How a Trump Second Term Could Reshape US Southeast Asia Policy

Plus subregional summitry; flashpoint violence; big 5G shock; coming chip fund; new cyber win; rare earth disruption; EV boom and much, much more.

Greetings to new readers and welcome all to the latest edition of the weekly ASEAN Wonk BulletBrief! If you haven’t already, you can upgrade to a paid subscription for $5 a month/$50 a year below to receive full posts by inserting your email address and then selecting an annual or monthly option. You can visit this page for more on pricing for institutions, groups as well as discounts. For current paid subscribers, please make sure you’re hitting the “view entire message” prompt if it comes up at the end of a post to see the full version.

For this iteration of ASEAN Wonk BulletBrief, we are looking at:

Assessing the significance of Donald Trump’s election for Southeast Asia and future prospects following our regional trip to the region as results were unveiled;

Mapping of regional datapoints, including subregional summitry; maiden voyage and flashpoint violence;

Charting evolving geopolitical, geoeconomic and security trends such as big 5G shock; coming chip fund and fresh dispute inroads;

Tracking and analysis of industry developments and quantitative indicators including new cyber win; rare earth disruption and EV boom;

And much more! ICYMI, check out our new ASEAN Wonk Podcast episode on India’s shifting stakes in Southeast Asia and the wider Indo-Pacific.

This Week’s WonkCount: 2,127 words (~10 minutes)

Subregional Summitry; Maiden Voyage; Middle East Violence & More

Tariff War Damage; AI Competitiveness & Bottom-Up Governance

“Proposed tariffs put forward by Donald Trump could reduce GDP in the United States by -0.64% and in China by -0.68% while the European Union would face a more modest reduction of -0.11%…other major emerging economies, including India, Indonesia and Brazil, would be much less negatively affected with GDP losses of -0.03%, -0.06% and -0.07% respectively,” according to newly published research by the London School of Economics. The lesser impact on emerging market economies is due to their exposure to only the universal tariff instead of the China-specific tariff, along with their relatively lower exposure to trade with the United States relative to China and the EU (link).

US Tariffs Under Trump Administration, Biden Administration and Proposed Second Trump Administration

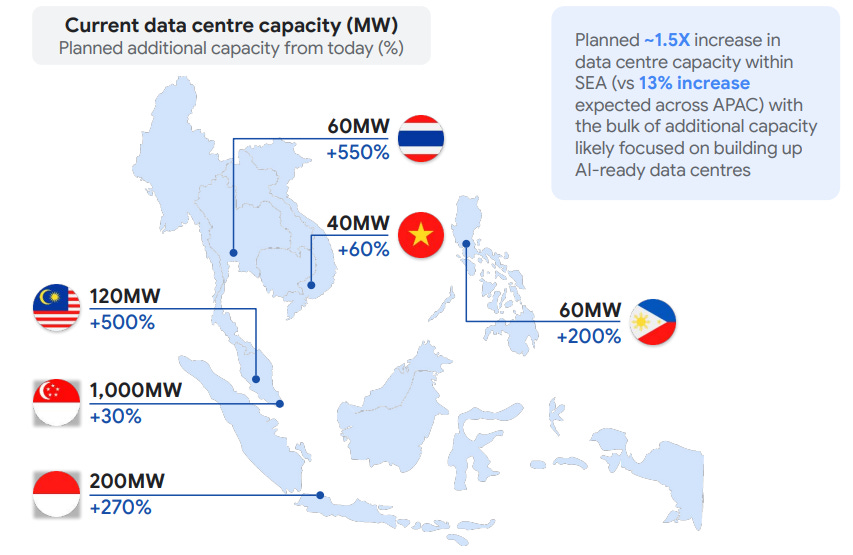

“Southeast Asia has a unique opportunity to compete in the global AI landscape,” notes a new iteration of an annual report on the state of Southeast Asia’s digital economy jointly released by Google, Temasek and Bain & Company. The report, which includes snapshots of various sector aspects and country profiles, notes several trends in the AI space including accelerated investments in data centers in the region (link).

Data Center Capacity and Planned Additions Across Select ASEAN States

“Local governments can be the primary body that understands local needs,” argues a new report on strengthening local government engagement in the Mekong published by the Asian Development Bank. The report specifies the rationale and benefits of local government involvement and includes recommendations for how to enhance participation in this regard (link).

Depicted Economic Corridor Map in the Mekong Subregion

How a Trump Second Term Could Reshape US Southeast Asia Policy

What’s Behind It

Unlike Trump's shock 2016 election, his 2024 return is seeing more prepared Southeast Asian states begin to shape pathways to safeguard their interests. ASEAN Wonk was struck by the contrast between 2016 and 2024 in engaging Southeast Asian officials during visits to 10 of the region’s countries this year, including our regional trip just as results were released. The stakes for Southeast Asian states are diverse but high, which is why, as one official put it, a Trump election — along with prolonged indecision on an outcome — were among the factors “baked into” scenario planning. Some high-deficit trade partners like Vietnam or Malaysia have been mentioned by those in Trump’s orbit as targets for redress, while others like Cambodia have been seen as falling too far into an emerging Chinese sphere of influence as Washington tries to construct an anti-hegemonic coalition to counter Beijing’s rise1. In this context, early responses from Southeast Asian states have stressed the current value and historical nature of ties with Washington amid concerns on greater transactionalism and unpredictability (see ASEAN Wonk graphic below). Malaysia and Cambodia referenced respective roles as ASEAN chair and U.S.-ASEAN dialogue partner coordinator2. Singapore Prime Minister Lawrence Wong reiterated in a congratulatory note to Trump that Singapore is the third-largest Asian investor into the United States, supporting over 270,000 U.S. jobs3.

Select Southeast Asia State Congratulatory Messages to Donald Trump After 2024 Election Results

The context for U.S. policy and Southeast Asia is also markedly different than it was nearly a decade ago when Trump took office. Surveys of the region indicate a reinforced focus on economic issues and sectoral opportunities in areas like climate or the digital economy, with a majority of countries seeing new leaders positioning their countries in the race for post-pandemic growth4. While the United States remains the leading security provider and investor, China is growing its influence in fields like trade and diplomatic presence and has made gains capitalizing on developments like the Israel-Gaza war to portray itself as the guardian of Global South interests5. In this context, even advocates of a stronger U.S. presence in Southeast Asia worry that a strategy that is too narrowly focused around countering China through mechanisms like security partnerships and economic restrictions — while not addressing pressing issues like climate change or crafting economic incentives — would not bode well for U.S. competitiveness vis-a-vis China. As Indonesia’s former ambassador to the United States Dino Patti Djalal noted ahead of the U.S. election, “To enhance its engagement, the United States must be relevant to a wide range of issues that are important to Southeast Asians”6. Trump’s first term saw some inroads on this front — including a stronger U.S. commitment to the Philippines in the South China Sea and an expanding U.S. Mekong strategy — but also concerns like U.S. withdrawal from the Trans-Pacific Partnership and disinterest in ASEAN.

Why It Matters

Trump's election also raises the question of key datapoints to watch with respect to major policies under a second term and the implications for Southeast Asian states as well as the region more generally (see originally generated ASEAN Wonk table below on notable developments on areas to watch, select major datapoints and key domains. Paying subscribers can also read on for more on what to expect and future implications in the rest of the “Why It Matters” and “Where It’s Headed” sections, along with remaining paid-only sections of the newsletter as usual).