Southeast Asia’s Taiwan Conundrum in Focus with China Poll Tantrum

Plus ASEAN’s artificial intelligence push; fresh critical mineral discovery; measuring Indo-Pacific growth risks; counting border trade changes and much more.

Greetings to new readers and welcome all to the latest edition of the weekly ASEAN Wonk BulletBrief! If you haven’t already, you can upgrade to a paid subscription below to receive our full posts.

For this iteration of ASEAN Wonk BulletBrief, we are looking at:

Assessing the geopolitical significance of China’s protests regarding some Southeast Asian states’ responses to the Taiwan elections, and the region’s wider connections with Taipei;

Mapping of regional developments including a new defense pact and talk of a more “seamless” ASEAN and Mekong subregion amid a fractured world;

Charting evolving security, geopolitical and geoeconomic trends such as the development of long-range strike capabilities by Southeast Asian states and Indo-Pacific growth risks;

Tracking and analysis of industry developments and quantitative indicators including ASEAN’s artificial intelligence push; a fresh critical mineral discovery and more;

And much more! ICYMI, check out our review of a new book on Myanmar’s struggle for freedom and reform written by a formerly detained top advisor to the country’s ousted civilian government.

WonkCount: 1,913 words (~9 minutes reading time)

New Defense Pact; Border Fence Talk; “Seamless” Mekong Pursuit & More

Long-Range Strike Capabilities; Indo-Pacific Growth Risks & China Global Investment Snapshot

“In Southeast Asia, the Philippines and Vietnam are embarking on their own long-range strike programs…for now, many of these efforts are focused on developing anti-ship capabilities, mostly in response to China’s assertive behavior in the South China Sea and to ongoing territorial disputes,” argues a new report released by the IISS think tank on the development of long-range strike capabilities in the Asia-Pacific region. The report notes that Southeast Asian states may look to develop or procure more advanced capabilities if regional security continues to deteriorate (link).

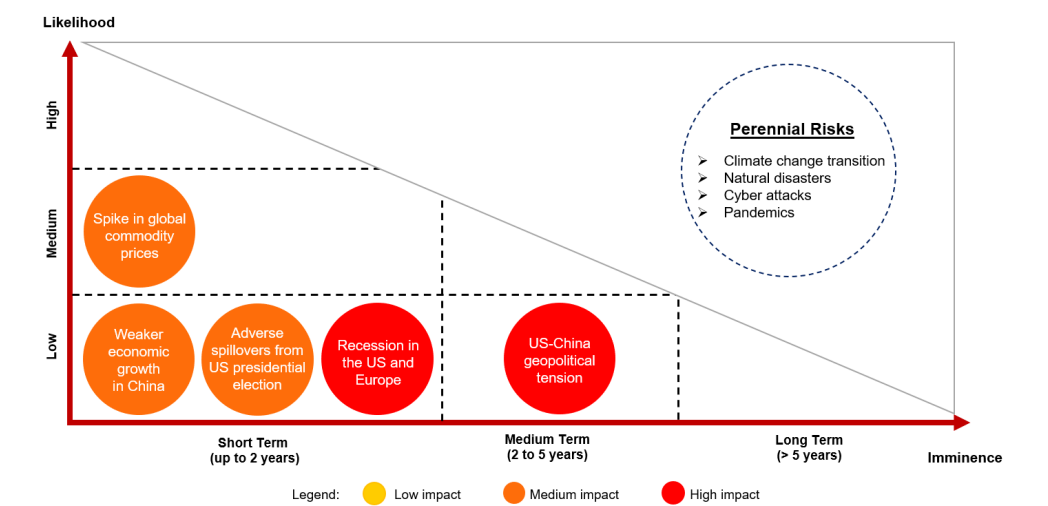

Possible Coverage of the Philippines’ New Anti-Ship Missiles

“The overall balance of risk remains tilted to the downside,” notes the latest iteration of the quarterly forecast for ASEAN +3 economies (ASEAN plus China, Japan and Korea) by the ASEAN + 3 Macroeconomic Research Office (AMRO). The report assesses that major risks impacting baseline forecasts include spike in global commodity prices; adverse spillovers from the U.S. presidential election; weaker economic growth in China; recession in Europe and the United States; and further escalation of U.S.-China tensions. This is in addition to longer-term ones such as climate change, natural disasters, emergence of new infectious diseases and global cyber threats (link).

AMRO ASEAN+3 Regional Risk Map

“The electric vehicle supply chain, starting with nickel mining in Indonesia, attracted the most funds” in China’s global investment in 2023, argues the newest iteration of the China Global Investment Tracker released by the American Enterprise Institute. The analysis from the updated tracker suggests that the battery chain is unlikely to prove sufficient for China to sustain an investment surge in 2024, suggesting that Beijing will either need another priority sector or a return of investment in Russia (link).

Select Estimated China Global Investment and Construction (2005-2023)

Southeast Asia’s Taiwan Conundrum in Focus with China Poll Tantrum

What’s Behind It

China publicized that it had protested congratulatory messages sent to both the Philippines and Singapore to Lai Ching-te after his victory in Taiwan’s presidential election held on January 13 handed the Democratic Progressive Party (DPP) another term in office1. Separately, China’s foreign ministry also revealed an evolving list of countries that it assessed at the time to have reaffirmed their commitment to the one-China principle after the election, which included Laos and Myanmar2 (see a timeline snapshot of select post-election Southeast Asia statements below, reflecting the spectrum of evolving positions at play among regional states3).

Timeline Snapshot of Select Post-Taiwan Election Southeast Asia Statements

Beijing’s post-election pressure on Southeast Asian states is just the latest in a series that have found their way to the public domain. As we noted in our ASEAN Wonk forecast for 2024, though Taiwan has long been a sensitive issue in China’s engagements with Southeast Asian states, Beijing has gradually intensified its pressure on regional states to align with its hardening line on Taipei. This coercion narrows the complex reality of Southeast Asia-Taiwan linkages, with developments in just the past few months alone focused on an array of issues — both opportunities such as tourism connections and semiconductor talent, as well as challenges like migrant worker protections and telecom fraud4. The heightening of U.S.-China tensions has also added to a crowded flashpoint mix that includes issues like the South China Sea. In this post-Taiwan election case, ASEAN Wonk understands from sources that other Southeast Asian states were also subject to private communications by China on this front, even though the Philippines and Singapore were the focus of Beijing’s public protests5.

Why It Matters

While this round of post-election pressure has gotten significant attention, it is in fact just the latest episode of simmering cross-Strait tensions continuing to play out in Southeast Asia more generally. China has tried to utilize the intensification of its ties with certain Southeast Asian states to affect their positions on Taiwan and other issues central to Beijing’s interests. Taipei, for its part, has tried to adjust its own regional approach while also issuing occassional private and public protests in response to instances where China is deliberately using the Taiwan issue as leverage to (see table below for a brief snapshot of recent significant incidents curated by the ASEAN Wonk team).