Russia Submarine Hype Amid Philippines Maritime Contestation

Plus BRICS tariff wars chatter; minilateral bid snapshot; new artificial intelligence partnership; shifting EV competitive landscape; and much, much more.

Greetings to new readers and welcome all to the latest edition of the weekly ASEAN Wonk BulletBrief! If you haven’t already, you can upgrade to a paid subscription for $5 a month/$50 a year below to receive full posts by inserting your email address and then selecting an annual or monthly option. You can visit this page for more on pricing for institutions, groups as well as discounts. For current paid subscribers, please make sure you’re hitting the “view entire message” prompt if it comes up at the end of a post to see the full version.

For this iteration of ASEAN Wonk BulletBrief, we are looking at:

Assessing the geopolitical and geoeconomic significance of a Russia submarine sighting and the maritime contestation landscape with insights from recent discussions with officials in Manila and neighboring capitals;

Mapping of regional developments, such as BRICS tariff war chatter; stalled dispute talks and coming partnership sequel;

Charting evolving geopolitical, geoeconomic and security trends such as new artificial intelligence partnership; shifting EV competitive landscape and cross-regional geoeconomic flux;

Tracking and analysis of industry developments and quantitative indicators including cross-border SEZ dynamics; coming trade pact and mainland sectoral inroads;

And much more! ICYMI, check out our annual forecast of what to watch in 2025 in Southeast Asia geopolitics and geoeconomics. Thank you to those who have reached out to us with follow up inquiries, and please do reach out if you have additional insights or feedback!

This Week’s WonkCount: 2,127 words (~9 minutes)

Stalled Dispute Talks; Coming Partnership Sequel; BRICS Tariff War Chatter & More

The Dragon’s Shadow; Arms Futures & Minilateral Bid Snapshot

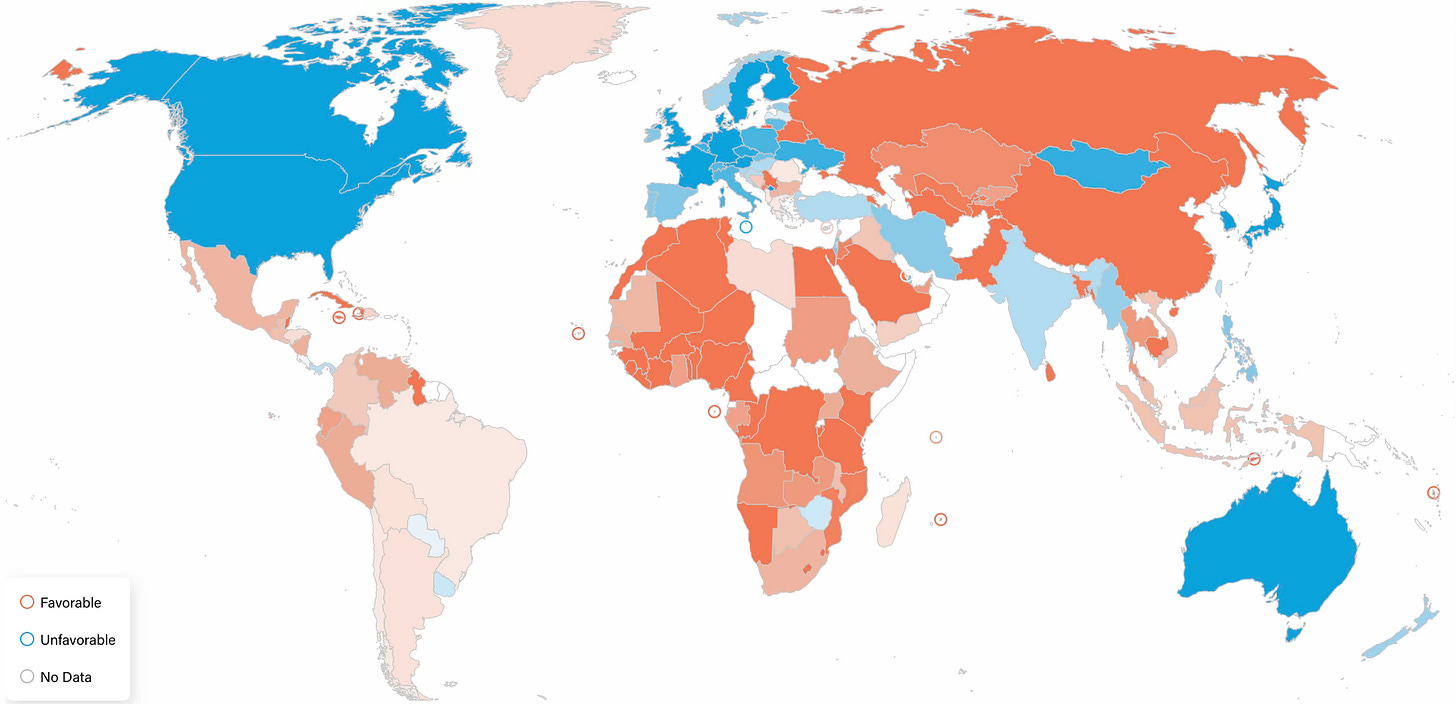

“China’s image…may even have improved in Southeast Asia,” in recent years even as it took a particular hit in other regions like Latin America, notes a newly-launched interactive website on global public opinion on China by the Asia Society Policy Institute. The website attempts to consolidate nearly 2,500 survey results from over 160 countries (link).

Depiction of Relative Distribution of Global Public Opinion on China

“The 23 companies based in Asia and Oceania in the Top 100 increased their arms revenues by 5.7 percent to $136 billion…companies in South Korea (+39 percent); Japan (+35 percent) and Taiwan (+27 percent) increased their arms revenues substantially,” according to new data released by SIPRI on the top 100 arms-producing and military-services companies. US and Chinese companies had the first and second largest aggregate arms revenues, though Chinese firms recorded their lowest level of growth (+0.7 percent) since 2019 due to “the country’s slowing economy.” (link)

Percentage Change in Arms Revenues of Companies in SIPRI Top 100 By Country (2022-2023)

“[E]xposure to global uncertainty remains high,” warns an economic survey of Indonesia issued by the Organization of Economic Cooperation and Development (OECD) released following Jakarta’s publicizing of its application to join the grouping which was the first from Southeast Asia at the time. The survey notes that while Indonesia has rebounded from COVID-19 and has weathered inflationary pressures, there are steps that should be taken across areas including monetary and fiscal policy, taxation, corruption and the climate (link).

Indonesia’s GDP Per Capita Relative to % of OECD Average By Year

Russia Submarine Hype Amid Philippines Maritime Contestation

What’s Behind It

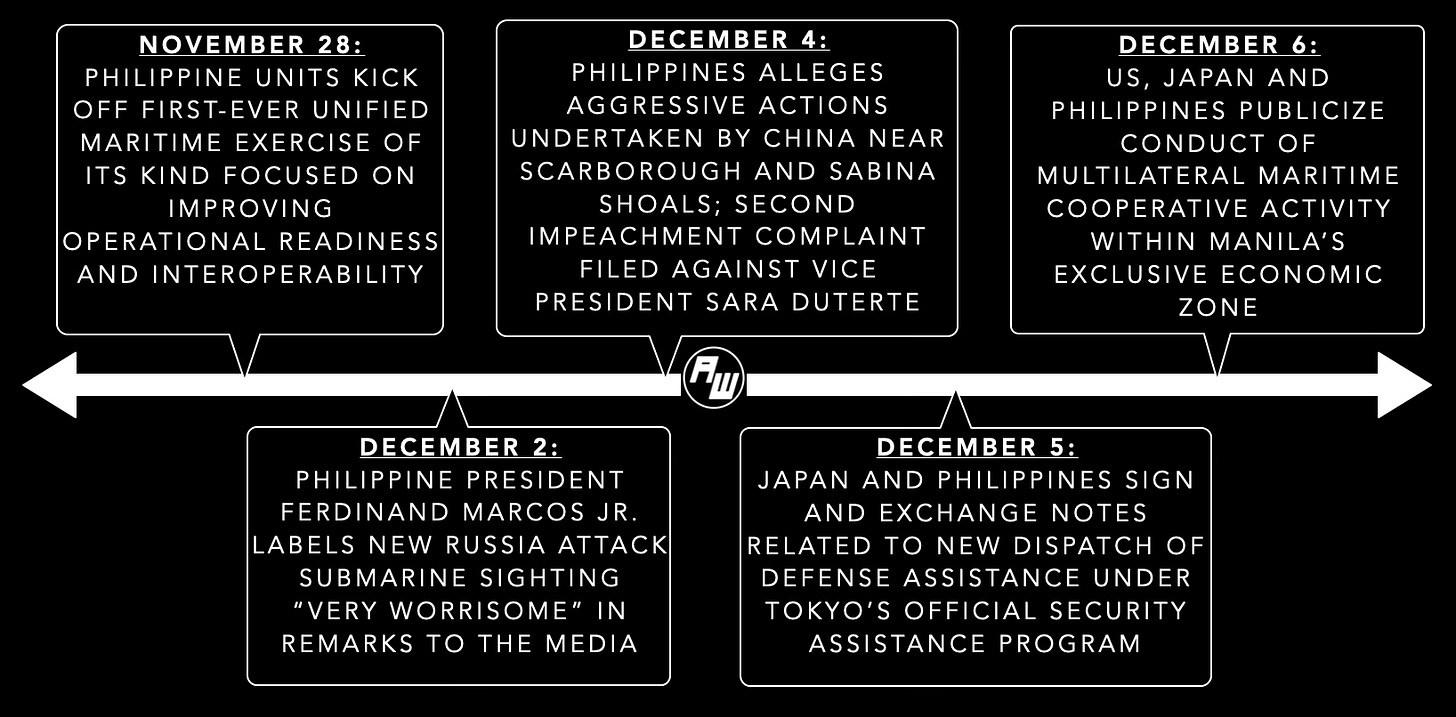

The new publicizing of a Russia submarine sighting by the Philippines reinforced the country’s position amid intensifying maritime contestation1. Beyond the development itself, which Philippine President Ferdinand Marcos Jr. characterized as “very worrisome,” one Philippine official also noted to ASEAN Wonk that Russia’s strong public response also pointed to the state of contestation “across domains” set to continue in 2025 which we also heard in conversations with policymakers in Manila during our recent trip there in November.2 This also occurred in the context of another active week in maritime developments involving the Philippines. Among these were the holding of trilateral maritime drills, the dispatch of new security assistance as well as a quick chorus of concerns by Manila’s partners following allegations against China in both Scarborough Shoal and Sabina Shoal (see graphic below)3.

Select Recent Maritime-Related Regional Developments Involving the Philippines

The engagement also spotlighted the broader question of Russia’s attempted inroads in its ties with Southeast Asian states more generally. Russia continues to find outlets for security cooperation with some states despite limits in its capabilities and concerns around its invasion of Ukraine and closer ties with China. Indeed, the past month or so has seen a series of developments that reinforce this point, including what has been characterized as the first-ever visit of Russian navy ships to the port of Kota Kinabalu in Malaysia as well as the first-ever joint naval exercises of their kind with Indonesia4. In these cases, Russian state media have played up the wider significance of some recent military drills despite their basic nature5. This has been accompanied by other non-military developments as well, including several Southeast Asian states announcing partnerships with BRICS in meetings Russia hosted in Kazan6. Close observers will also recall that Philippine officials have expressed concern about how growing Sino-Russian collaboration could affect Manila’s interests in the South China Sea7.

Why It Matters

The development also highlights key datapoints to watch in 2025 with respect to the major external partnerships that the Philippines has (see originally generated ASEAN Wonk table below on notable developments on areas to watch, select major datapoints and key domains. Paying subscribers can also read on for more on what to expect and future implications in the rest of the “Why It Matters” and “Where It’s Headed” sections, along with remaining paid-only sections of the newsletter as usual).