ASEAN Agrees New Geoeconomic Wins Amid Global Tariff Fears

Plus big Middle East tour; cross-continental nuclear pact; coming trade agreement; twin new digital laws; climate deal; mystery cyber attack & much, much more.

Greetings to new readers and welcome all to the latest edition of the weekly ASEAN Wonk BulletBrief! If you haven’t already, you can upgrade to a paid subscription for $5 a month/$50 a year below to receive full posts by inserting your email address and then selecting an annual or monthly option. You can visit this page for more on pricing for institutions, groups as well as discounts. For current paid subscribers, please make sure you’re hitting the “view entire message” prompt if it comes up at the end of a post to see the full version.

For this iteration of ASEAN Wonk BulletBrief, we are looking at:

Assessing the geopolitical and geoeconomic significance of newly-agreed ASEAN wins amid global tariff fears as well as their wider implications;

Mapping of regional developments, including big Middle East tour; new maritime security inroads and diplomatic upgrade chatter;

Charting evolving geopolitical, geoeconomic and security trends such as cross-continental nuclear pact; coming trade agreement and artificial intelligence cooperation hype;

Tracking and analysis of industry developments and quantitative indicators including twin new digital laws; climate deal; mystery cyber attack and more;

And much more! ICYMI, check out our ASEAN Wonk review of a timely new book on evolving U.S. perceptions in Southeast Asia as the second administration of U.S. President Donald Trump takes shape.

This Week’s WonkCount: 2,127 words (~10 minutes)

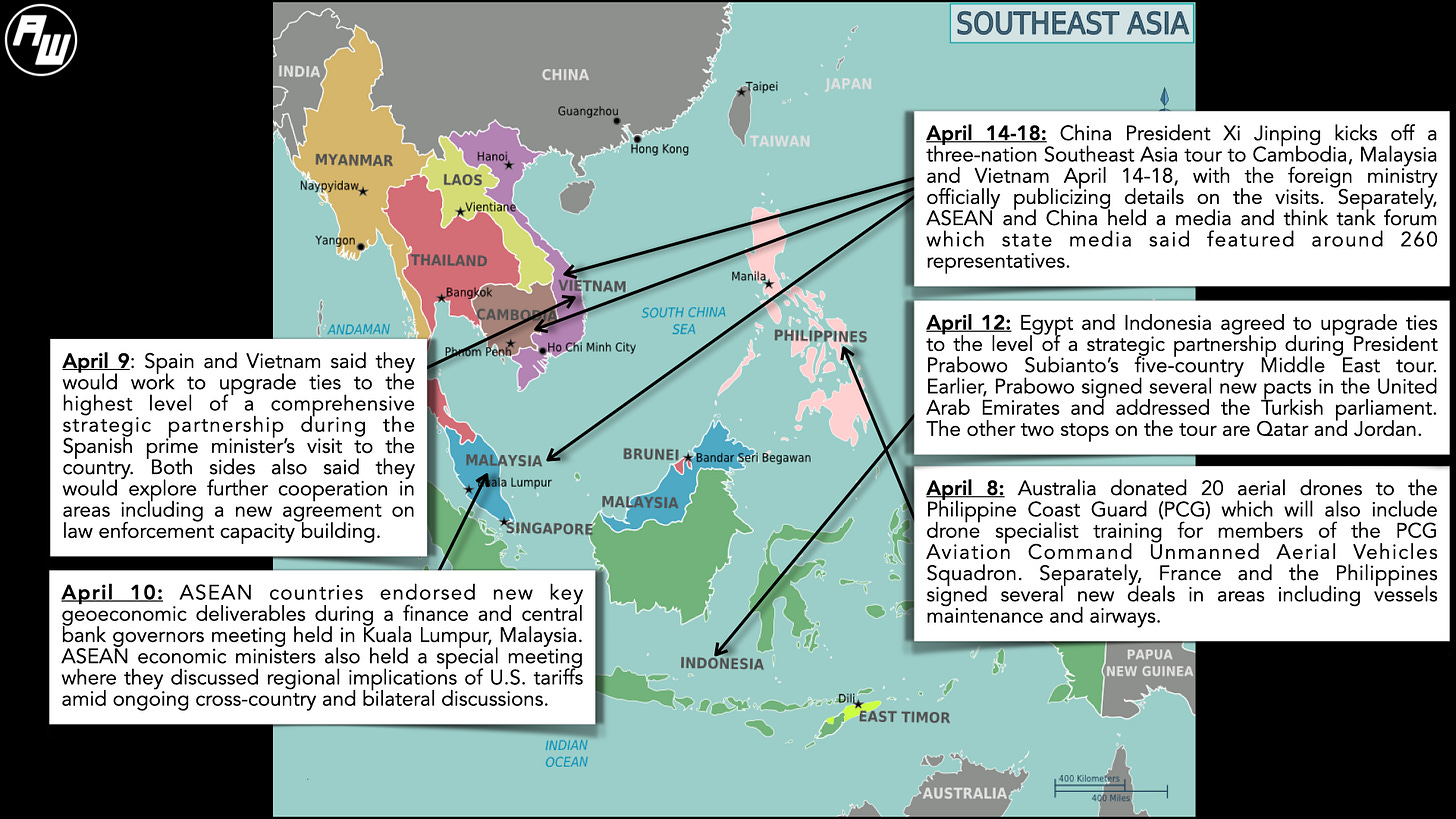

Big Middle East Tour; New Maritime Security Inroads & More

Resourcing China Competition; Transborder Management & Forecasting Climate Disruptions

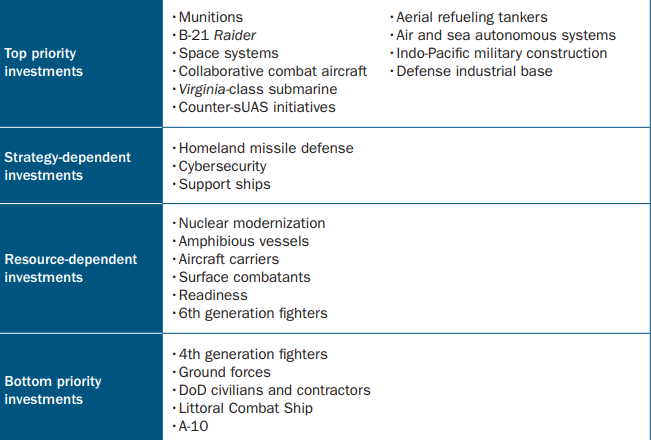

“In our exercise, teams embraced four orphans…munitions, air and sea autonomous systems, Indo-Pacific Command military construction, and counter small unmanned aircraft system initiatives,” according to a new report based on a U.S. multistakeholder exercise on how to approach the China challenge published by the Center for Strategic and Budgetary Assessments. The report finds that Washington needs to both spend more effectively and spend more on defense given the reality of two peer competitors in the nuclear domain, with defense investment divided into four categories: 1) top-priority investments; 2) strategy-dependent investments; 3) resource-dependent investments; and 4) bottom priority investments (link).

Categories Of Strategic Defense Investment Prioritization

“Rather than build physical barriers, India should address legitimate security concerns along its Myanmar frontier without disrupting the lives of transborder communities," argues a new report by the International Crisis Group on India’s evolving ties with Myanmar after the 2021 coup. The report suggests other recommendations including boosting collaboration with non-state actors in northeast India, investing in refugee services and bolstering engagement with the ruling junta’s opponents (link).

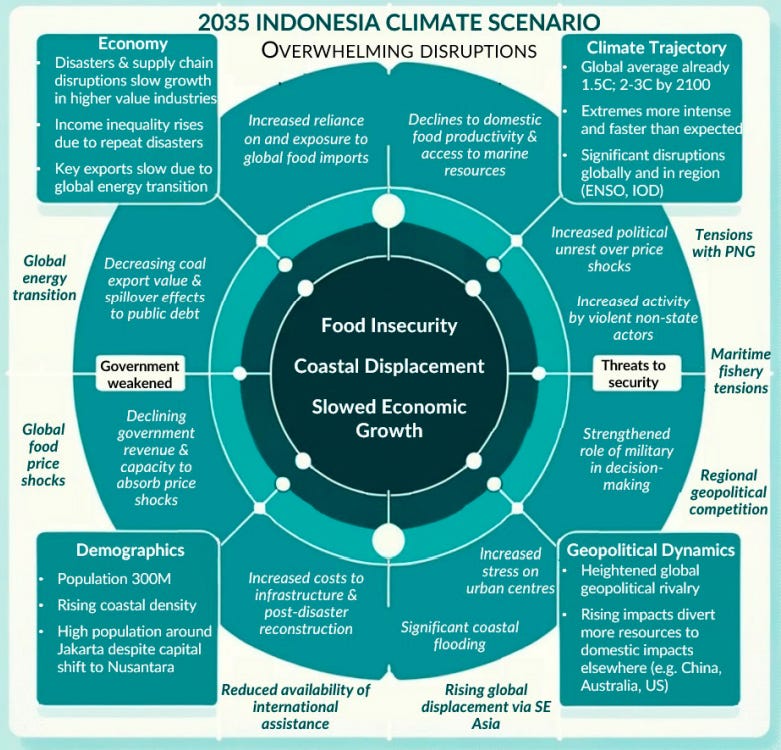

“A major finding of this research is that, in little more than a decade, Indonesia is likely to experience major climate disruptions that also amplify climate and security risks in the region, resulting in a range of additional and cascading risks,” per a new report released by the Australia Strategic Policy Institute on climate risks to Indo-Pacific security emerging from Indonesia out to 2035. The report details three categories of climate disruptions: food insecurity; coastal population displacement; as well as slowed economic growth (link).

Graphical Illustration Of 2035 Climate Disruption Scenario Forecast

ASEAN Agrees New Geoeconomic Wins Amid Global Tariff Fears

What’s Behind It

Southeast Asia finance officials set out priority geoeconomic areas at key meetings amid global growth anxieties linked to U.S. tariff policy. Malaysia Prime Minister Anwar Ibrahim as ASEAN chair reiterated the public line adopted by most Southeast Asian states thus far when he told an audience that he would avoid “megaphone diplomacy” on the tariff question even as various quiet diversification efforts would be expedited1. ASEAN Wonk understands that private discussions between Southeast Asian states and U.S. officials have been testier, including in the case of Vietnam which has been the first in line from the region to try to kick off bilateral negotiations with Washington2.

Select Key Recent Geopolitical and Geoeconomic Developments Amid Key ASEAN Economic Meetings

The engagements highlight the region’s continued quest for growth amid a more challenging geoeconomic environment. To date, data indicate that Southeast Asia for all its limits and geopolitical headwinds has still managed to maintain its geoeconomic position as an oasis for global growth and a magnet for foreign direct investment3. Yet U.S. tariff policy is already feeding into concerns that this could further worsen already downgraded growth outlooks for individual economies and the region as a whole to even below the 4 percent mark, which is a key metric for domestic regime legitimacy4. Further out, this could also affect the attempt by many regional governments to move past the so-called middle income trap via existing economic strategies out to the 2030s and 2040s. Moving past this trap is much more difficult than these publicized strategies may indicate — by one count, only over 30 countries have been able to do since the end of the Cold War with over 100 now stuck in this situation globally5.

Why It Matters

The key meetings also puts the spotlight on new geoeconomic initiatives to watch in the future as countries manage tariffs, growth uncertainty and wider regional and global dynamics (see originally generated ASEAN Wonk table below on notable indicators and additional specifics. Paying subscribers can read on for more on what to expect and future implications in the rest of the “Why It Matters” and “Where It’s Headed” sections, along with paid-only sections of the newsletter as usual).