Can ASEAN Shape its Maritime Sphere Amid South China Sea Tensions?

Plus new China Myanmar shadow government policy; Indonesia's foreign policy after 2024 polls; big defense deal delay; TikTok geopolitical fallout and much more.

Greetings to new readers and welcome all to the first 2024 edition of the weekly ASEAN Wonk BulletBrief! If you haven’t already, you can upgrade to a paid subscription below to receive our full posts.

For this iteration, we are looking at:

Assessing the impacts of a rare standalone ASEAN statement on securing its “maritime sphere,” including the South China Sea;

Mapping of regional developments including the first-of-its-kind Myanmar shadow government policy statement on China and Indonesia’s presidential debate on foreign and security policy;

Charting evolving trends such as on Southeast Asia’s climate change futures and Thailand’s defense diplomacy;

Tracking and analysis of industry developments and quantitative indicators including a big defense deal delay; new database rollout concerns and more;

And much more! ICYMI, check out our take on five critical things to watch in 2024 in Southeast Asia geopolitics and geoeconomics.

WonkCount: 1,817 words (~9 minutes reading time)

Dueling South China Sea Patrols; New Myanmar Shadow Government China Statement & More

Can ASEAN Shape its Maritime Sphere Amid South China Sea Tensions?

What’s Behind It

ASEAN foreign ministers issued a rare standalone statement reaffirming the need to strengthen stability in the “maritime sphere” and strengthen maritime cooperation, including the South China Sea. Though the statement unsurprisingly did not mention recent developments such as Chinese provocations against the Philippines by name, it made references to international maritime law and the stabilization of U.S.-China relations1. The statement was issued on December 30, during one of the last days of Indonesia’s holding of the annually-rotating ASEAN chairmanship before the transition to Laos2.

The statement came amid growing concerns within parts of ASEAN about the centrality of its maritime sphere. Forward-leaning states within ASEAN have been pressing for more action in the face of rising challenges in the maritime domain, including U.S.-China tensions spilling over into the South China Sea, illegal fishing and plastic waste management. In August, Indonesian Foreign Minister Retno Marsudi captured this anxiety when she told a key maritime forum that Southeast Asia’s maritime sphere risks becoming an “Epicentrum of Conflict”3. ASEAN has also faced growing pressure to respond to Chinese provocations against member states in the South China Sea. This includes using blinding lasers and water cannons against Philippine vessels; intruding into Vietnam’s exclusive economic zone for weeks at a time; and protesting energy exploration efforts by Indonesia and Malaysia. For some ASEAN states, the effects on commercial shipping triggered by Houthi attacks in the Red Sea are also a reminder of the broader maritime stakes at play4.

Why It Matters

The notion of a “maritime sphere” is part of an effort by some within ASEAN to increase the role for the grouping in addressing maritime-related questions including the South China Sea. While the standalone statement itself is new, close ASEAN watchers will note that the concept of a “maritime sphere” was mentioned in a brief paragraph in the ASEAN foreign ministers’ meeting joint communique in Jakarta in July5. That paragraph noted the need for strengthening stability and boosting maritime cooperation. Some of that involves institutionalizing new initiatives, including the first-ever ASEAN Maritime Outlook we analyzed back in August6. But part of it is also rooted in the grim recognition that ASEAN risks losing relevance if it is sidelined by major power contestation and minilateral initiatives by its own member states in recognition of the grouping’s impotence on questions like the South China Sea. One ASEAN official conveyed to ASEAN Wonk that while it may be seen as a modest effort to lift the “multilateral floor” on the South China Sea question, it is competing against simultaneous efforts to raise the ceiling with minilateral or bilateral initiatives7.

The development also capped a string of inroads by ASEAN in the maritime domain during Indonesia’s ASEAN chairmanship. As noted previously on ASEAN Wonk, in addition to the the issuing of the inaugural AMO, the chairmanship year also saw the holding of a ASEAN maritime exercise after a location adjustment; the fleshing out of the initial ASEAN Outlook on the Indo-Pacific with maritime cooperation as a pillar; and the passage of new ASEAN-China guidelines to accelerate seemingly never-ending negotiations for a code of conduct in the South China Sea8. See a brief snapshot of some of these key developments below.

Select ASEAN Maritime-Related Developments in 2023

Where It’s Headed

Looking ahead, traction on maritime-related initiatives will be important to monitor for the rest of 2024 and into 2025. ASEAN’s system of annually-rotating chairmanships between diverse members with differing interests means it can take a few cycles before initiatives can be considered institutionalized. This is particularly the case when some of the maritime-related ideas — such as a “maritime sphere” and periodic AMOs — are relatively new. Much of the immediate scrutiny in the headlines will be on Laos as the 2024 ASEAN chair, especially given its lesser maritime stakes as a landlocked, continental state bordering China. But beyond that, a more interesting question is what we may see in 2025 and 2026 with twin South China Sea claimants — Malaysia and the Philippines — chairing ASEAN consecutively (a rarity in the alphabetic rotation triggered by the grouping’s suspension of Myanmar from chairing in 2026)9.

A key subset of that will be the extent of movement we see on ASEAN’s South China Sea position (see our broader evaluation of flashpoints in the 2024 outlook). Beyond the scrutiny on any slippage during Laos’ ASEAN chairmanship in 2024, a key variable will be developments we see in the water in terms of China’s behavior towards key claimant states. Though the last quarter of 2023 saw the primary focus being on China-Philippine tensions, we could well see clearer multi-front assertiveness take shape during the new year as China recalibrates ties following notable 2023 events like Xi’s Vietnam visit as well as 2024 developments such as the emergence of a new Indonesian president expected to be inaugurated in the fourth quarter of the year.

Southeast Asia’s Climate Future; Thailand’s Defense Diplomacy & Malaysia’s Economic Outlook

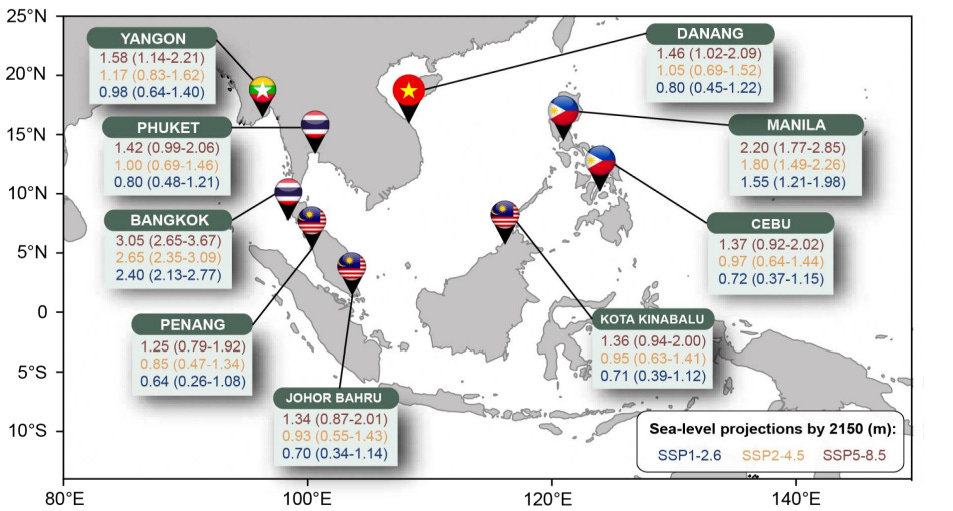

“Annual mean temperatures averaged over Southeast Asia land areas to increase by 0.5-5.4 degrees Celcius…sea level to rise across the region, but at different rates,” according to projections by Singapore’s newly-issued Third National Climate Change Study out to the remainder of the 21st century and beyond. Annual mean rainfall over Southeast Asia land areas is also expected to increase by between 2.6% and 13.4%. The report includes various infographics that delve deeper into trends at the regional and subnational levels (see example below on sea level changes in select cities) (link).

Projected Sea Level Rise in Select ASEAN Cities by 2150

“In Thailand, interactions at the military and defense ministry levels have consistently held a central role in the nation’s diplomatic endeavors,” notes a piece on Thailand’s defense diplomacy published as part of a dedicated volume on Thai foreign policy by the Journal of Indo-Pacific Affairs. The article examines six dimensions of Thai defense diplomacy — reception of foreign defense aid; joint exercises; defense education; international agreements; defense personnel contacts and international peacekeeping missions (see a table on the last aspect below). Other pieces in the volume look at a range of areas including the role of the military and alignment (link).

Thailand Involvement in External Support & UN Peacekeeping Missions (1950-2023)

“The prevailing gloomy global economic outlook—with IMF cutting global growth projections to 2.9% for 2024— will continue to be a challenge. Also, geopolitical risks stemming from the ongoing wars in different parts of the world will test supply chain resilience and put upward pressure on inflation,” notes an article forecasting Malaysia’s economic outlook in 2024 by Minister of Investment, Trade and Industry Tengku Zafrul Aziz (link).