Can China APEC 2026 Shift ASEAN, Indo-Pacific Geoeconomics?

Plus new pre-summit commitments; first semiconductor facility boost; new nuclear update; maritime fund launch; quiet tariff group setup and much, much more.

Greetings to new readers and welcome all to the latest edition of the weekly ASEAN Wonk BulletBrief! If you haven’t already, you can upgrade to a paid subscription for $5 a month/$50 a year below to receive full posts by inserting your email address and then selecting an annual or monthly option. You can visit this page for more on pricing for institutions, groups as well as discounts. For current paid subscribers, please make sure you’re hitting the “view entire message” prompt if it comes up at the end of a post to see the full version.

For this iteration of ASEAN Wonk BulletBrief, we are looking at:

Assessing the geopolitical and geoeconomic significance of China’s coming 2026 APEC host year and implications for the Indo-Pacific and Southeast Asia;

Mapping of regional developments, including new pre-summit commitments and minilateral geoeconomics;

Charting evolving geopolitical, geoeconomic and security trends such as quiet tariff group setup; first semiconductor facility and maritime fund launch;

Tracking and analysis of industry developments and quantitative indicators, including EV supply chains; nuclear update; rare earth dependence and more;

And much more! ICYMI, check out our ASEAN Wonk review of a recent book on a government advisor’s rare inside look on the geopolitics of managing China dependence and coordinating major power assistance.

This Week’s WonkCount: 2,258 words (~ 9 minutes)

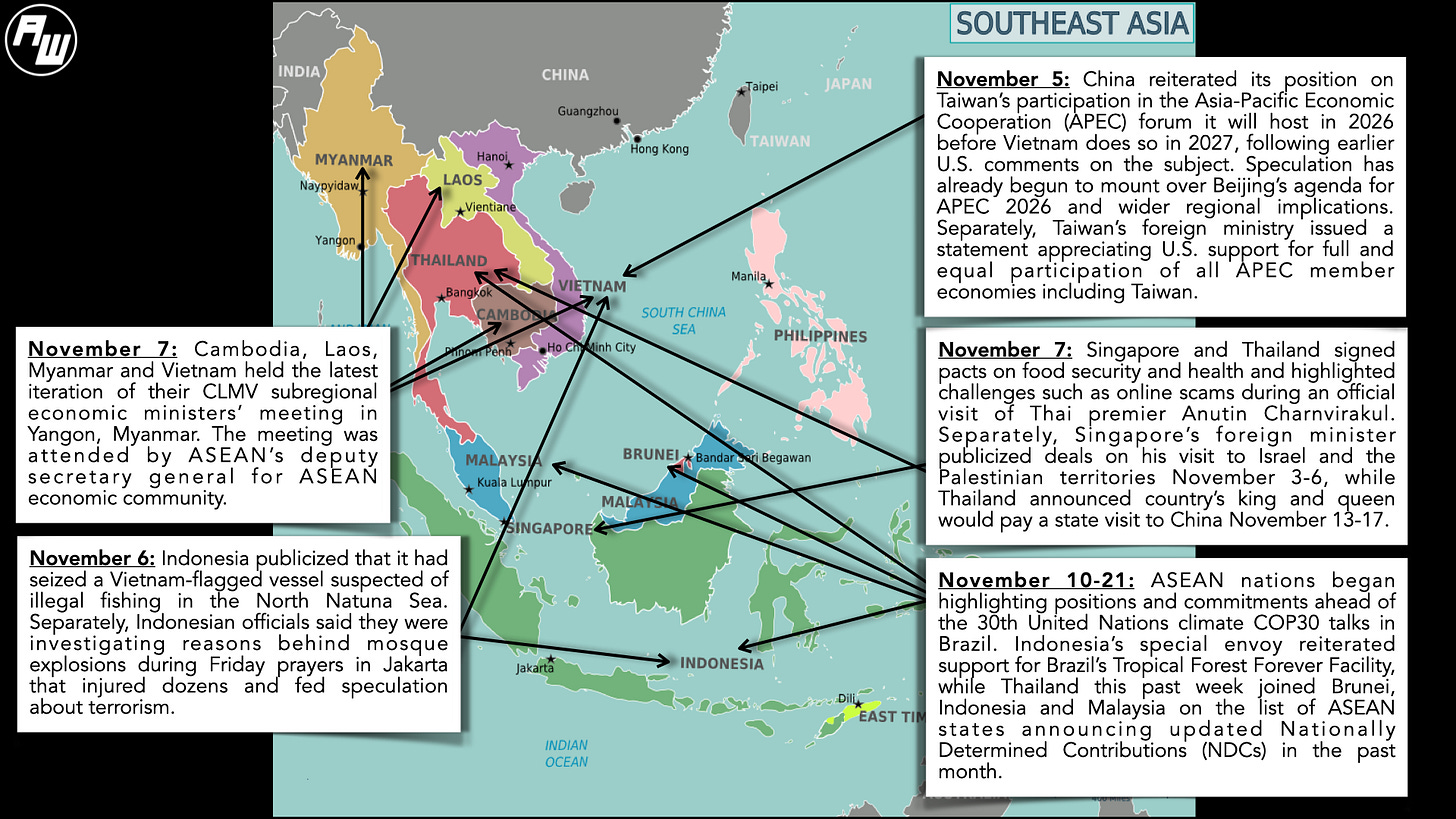

New Pre-Summit Commitments; Minilateral Geoeconomics & More

Sectoral Distributions; Giant Gaps & “Life and Death” Geopolitics

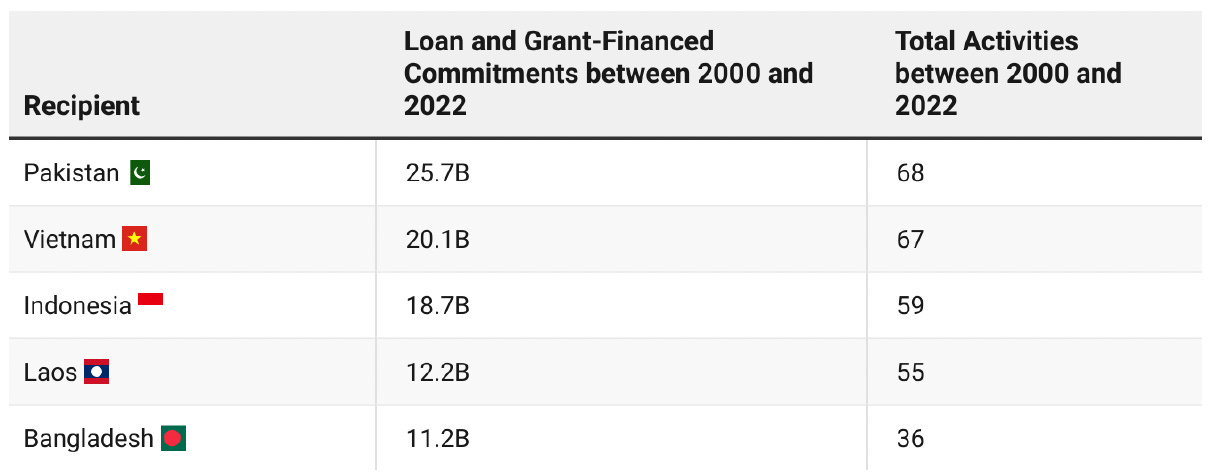

“China’s energy finance commitments in the Indo-Pacific are highly concentrated in a few key countries: Pakistan, Vietnam, Indonesia, Laos and Bangladesh…however, many of its international cooperation initiatives in the Indo-Pacific have specifically focused on ASEAN,” notes a new report published by AidData. The report assesses that in total, over 60 percent of China’s energy financing in the Indo-Pacific has been directed towards just the top three recipients: Pakistan, Vietnam and Indonesia (link).

Table Showing China’s Top Energy Finance Recipients In the Indo-Pacific Region

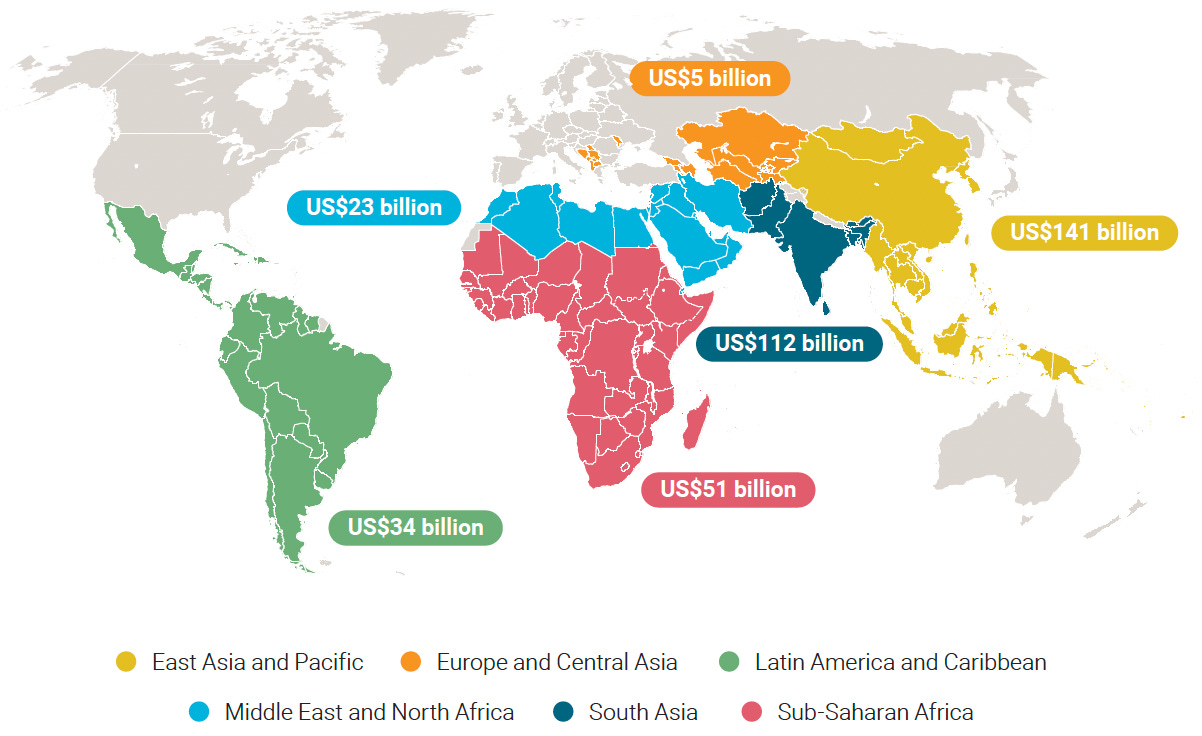

“[C]hanging geopolitical priorities and increasing fiscal constraints are making it more challenging to mobilize the resources needed,” according to the latest iteration of an ongoing report series by the United Nations which analyzes gaps in climate priorities produced ahead of the COP30 UN climate talks in Brazil. The report assesses that severe shortfalls exist, forecasting that the needs of developing countries by 2035 will be at least 12 times as much as current international public adaptation finance flows (link).

Graphic On Adaptation Finance Needs By Region

“Given the context, the question for all countries is not only which side to take, where to stand, but how to stand firmly, how to be autonomous. For Viet Nam this is a matter of life and death,” Vietnam communist party chief To Lam noted during a speech at Oxford University during a trip where Hanoi also upgraded ties with the United Kingdom to the highest level of a comprehensive strategic partnership (link).

Can China APEC 2026 Shift ASEAN, Indo-Pacific Geoeconomics?

What’s Behind It

The focus on China’s agenda for its APEC 2026 host year before the handoff to Vietnam in 2027 has already intensified following South Korea’s hosting of the APEC leaders’ meeting earlier this month. The barb-trading over Taiwan’s 2026 APEC participation is only part of anxieties already quietly expressed by officials about the trajectory of U.S.-China relations, with Trump expected to visit China next year and opportunities for high-level engagement (and breakdown) with the dual dynamic of China hosting APEC and the United States hosting the G-201. Beyond this aggregate reality, one regional official noted to ASEAN Wonk that these U.S.-China dynamics also play into how Southeast Asian countries “play or wait” in pacing high-level engagements with Washington heading into 2026, including the speed of concluding trade and sectoral pacts. This is especially since despite the hype around recently publicly released statements (for Cambodia, Malaysia, Thailand and Vietnam), “joint statements” and “joint statements on frameworks” need to be translated into actual agreements. The blowback in Malaysia is also an important reminder of sensitive domestic politics countries have to manage, even though the same government of Anwar Ibrahim now being accused of adopting too much of a “pro-U.S. tilt” was dismissed by some as being too “pro-China” and too fierce in its Gaza rhetoric just a few months ago.

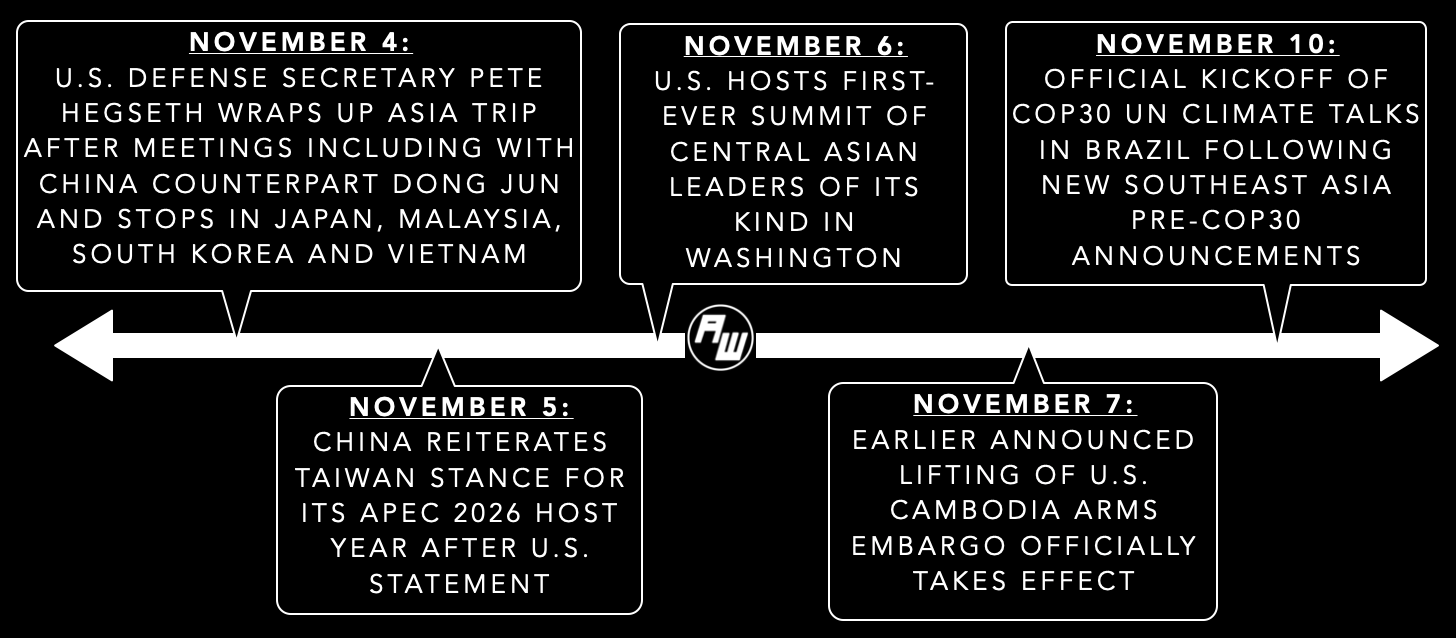

Select Key Geopolitical and Geoeconomic Developments Alongside Focus on Potential APEC 2026 Agenda Items

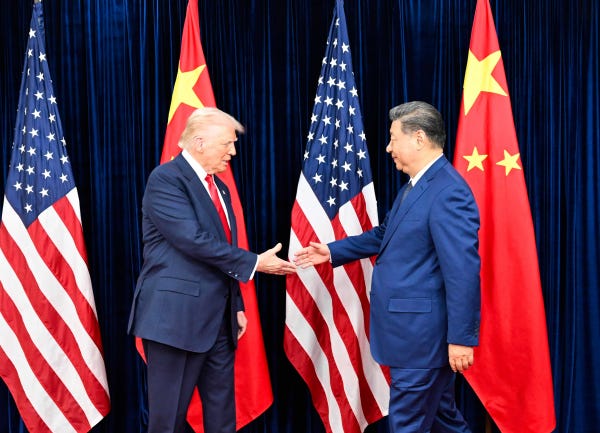

The proceedings and their aftermath also highlight the geoeconomic and geopolitical priorities and datapoints that lie ahead. As we have noted previously on ASEAN Wonk, this round of APEC meetings point to substantive prioritization of shared regional geoeconomic issues likely to recur in future years such as artificial intelligence and demographics, apart from the focus on the meeting of China President Xi Jinping and U.S. President Donald Trump2. Per one modeling estimate, the share of people aged 65 and over in the Asia-Pacific region is expected to nearly triple in percentage to 20 percent by 2050 from just 7 percent in 1990 on the back of twin demographic challenges of falling birth rates and aging populations, while artificial intelligence is projected to add up to nearly 4 percentage points to GDP as countries search furiously for growth drivers3.

Why It Matters

The inroads also point to priority datapoints to watch with wider regional as well as global implications (see originally generated ASEAN Wonk table below on notable areas to monitor and additional specifics. Paying subscribers can read on for more on what to expect and future implications in the rest of the “Why It Matters” and “Where It’s Headed” sections, along with paid-only sections of the newsletter as usual).