Xi Visit, Trump Tariffs Hit Southeast Asia US China Balance

Plus new 2030 vision; fresh rail pledge; big sectoral pact; coming EV guide; new infrastructure roadmap; cross-continental digital deal & much, much more.

Greetings to new readers and welcome all to the latest edition of the weekly ASEAN Wonk BulletBrief! If you haven’t already, you can upgrade to a paid subscription for $5 a month/$50 a year below to receive full posts by inserting your email address and then selecting an annual or monthly option. You can visit this page for more on pricing for institutions, groups as well as discounts. For current paid subscribers, please make sure you’re hitting the “view entire message” prompt if it comes up at the end of a post to see the full version.

For this iteration of ASEAN Wonk BulletBrief, we are looking at:

Assessing the geopolitical and geoeconomic significance of new U.S. tariffs and Chinese President Xi Jinping’s coming visit on Southeast Asia’s US-China balance amid wider evolving regional and global dynamics;

Mapping of regional developments, including a new 2030 vision; foiled terror plot and Kremlin power inroads hype;

Charting evolving geopolitical, geoeconomic and security trends such as new rail pledge; pathfinding sectoral agreement and loan wars;

Tracking and analysis of industry developments and quantitative indicators including coming electric vehicle guide; cross-continental digital pact; new infrastructure roadmap and more;

And much more!

This Week’s WonkCount: 2,167 words (~10 minutes)

New 2030 Vision; Giant Terror Plot Uncovered & More

Shifting US-China Views; Quad Futures & Rocky Digital Road

“ASEAN-10 respondents have shifted again on the question of strategic alignment, with 52.3% favoring the US over China at 47.7% if the region were forced to choose,” according to the latest edition of The State of Southeast Asia survey report released by the ISEAS–Yusof Ishak Institute. 72.2% of respondents in Indonesia and 70.8% of those from Malaysia showed the strongest support for aligning with China, while support for aligning with the US was highest in the Philippines at 86.4% and then Vietnam at 73.5%. The analysis includes sections on a range of topics including perceptions of international developments, the major powers’ influence, trust in major powers and soft power (link).

Responses To “If ASEAN Were Forced To Align Itself With One Of The Strategic Rivals (US or China), Which Should It Choose?”

"The breadth of its initiatives has at once established the partnership as a premier minilateral forum in the Indo-Pacific as well as raised

concerns about the Quad stretching itself too thin across multiple lines of effort,” notes an analysis by the United States Studies Centre on the state of the Quad. The report examines opportunities, challenges and tradeoffs Quad members face to maintain relevance of their partnership (link)."Neither the United States nor China has a clear advantage in deploying regional subsea cable infrastructure," notes an analysis by Center for a New American Security that examines the Digital Silk Road and U.S.-China competition dynamics as applied to Indonesia. Subsea cables is regarded as one of several domains of competition, which also include data centers and cloud services as well as artificial intelligence (link).

Select Early Subsea Cable Projects And Links to China-US-Southeast Asia Dynamics

Xi Visit, Trump Tariffs Hit Southeast Asia US China Balance

What’s Behind It

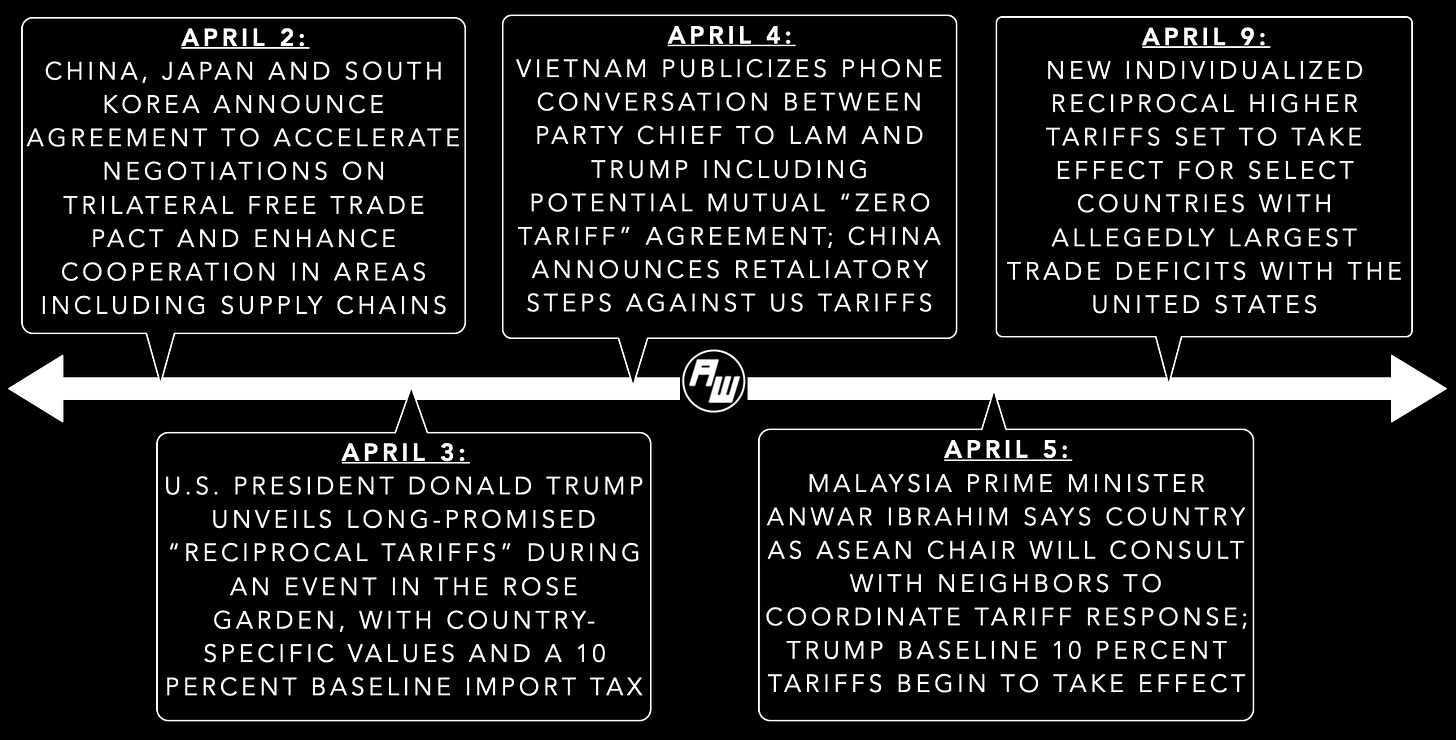

Southeast Asian states have begun articulating responses to expected and newly-announced U.S. tariffs affecting all ten ASEAN members1. The tariffs came just as build-up intensifies regarding Chinese President Xi Jinping’s long-speculated visit to several regional countries later this month with no shortage of agenda items ahead2. ASEAN Wonk was in Cambodia for a dialogue right before the tariffs hit where interlocutors consistently cited opportunities for the administration of U.S. President Donald Trump to positively engage the government even as events were also simultaneously being planned for Xi’s upcoming trip3. Other regional developments such as China-Japan-South Korea trade talks have also spotlighted evolving regional dynamics4.

Select Key Recent Geopolitical and Geoeconomic Developments Amid Southeast Asia US Tariff Fallout

The tariffs point to wider geopolitical and geoeconomic challenges Southeast Asian states face that extend beyond just the United States or China. Xi’s upcoming visit will feed into the narrative some Chinese interlocutors have been advancing about a so-called “window of opportunity” for Beijing to make inroads in Southeast Asia following U.S. tariffs, with Beijing already playing up notions of “zero tariffs” for lesser-developed states5. In truth, China poses economic challenges of its own, be it the risk of overdependence or being overly flooded by cheap imports which has prompted countermeasures6. Indeed, the trade challenge for several Southeast Asian states speaks to more of a need for what might be termed “dual U.S.-China derisking”: managing the impact of growing Chinese imports while diversifying away from the United States as a key export market which officials can be heard discussing more openly today. This will likely play out in ongoing bilateral talks as well as coming regional discussions, including U.S.-ASEAN engagements that officials say are in the works7.

Why It Matters

The development also puts the spotlight on how individual Southeast Asian states are navigating tariffs and the future negotiating datapoints to watch amid wider regional and global dynamics —- (see originally generated ASEAN Wonk table below on notable indicators and additional specifics. Paying subscribers can read on for more on what to expect and future implications in the rest of the “Why It Matters” and “Where It’s Headed” sections, along with paid-only sections of the newsletter as usual).