New Indonesia CPTPP Bid Puts Prabowo Geoeconomic Agenda in Focus

Plus new upgrade diplomacy; twin mineral boosts; new digital strategy; unpacking transition commitments; high-speed rail ambitions and much, much more.

Greetings to new readers and welcome all to the latest edition of the weekly ASEAN Wonk BulletBrief! If you haven’t already, you can upgrade to a paid subscription for $5 a month/$50 a year below to receive full posts by inserting your email address and then selecting an annual or monthly option. You can visit this page for more on pricing for institutions, groups as well as discounts. For current paid subscribers, please make sure you’re hitting the “view entire message” prompt if it comes up at the end of a post to see the full version.

For this iteration of ASEAN Wonk BulletBrief, we are looking at:

Assessing the geoeconomic significance of the evolving Indo-Pacific trade landscape amid Indonesia’s new Indo-Pacific membership bid;

Mapping of regional developments, such as new upgrade diplomacy; coming chair vision and bridging multilateral gaps;

Charting evolving geopolitical, geoeconomic and security trends such as twin mineral boosts; new digital strategy & unpacking transition commitments;

Tracking and analysis of industry developments and quantitative indicators including coming high-speed rail ambitions; big new legal delay and cross-border warning;

And much more! ICYMI, check out our review of a new book by an ex-senior US trade official on the future of US Asia trade policy beyond the upcoming presidential elections.

This Week’s WonkCount: 2,124 words (~10 minutes)

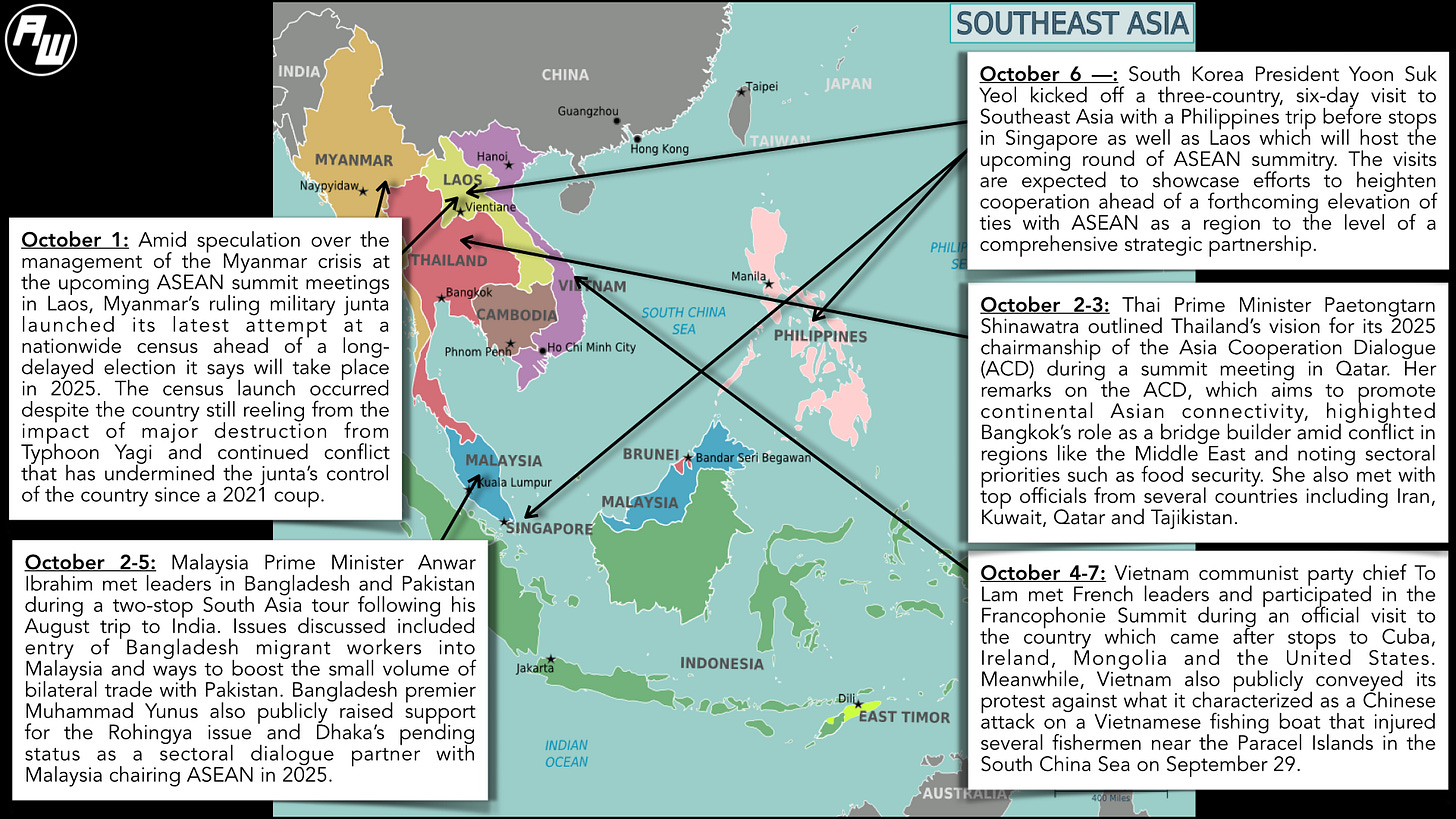

New Upgrade Diplomacy; Coming Chair Vision; Election Chatter & More

Geoeconomic Fallout; Fragmentation Fears & Bridging Multilateral Gaps

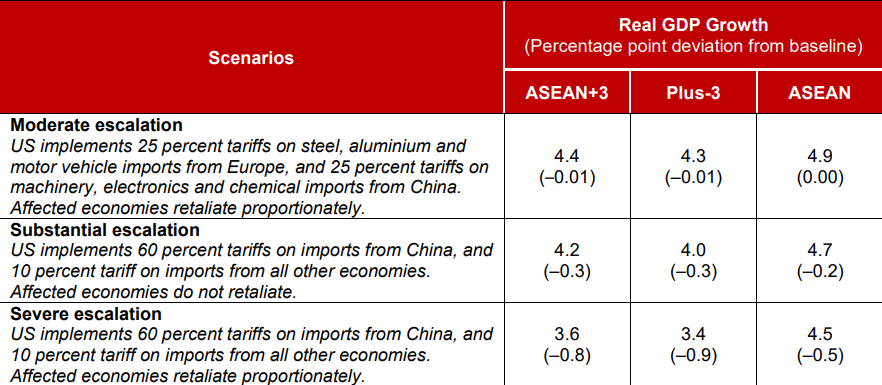

“[A] severe escalation of protectionist measures by the US, such as the implementation of universal tariffs on imports, could lower the region’s growth by almost 1 percentage point,” notes the new iteration of an assessment by the ASEAN+3 Macroeconomic Research Office. The report notes that this scenario would result in the lowest regional growth since the Asian Financial Crisis, with the exception of the pandemic years of 2020 and 2022 (link).

Scenarios of Escalation and Impact on ASEAN+3 Economies Amid New Protectionist US Measures

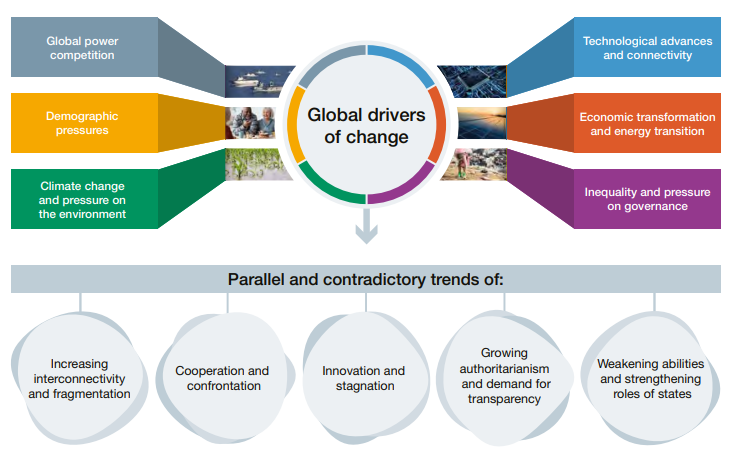

“Ultimately, the possibility of fragmentation due to differing levels of commitment on the part of member states should not be ruled out,” in both ASEAN and the PIF, argues a global assessment by the UK’s defense ministry out to 2055. The assessment examines futures affected by six drivers of global change (competition; demographics; climate change; technology; economic and energy transition; inequality and governance pressures) and five contradictions (interconnectivity and fragmentation; cooperation and controntation; innovation and stagnation; growing authoritarianism and more transparency demands; and weakening abilities and strengthening roles of states). It maps out four future worlds (multilateralism; network of actors; multipolarity and fragmentation) (link).

Graphic Illustrating Global Drivers of Change and Parallel Trends in Future World Forecasting

“Small states must continue to shape the rules and norms necessary for global governance, not least in the field of new and emerging technologies,” notes the foreword by Singapore’s Foreign Minister Vivian Balakrishnan in a report published via a partnership involving the Singapore government, the S. Rajaratnam School of International Studies and the International Peace Institute. The report notes various mechanisms through which small states can effect change, including through niche expertise, coalition formation and mediation in key areas like artificial intelligence and future thinking on the Sustainable Development Goals beyond 2030 (link).

New Indonesia CPTPP Bid Puts Prabowo Geoeconomic Agenda in Focus

What’s Behind It

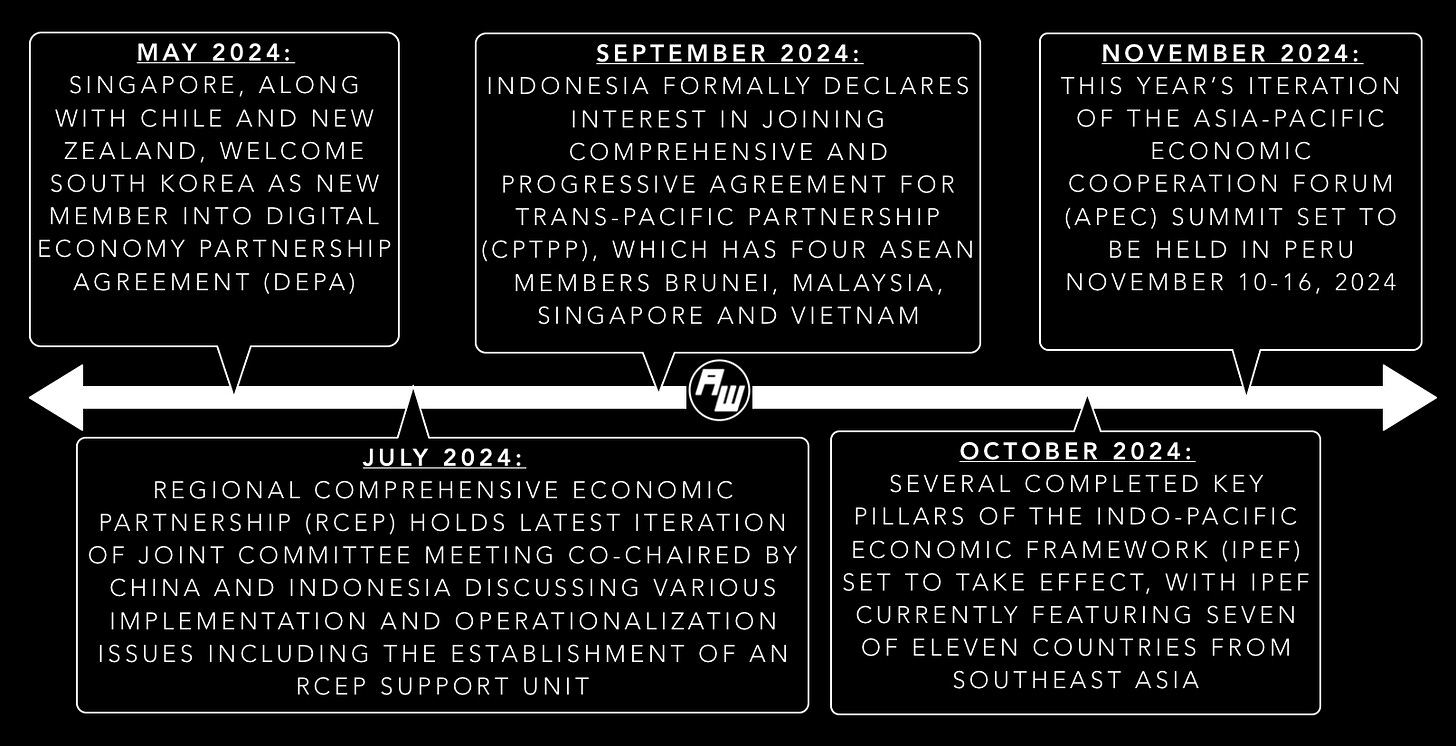

Indonesia announced on September 25 that it had formally submitted an official accession request letter to join a key Indo-Pacific trade agreement. As we discussed in a recent episode of our ASEAN Wonk Podcast, the evolving state of CPTPP membership is among the key threads in the Indo-Pacific geoeconomic conversation, with Washington leaving the pact it once led, China signaling its interest, and Britain’s acceptance as its first expansion candidate raising quesions about further additions1. The CPTPP, previously known as the TPP and renamed after U.S. withdrawal in 2017, is one of the world’s largest FTAs, with its current eleven full members (twelve including the UK) — with four ASEAN countries Brunei, Malaysia, Singapore and Vietnam — comprising more than 13 percent of world GDP2. While China’s potential entry tends to receive the most attention, wider interest is in fact already cross-continental nature, including Costa Rica, Ecuador, Ukraine Uruguay and Taiwan3. This has occurred amid the evolution of other pacts including the Digital Economy Partnership Agreement (DEPA), the Indo-Pacific Economic Framework (IPEF) and the Regional Comprehensive Economic Partnership (RCEP) — the world’s largest FTA with less comprehensive coverage relative to the CPTPP grouping all ASEAN states along with Australia, China, Japan, New Zealand and South Korea (see graphic below).

Select Recent Indo-Pacific Geoeconomic Developments Involving ASEAN Countries

The announcement marks another step in around a decade of speculation regarding Southeast Asian countries including Indonesia joining the pact. There have been multiple rounds of hype about whether other countries would join what is now called the CPTPP, including ASEAN states like Indonesia, the Philippines and Thailand. In the case of Indonesia, close regional observers will recall that outgoing President Joko “Jokowi” Widodo in fact publicly indicated Indonesia’s intent to join what was then the TPP back in 20154. Yet Indonesia saw no major movement towards full, formal membership for years, and public clarifications were made that preparations were not to be confused with a commitment to join5. Seen from this perspective, Indonesia’s request for CPTPP membership is significant in that this kicks off membership pursuit for what could be Southeast Asia’s first addition per official guidance on the accession process6. As with the case of Indonesia’s OECD bid submission, also gets the process kicked off before the transition from Indonesia’s outgoing President Joko “Jokowi” Widodo to President Prabowo Subianto who will be inaugurated October 20.

Why It Matters

The new bid also highlighted some of the key domains, policy areas and future datapoints at play in Indonesia’s calculations more generally amid its upcoming regional and global developments and a domestic transition (see originally generated ASEAN Wonk table below on future geoeconomic aspects to watch on specific areas and outcomes. Paying subscribers can also read on for more on what to expect and future implications in the rest of the “Why It Matters” and “Where It’s Headed” sections, along with remaining paid-only sections of the newsletter as usual)7.