How Are Shifting Semiconductor Geopolitics Impacting Southeast Asia?

A quick analytical scan of regional challenges and opportunities amid a tense geopolitical environment including heightened US-China rivalry and industrial policies.

Dear Subscribers,

Thank you for your continued support for ASEAN Wonk. Today, I’m pleased to introduce a new product called ASEAN Wonk GeoScanner, where we will share our ongoing quick horizon-scanning of geopolitical and geoeconomic issues shaping Southeast Asia and the world, with temporal snapshots of the past, present and future(s).

This occasional product adds to our flagship weekly ASEAN Wonk BulletBrief. As with BulletBrief, paid subscribers will receive the full five sections of GeoScanner, while free subscribers will get the first one or two sections.

GeoScanners will enable us on the ASEAN Wonk team to share quick insights on some of the top issues that have been flagged by readers or shareable content from some of our other ongoing research and work, including for paid individual and institutional subscribers (a big thank you to all of you who have reached out with ideas so far, and please keep them coming!)

The first GeoScanner was prompted by insights we were asked to draft for a recent government engagement on the current state of global semiconductor geopolitics. Securing permission to share this took a little longer than we would like, but I’m pleased that we’re now able to publicize some of the Southeast Asia-related findings on a subject that is of great interest.

As always, if you have feedback or would like to find out more about our bespoke products on this subject and others that are relevant to our work, please reach out to me at prashanth.aseanwonk@gmail.com.

And with that, let’s dig in!

Best,

PP

WonkCount: 1356 words (about 7 minutes).

How Are Shifting Semiconductor Geopolitics Impacting Southeast Asia?

Recent suggestions that individual Southeast Asian countries like Vietnam or Thailand may be “early winners” in the ongoing U.S.-China chip war are an interesting data point, but they can also understate the complexities of the impacts of shifting semiconductor geopolitics on Southeast Asia, including the sophistication of semiconductor value chains, the balance of opportunities and challenges in shifting supply chains and the diversity of competencies and policy environments across the region itself.

What’s Going On?

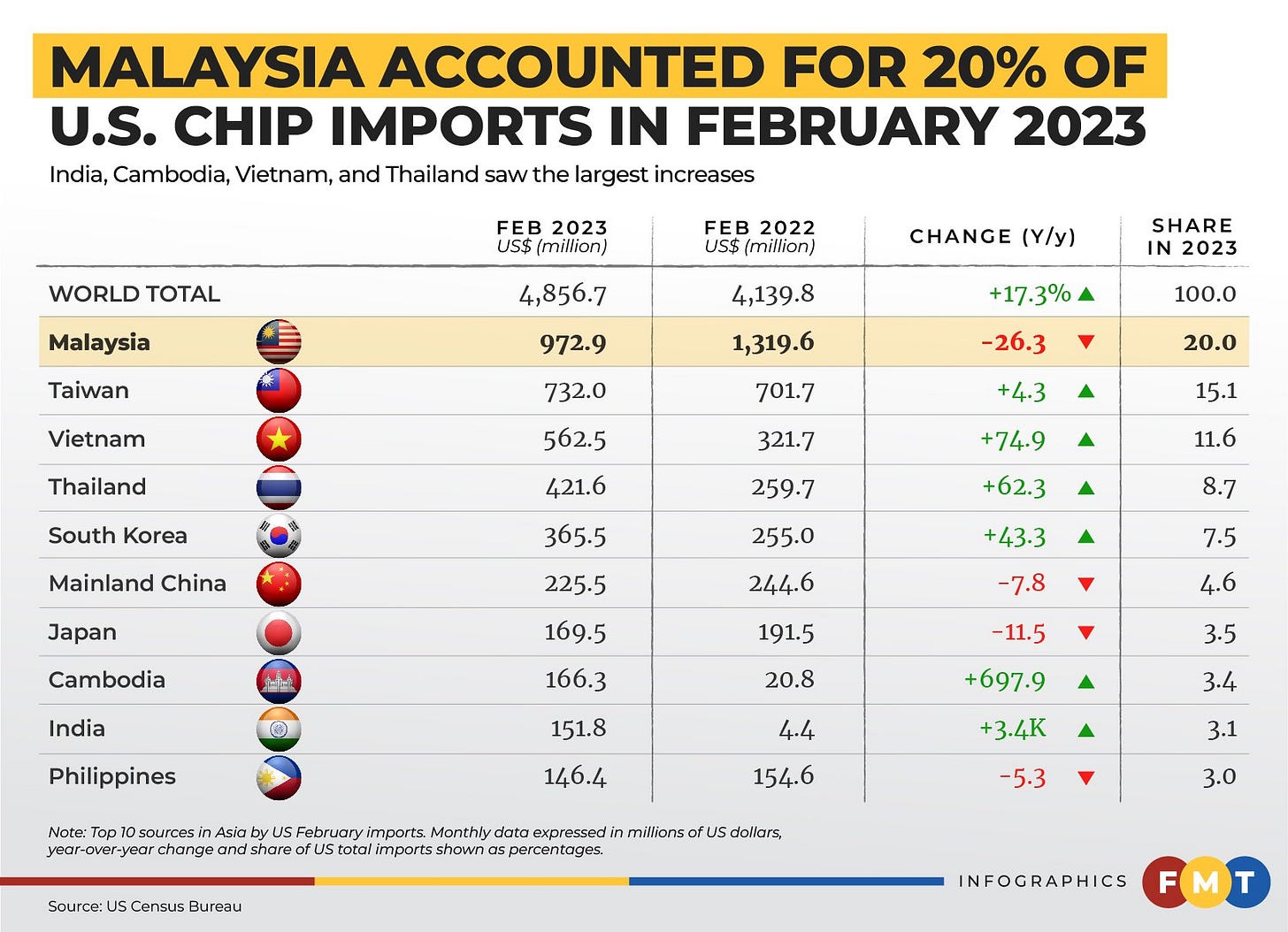

A new round of headlines has focused on recent data indicating that Thailand, Vietnam and Cambodia were among the top winners in semiconductor production diversification. The headlines, which emerged earlier this month, were focused around data from early 2023 which showed that Vietnam and Thailand increased their U.S. trade in the sector by 75 percent and 62 percent respectively (with Cambodia registering 698 percent growth, a testament to how volatile such data can be when limited only to a single period). Vietnam has accounted for over 10 percent of U.S. imports for seven straight months, while Malaysia, though still holding the lead in U.S. imports, saw its share drop to 20 percent (see the figure below).

Though this is a single snapshot of evolving data over time, it fits into a broader conversation about the extent to which Southeast Asia is benefiting from trends such as the U.S.-China chip war and friendshoring. For instance, just a few weeks ago, one of the headlines emerging out of the South China Morning Post’s China Southeast Asia conference was around the stakes for Southeast Asia amid “friendshoring” and the broader U.S.-China chip war, following remarks by Malaysia’s Trade Minister Tengku Zafrul Aziz about how while the country may gain some benefits amid existing trends, this also came amid a more worrisome global environment it has to navigate.

How Did We Get Here?

While nowhere near the dominance Northeast Asia has in semiconductor production – particularly Taiwan on high-end chips – Southeast Asia has nonetheless been a critical part of the semiconductor value chain for decades and is among the key regions to watch as the industry evolves. Indeed, by one count, Southeast Asia is the second-largest semiconductor exporter globally, commanding 22.5 percent of global semiconductor exports and five of its countries accounting for the world’s top 15 semiconductor exporters. The differentiated competencies in individual countries have developed over time (indeed, Chris Miller’s Chip War delves into part of the underappreciated story of the early role Southeast Asian countries like Malaysia and Singapore played in the evolution of the broader global semiconductor industry).

The region’s role in shifting semiconductor value chains has been in the spotlight in recent years amid wider geopolitical trends including COVID-19, intensifying U.S.-China competition and industrial policies. Chip shortages some companies experienced during the pandemic highlighted regional countries’ roles in parts of the value chain such as packaging and testing. Similarly, new policies like the CHIPS and Science Act have sparked a conversation around the rebalancing of the semiconductor supply chain and the region’s role within it, since not all activities across the value chain can be completely reshored and resilience has to be weighed alongside other considerations including cost.

Why Does This Matter Today?