New Vietnam Semiconductor Strategy Puts ASEAN Chip Race in Focus

Plus trilateral sideline meet; power pulse check; new nuclear roadmap; undersea minilateralism; coming cyber mechanism; big green setback and much, much more.

Greetings to new readers and welcome all to the latest edition of the weekly ASEAN Wonk BulletBrief! If you haven’t already, you can upgrade to a paid subscription for $5 a month/$50 a year below to receive full posts by inserting your email address and then selecting an annual or monthly option. You can visit this page for more on pricing for institutions, groups as well as discounts. For current paid subscribers, please make sure you’re hitting the “view entire message” prompt if it comes up at the end of a post to see the full version.

For this iteration of ASEAN Wonk BulletBrief, we are looking at:

Assessing the geopolitical and geoeconomic significance of ASEAN’s evolving chip race amid Vietnam’s new semiconductor strategy;

Mapping of regional developments, such as trilateral sideline meet; new submarine spotlight and fresh trade pact bid;

Charting evolving geopolitical, geoeconomic and security trends such as new nuclear roadmap; undersea minilateralism and coming cyber mechanism;

Tracking and analysis of industry developments and quantitative indicators including big green setback; maritime diversification quest and new investment facility;

And much more! ICYMI, check out our new podcast episode on Thailand’s foreign policy futures, including its approach to US-China competition and evolving BRICS-OECD twin bids under a new government.

This Week’s WonkCount: 2,136 words (~ 10 minutes)

Trilateral Sideline Meet; New Submarine Spotlight; Fresh Trade Pact Bid & More

Power Pulse Check; Regional Nuclear Perceptions & Coming Flashpoint Datapoint

“Southeast Asia’s heavyweights are getting heavier: Indonesia’s power has grown more than any other Index country since 2018,” notes the latest iteration of the Lowy Institute’s Asia Power Index. Indonesia, the Philippines and India recorded the greatest gains in this year’s index, which included East Timor for the first time. The index also captures other key trends, including Japan’s increased security activity; U.S. resilience and what is characterized as a “plateauing” of Chinese power at a level below the United States (link).

Asia Power Distribution for Key States Per 2024 Asia Power Index

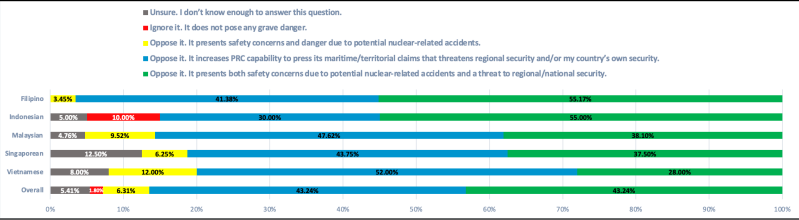

“Southeast Asian states have yet to connect China’s rapid nuclear weapons expansion to their own national security,” reads a new report published by the think tank Pacific Forum. The report finds that regional countries do not perceive a high probability of nuclear use in key scenarios like Taiwan or the South China Sea. That said, Southeast Asian states have varying degrees of concern with respect to individual scenarios, including one where China deploys floating nuclear power plants to artificial islands build in the South China Sea (link).

Potential Responses to China Deployment Floating Nuclear Power Plants to the South China Sea

“Pragmatism has always been strength of Malaysia’s foreign policy engagements, but it would be a mistake to confuse pragmatism for concessions that enable a junta that has no interest in meeting ASEAN halfway nor live up to the spirit of the ASEAN Charter,” argues a commentary published by the think tank ISIS Malaysia. The piece recommends Malaysia expand engagement to actors beyond the junta and strengthen the office and position of the ASEAN special envoy to Myanmar (link).

New Vietnam Semiconductor Strategy Puts ASEAN Chip Race in Focus

What’s Behind It

Vietnam Prime Minister Pham Minh Chinh signed a decision issuing Vietnam’s new semiconductor strategy on September 21 amid an active few weeks for the country’s international engagement1. As ASEAN Wonk noted following a trip to Hanoi earlier this month, semiconductors have been a key national priority and continued to surface in some of Vietnam’s major external interactions amid evolving regional developments (see graphic below). Cases in point this month include new chip funding highlighted during the first anniversary of the U.S.-Vietnam double upgrade as well as some of the tech-related engagements that recently-installed communist party chief To Lam had on the sidelines of United Nations meetings this past week2.

Select Semiconductor-Related Developments in Southeast Asia in the Month of September 2024

The strategy is also just the latest development to spotlight the broader ASEAN chip race underway between some of the region’s key economies. As we have noted previously in these pages, while nowhere near the dominance Northeast Asia has in semiconductor production — particularly Taiwan on high-end chips — Southeast Asia nonetheless plays an important, underappreciated role in the global chip industry3. Indeed, by one count, the region is the second-largest semiconductor exporter globally, accounting for nearly a quarter of world chip exports with five of its eleven countries being in the top 15 semiconductor exporter list4. Differentiated competencies by early movers like Malaysia or Singapore developed over decades5. Other markets like Vietnam, which see themselves as so-called “latecomers” relatively speaking, have sought to articulate strategies to build advantages in a competitive regional sectoral environment as we have seen in other areas like critical minerals and electric vehicles.

Why It Matters

The new strategy highlighted some of the key variables, components and datapoints at play in Vietnam’s calculations more generally amid regional and global developments (see originally generated ASEAN Wonk table below on future inroads to watch on areas and outcomes. Paying subscribers can also read on for more on what to expect and future implications in the rest of the “Why It Matters” and “Where It’s Headed” sections, along with remaining paid-only sections of the newsletter as usual)6.