tirades played up Southeast Asia representation at the upcoming BRICS Summit in Kazan, while Beijing and Washington spotlighted their competing digital visions amid South China Sea barb-trading and anxiety over Myanmar’s 2025 outlook5.

Select Recent Key Regional and Global Developments Around the Latest Round of ASEAN Summitry

The timing of this year’s ASEAN summitry also reinforced a dynamic where consequential forthcoming strategic developments affected agenda and attendance. Agenda-wise, the deliberate simultaneous scheduling of both 44th and 45th ASEAN summits in the first half of October in Vientiane, as opposed to the usual split pattern, meant greater publicization flood of intraregional and extraregional outcomes for officials to manage6. But timing also played into attendance dynamics, as evidenced by the expected absences of presidents Joko “Jokowi” Widodo and Joe Biden amid Indonesia’s upcoming presidential inauguration and high U.S. election stakes (Biden was represented by Secretary of State Antony Blinken, which, while far from ideal, cleared the low bar of a cabinet-level stand-in that saw a near regional boycott when breached in 2019, as some ASEAN diplomats still recall)7. Institutional management dynamics on climate and trade also played out ahead of November engagements. China touted progress on ASEAN trade pact upgrade talks, while Japan’s premier Shigeru Ishiba tried to bolster a key energy initiative in his ASEAN summit debut beyond hype around his “Asian NATO” rhetoric8. The November calendar includes Asia-Pacific Economic Cooperation (APEC) and Group of Twenty (G-20) meetings in Peru and Brazil respectively as well as global climate change COP29 talks in Azerbaijan.

Why It Matters

New summit outcomes highlighted some of the key domains and datapoint at play in major power engagements with ASEAN in 2025 more generally amid regional and global developments (see originally generated ASEAN Wonk table below on future inroads to watch on areas and outcomes. Paying subscribers can also read on for more on what to expect and future implications in the rest of the “Why It Matters” and “Where It’s Headed” sections, along with remaining paid-only sections of the newsletter as usual)