Historic US-Vietnam Double Upgrade: The Substance of Symbolism in the New Comprehensive Strategic Partnership

Plus the China-Southeast Asia military drills; new Australia-Philippines strategic partnership; critical minerals deal chatter and much more.

Greetings to new readers and welcome all to this edition of the weekly ASEAN Wonk BulletBrief! For this iteration, we are looking at:

Assessing the implications of the historic new U.S.-Vietnam double upgrade in relations to a comprehensive strategic partnership;

Mapping of regional developments including outcomes from the recent round of ASEAN summitry in Indonesia; the new Australia-Philippines strategic partnership and more;

Charting evolving trends such as on China’s military exercises in Southeast Asia and the challenges of supply chain diversification for countries in the Indo-Pacific Economic Framework (IPEF);

Tracking and analysis of industry developments including a new free trade pact; critical minerals deal chatter; Southeast Asia’s ongoing electric vehicle race and more;

And much more! ICMYI, check out our assessment of the significance of ASEAN Summit outcomes, with a focus on the grouping’s approach to the Indo-Pacific and how it may fare when the chairmanship transitions to Laos in 2024;

WonkCount: 1655 words (~8 minutes reading time)

New ASEAN Summit Outcomes; Australia-Philippines Strategic Partnership; Myanmar’s Elusive Election & More

Historic U.S.-Vietnam Double Upgrade: The Substance of Symbolism in the New Comprehensive Strategic Partnership

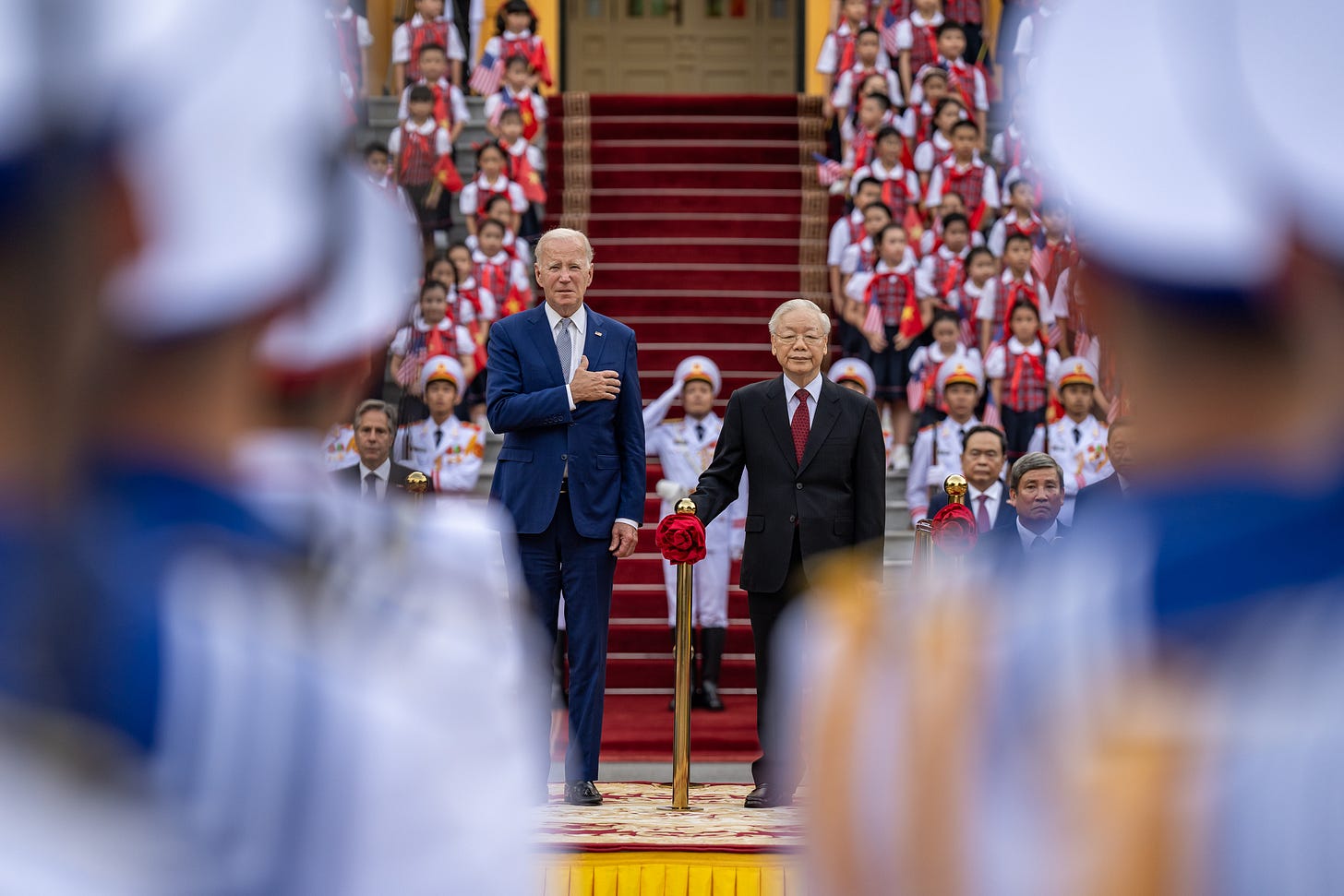

The agreement by the United States and Vietnam for a double upgrade of ties within Hanoi’s multi-tiered partnership system is much more than symbolic — it reveals both Vietnam’s ongoing struggle to diversify its ties as it manages a more assertive China and advances its economic aspirations, as well as a longstanding U.S. effort across multiple administrations to raise the potential of U.S.-Vietnam ties within Washington’s overall Indo-Pacific strategy.1

What’s Behind It

The United States and Vietnam agreed to elevate their ties to the level of a comprehensive strategic partnership (CSP) during U.S. President Joe Biden’s visit to the country. As noted previously in these pages, that places the United States in a tier that had initially been reserved for more traditional partners limited to China and Russia, but has since expanded to India (2016) and South Korea (2022). It also marks the culmination of a years-long process in upgrading ties, which has seen Hanoi over the past few months also signal other potential CSPs with other countries in part so that the U.S. upgrade — as with other periodic developments involving Washington — does not detract from its careful calibration of ties2 (see table below for a snapshot of recent upgrades, with the caveat that this does not include other iterations, such as the special strategic partnership with Cambodia and Laos or the “extensive strategic partnership” with Japan reached in 2014)3.

Select Notable Vietnam Partnership Upgrades

The idea of upgrading ties has long been in the works, but its realization speaks to relatively increasing strategic convergence between the two sides. The United States has seen Vietnam as a capable partner to cultivate in Southeast Asia beyond established ones like Singapore or treaty allies like Philippines and Thailand, which was the logic behind steps such as the establishment of the U.S.-Vietnam comprehensive partnership in 20134. The urgency of that has grown in the context of intensifying U.S.-China competition and Vietnam’s status as one of Asia’s fastest-growing, diplomatically active countries5. The Vietnamese Communist Party has gradually eased its traditional Vietnam War-era suspicions of the United States and regime security amid China’s growing South China Sea assertiveness and opportunities offered by closer ties with Washington, including in the economic domain in areas like semiconductors and energy. This is despite previous complications during both the Trump and Biden administrations on issues like North Korea, trade and Russia’s war on Ukraine.

Why It Matters

Symbolism often has its own substance in Southeast Asia, and the double upgrade is an illustration of that. While terms like allies and partners may be used more loosely in some U.S. circles, Vietnam has a structured, hierarchical set of partnerships. An elevation like this one thus sends an important signal within Vietnam’s system about where its priorities lie that can substantively affect how cooperation advances in designated areas (see table below for the key areas announced within the CSP as part of the White House fact sheet).

Select Details in the U.S.-Vietnam CSP Fact Sheet’s Eight Categories of Cooperation

A rare Biden bilateral Southeast Asia visit also illustrates the value the administration is placing on the double upgrade and Vietnam’s place in U.S. Southeast Asia policy. This is Biden’s first standalone bilateral trip of this kind to a Southeast Asian country during his term — the other two Southeast Asia bilaterals to date have resulted from leaders coming to Washington for summits: firstly Singapore Prime Minister Lee Hsien Loong in March 2022 and then Philippine President Ferdinand Marcos Jr. in May 2023. Biden has missed trips he could have made to two Southeast Asia stops for multilateral engagements — Thailand for APEC in November 2022 and Indonesia for ASEAN this September (the White House recently publicly confirmed a bilateral is in the works when Indonesian President Joko Widodo visits the United States in November)6. Biden making the trip to Vietnam is also significant given the additional challenges Vietnamese leaders would face with making the voyage to Washington, including health issues faced by General Secretary Nguyen Phu Trong.

Where It’s Headed

Looking ahead, a key storyline will continue to be around the extent to which the upgrade results in substantive inroads in aspects of U.S.-Vietnam relations. The partnership fact sheet publicly released by the White House contains some areas for both sides to work through, but close observers of the relationship will note that the more details are around areas Vietnam would have less sensitivities about, such as people-to-people ties or economics (the security portion of the fact sheet, for example, is among the shortest sections, despite previously announced gains extending to areas like coast guard cooperation and civil space). Inroads in some defense or economic areas will also have to contend with wider dynamics within Vietnam, like its traditional reliance on Russia for most of its weapons, resistance from China as well as ongoing domestic intra-state differences over personnel and the extent of reform that can affect the environment for rights and investment.

Another area to watch is how the double upgrade affects Vietnam’s calibrated effort to diversify its ties as part of its omnidirectional foreign policy. As noted before (see first table above), Vietnam has already begun an effort to recalibrate other relationships to ensure that the U.S. upgrade is not seen as throwing off the balance of its ties too greatly, even though Vietnamese officials acknowledge that these upgrades would in practice be much easier to facilitate than ones with Washington and not all upgrades are created equal either in symbolism or in substance. Much of the focus in the headlines in this regard will surround Vietnam’s relations with China and Russia to create a sense of distance from Washington. Yet equally important will be ties with neighboring countries and other middle powers that factor into Vietnam’s diversification efforts and are significant in their own right, be it Australia or Singapore.

China-Southeast Asia Military Drills; Indo-Pacific Supply Chain Realities & Singapore’s Cyber Capabilities

“In the first nine months of 2023, the PLA held 11 military engagements in [Southeast Asia]: the highest number ever and more than in any other part of the world this year,” even though this increased activity “belies a lack of trust,” notes a new commentary over at Fulcrum (link).

Select China Exercises with Southeast Asian States Thus Far in 2023

“For IPEF economies, both import sources and export destinations have become less diversified on average since 2010…[d]eeper bilateral linkages to China drove much of this change,” concludes the first of a series of posts on supply chain dynamics by the Peterson Institute for International Economics. The post illustrates the challenge faced by initiatives like the Indo-Pacific Economic Framework (IPEF) which include aspects of supply chain diversification away from China (link).

Snapshot of Import Diversification for IPEF Countries

“[S]ingapore has developed a robust cyber governance structure…though command and control of cyber capabilities in the civilian sector is far more developed than in the military realm,” observes Volume 2 of a report series on cyber capabilities released by the International Institute for Strategic Studies (IISS). Despite advanced cyber capabilities in several areas, due to its size, Singapore is still classified as a “Tier Three” country across seven categories of analysis (see assessment snapshot below), along with fellow Southeast Asian countries Indonesia, Malaysia and Vietnam (link).