ASEAN 2025 Security Agenda in Focus with ADMM and ADMM-Plus Meets

Plus new vision statement; coming EV inroads; giant defense breakthrough; biggest trade mission talk; emerging maritime framework and much, much more.

Greetings to new readers and welcome all to the latest edition of the weekly ASEAN Wonk BulletBrief! If you haven’t already, you can upgrade to a paid subscription for $5 a month/$50 a year below to receive full posts by inserting your email address and then selecting an annual or monthly option. You can visit this page for more on pricing for institutions, groups as well as discounts. For current paid subscribers, please make sure you’re hitting the “view entire message” prompt if it comes up at the end of a post to see the full version.

For this iteration of ASEAN Wonk BulletBrief, we are looking at:

Assessing the geopolitical and geoeconomic significance of just-concluded ASEAN defense ministers’ meetings and engagements with partner countries;

Mapping of regional developments, such as a new vision statement; diplomatic upgrade and rebel hype;

Charting evolving geopolitical, geoeconomic and security trends such as coming EV inroads; giant defense breakthrough and biggest trade mission talk;

Tracking and analysis of industry developments and quantitative indicators including coming maritime framework; new climate target; cross-border infrastructure chatter and more;

And much more! ICYMI, check out our review of a new book on Indo-Pacific stakes including in Southeast Asia of growing Indian Ocean contestation.

This Week’s WonkCount: 1,897 words (~10 minutes)

New Vision Statement; Diplomatic Upgrade & More

Gray Zone Wars; Tariff Dodging & Order Perceptions

“[A]lthough the United States seems to focus on and prepare for the contingency of a kinetic war against China, it risks losing a gray zone conflict in which China is able to effectively gain sovereignty over the South China Sea without ever having to fire a shot,” argues a new report on understanding and countering China’s maritime gray zone operations published by the RAND Corporation. The report includes a series of recommendations for how to counter China’s efforts, summarized in the gray zone logic model from China’s perspective below. These are divided into four primary pathways: 1) presence operations; 2) transparency initiatives; 3) building partner capacity; and 4) possible use of non-lethal weapons in a gray zone context (link).

Depiction of Gray Zone Logic Model From China’s Perspective

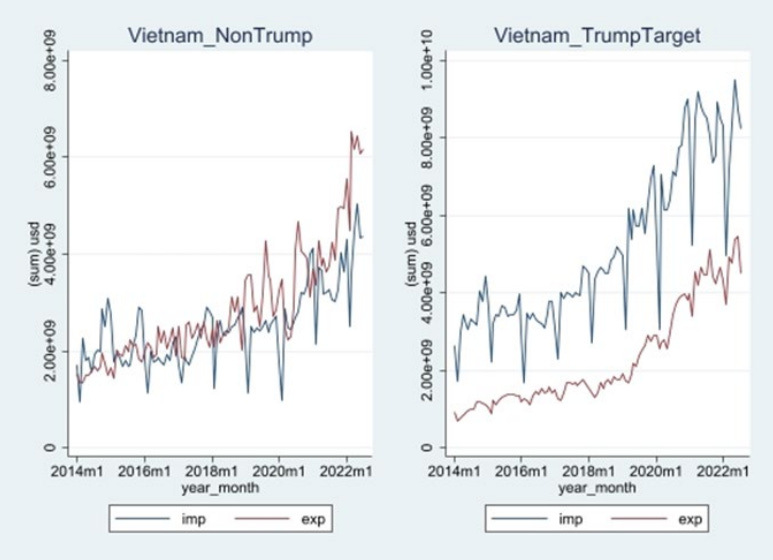

“With the extended period, there are some signs of roundabout trade for Mexico and Vietnam, indicating that, as time goes by, traders learn how to dodge Trump tariffs,” notes a newly-released paper on tariff dodging released by the Economic Research Institute for ASEAN and East Asia (ERIA) as speculation continues about tariffs under incoming U.S. President Donald Trump’s administration. The paper examines implications from an extended data set up to 2023 including select countries that are top U.S. import partner and Chinese export partner countries (link).

Visualization of Findings on Vietnam Imports from China and Exports to the US of Non-Trump-Targeted Goods and Trump-Targeted Goods

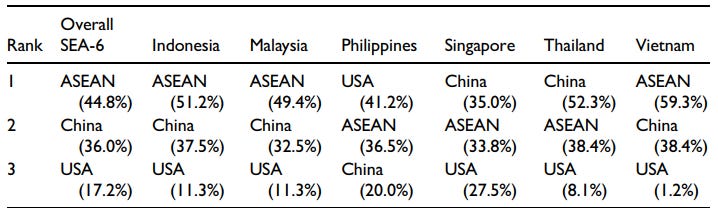

“[R]espondents in Singapore and Thailand view China as the most influential in their countries…the Philippines regards the United States as the most influential,” according to new elite survey findings published in the Journal of Current Southeast Asian Affairs. The findings suggest that while most elites view China as influential and having cultural affinity, they do not necessarily perceive Beijing as having the authority to preside over the regional order (link).

Depiction of Findings for “Top 3 Most Influential Country/Organization in the Respondent’s Country”

ASEAN 2025 Security Agenda in Focus with ADMM and ADMM-Plus Meets

What’s Behind It

ASEAN countries convened this year’s iteration of the ASEAN Defense Ministers’ Meeting (ADMM) and the ADMM-Plus with partner countries1. The meetings were convened in Laos, which is finishing up its ASEAN chairmanship year and Malaysia set to hold the position for 2025 which will officially usher in a new phase of regional community-building out to 2045. A majority of Southeast Asian states happened to be holding exercises during an active defense week, which included a range of dialogue partners such as Australia and China. U.S. and Philippine defense chiefs also finally inked a new foundational defense agreement that both sides had long identified as a key step forward in strengthening alliance architecture, even amid questions about how dynamics will proceed under the second term of U.S. President Donald Trump2.

The engagements spotlighted some key challenges dominating the ASEAN defense space. While the ADMM-Plus had grown to be regarded by key powers as being among the most promising regional security platforms in the 2010s, officials have also privately admitted that intensifying major power competition and managing post-coup Myanmar has complicated progress in recent years. Singapore’s Defense Minister Ng Eng Hen publicly captured some of this frustration playing out behind closed doors at the ADMM, noting that issues held at an impasse due to Naypyidaw’s sole objection risk “undermining the ASEAN centrality that we have painstakingly built” and that “the ADMM will lose credibility.”3 Both China and the United States also held iterations of separate informal defense ministers’ meetings with ASEAN in addition to the ADMM and ADMM-Plus meetings, even as the interactions were clouded by U.S.-China barb-trading over why their defense chiefs did not formally meet each other despite being present at the same venue4. One relatively undernoticed development was the public unveiling of the anticipated new U.S. defense vision statement for ASEAN, focusing on six areas: 1) domain awareness; 2) exercises; 3) education and training; 4) defense industry; 5) defense institutions; and 6) climate5.

Select Recent Southeast Asia Defense-Related Developments Amid ADMM and ADMM Meetings

Why It Matters

The meetings also pointed to key defense datapoints to watch in the ASEAN space and the implications for Southeast Asian states and the region (see originally generated ASEAN Wonk table below on notable developments on areas to watch, select major datapoints and key domains. Paying subscribers can also read on for more on what to expect and future implications in the rest of the “Why It Matters” and “Where It’s Headed” sections, along with remaining paid-only sections of the newsletter as usual)6.