Where Next in US Philippine Alliance Post Trump Marcos Meet?

Plus conflict mediation chatter; first artificial intelligence hub; quiet blockchain rollout; new high-speed rail expansion chatter and much, much more.

Greetings to new readers and welcome all to the latest edition of the weekly ASEAN Wonk BulletBrief! If you haven’t already, you can upgrade to a paid subscription for $5 a month/$50 a year below to receive full posts by inserting your email address and then selecting an annual or monthly option. You can visit this page for more on pricing for institutions, groups as well as discounts. For current paid subscribers, please make sure you’re hitting the “view entire message” prompt if it comes up at the end of a post to see the full version.

For this iteration of ASEAN Wonk BulletBrief, we are looking at:

Assessing the geopolitical and geoeconomic significance of alliance futures and regional implications following a recent major summit meeting;

Mapping of regional developments, including conflict mediation chatter and trilateral exercise talks in the region;

Charting evolving geopolitical, geoeconomic and security trends such as first artificial intelligence hub; quiet blockchain rollout; and new high-speed rail expansion chatter;

Tracking and analysis of industry developments and quantitative indicators including new fighter jet deal details; coming rare earth facility; growth sectoral outlook; and more;

And much more! ICYMI, check out the latest episode of our ASEAN Wonk Podcast featuring insider insights from a former ASEAN deputy secretary-general on the grouping’s newly-launched vision and implications for the Indo-Pacific and the wider world.

This Week’s WonkCount: 2,116 words (~10 minutes)

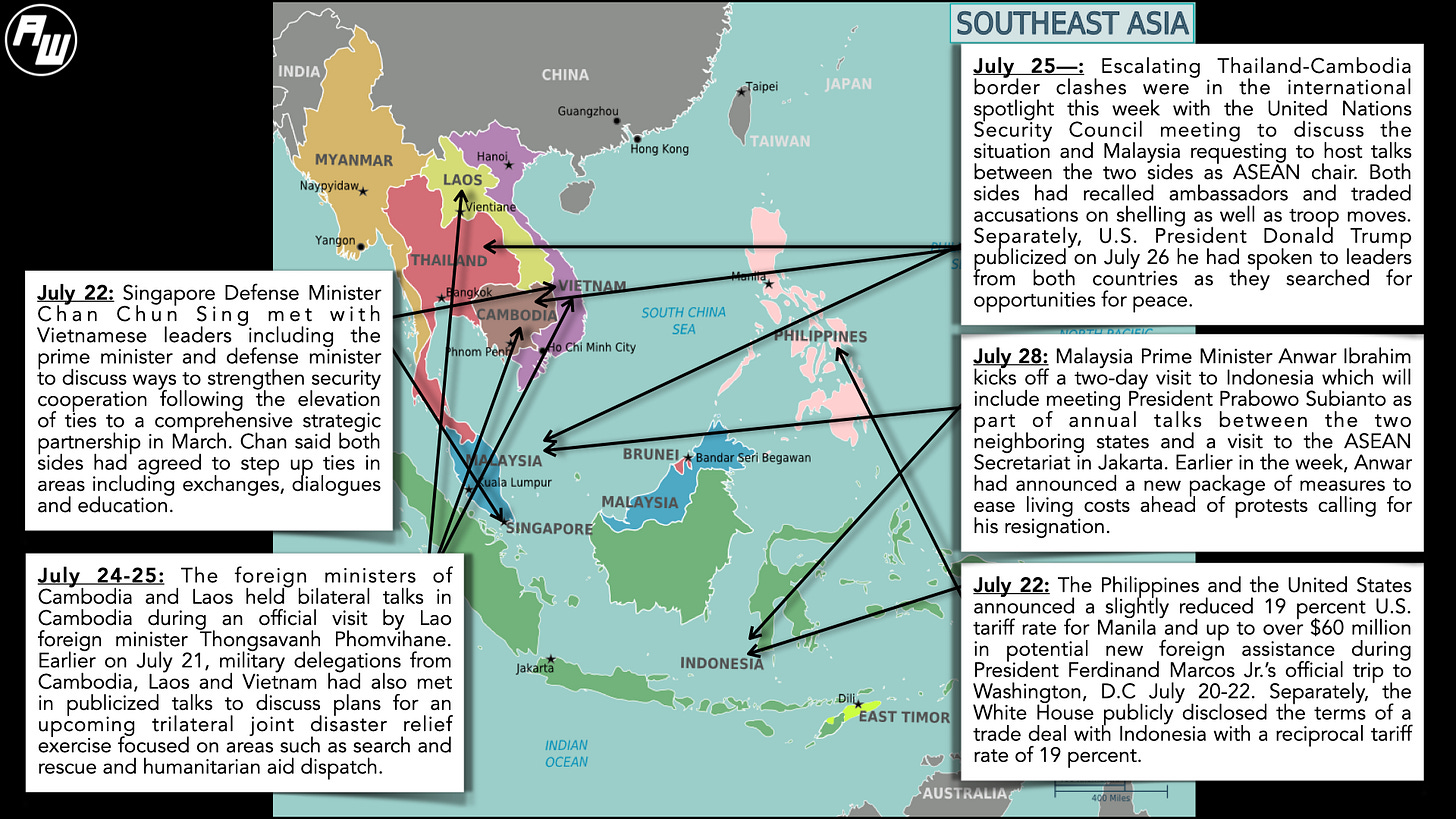

Conflict Mediation Chatter; Trilateral Exercise Talks & More

Defense Strategy; Digital Divides & Membership Outlook

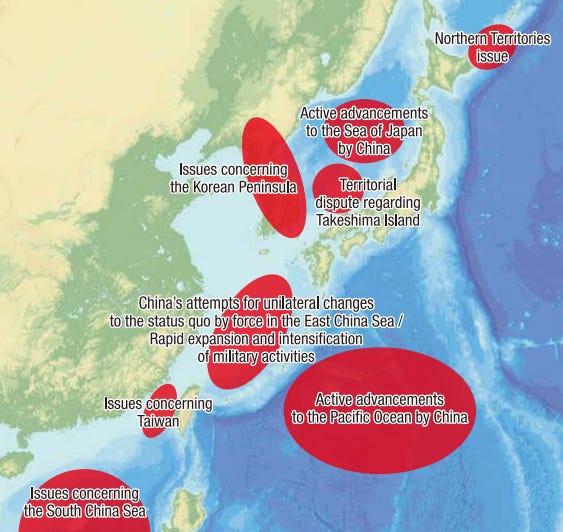

“In the event of a blockade of Taiwan, there is a possibility that China will deploy its coast guard at the forefront to carry out the blockade within the gray zone,” notes a summary of Japan’s recently-released annual white paper. The document notes several Southeast Asia-related datapoints, including Japan’s perspective at the recent Shangri-La Dialogue in Singapore, defense cooperation with Indonesia and the Philippines, China’s maritime assertiveness in the South China Sea and ASEAN cyber cooperation (link).

MOD Japan Depiction of Security Environment Surrounding Japan

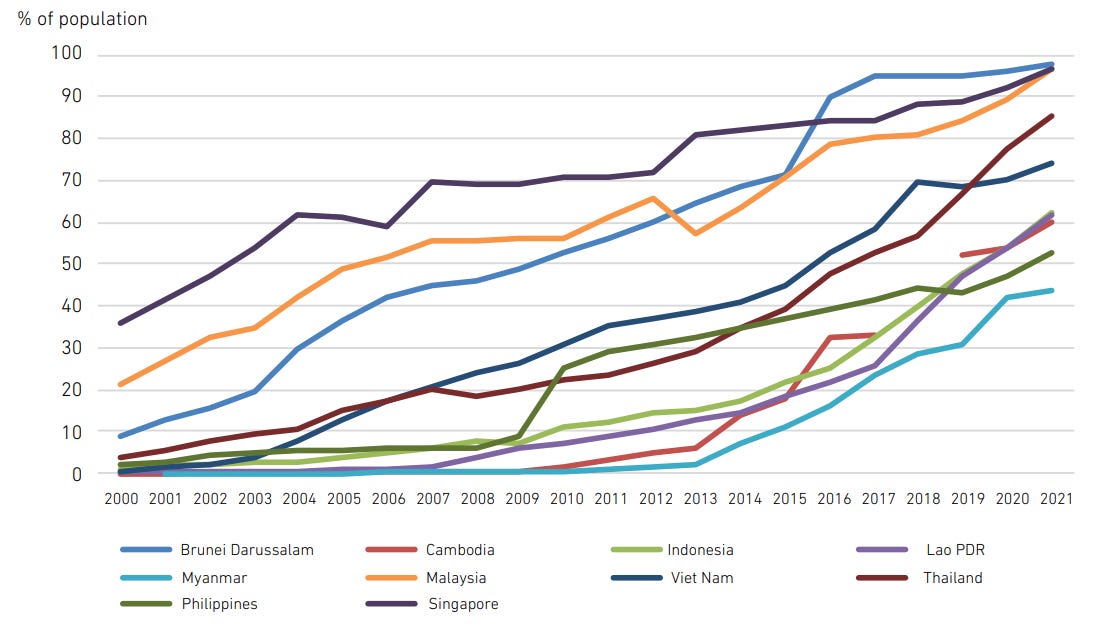

“Despite efforts to advance digitalization, the rapid pace of global digital transformation presents considerable challenges for ASEAN, much like other developing regions,” argues a new report by Economic Research Institute for ASEAN and East Asia (ERIA) on ASEAN’s digital future. The report argues that the “spectrum of risks and challenges” fall broadly into five clusters — data security, cybersecurity and competition; productivity; connectivity; the digital divide; and environmental sustainability (link).

Internet Usage By % of the Population in Individual ASEAN Member States

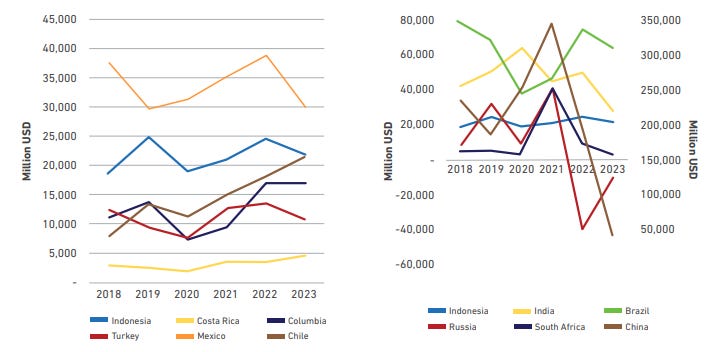

"Crucially, the benefits of OECD membership will be maximised not only by undertaking the reforms necessary for accession, but also by maintaining the momentum of reform well beyond the point of membership,” cautions a new report released by Center for Indonesian Policy Studies on the potential economic implications of Indonesia’s accession to the Organization for Economic Cooperation and Development (OECD). The report also argues that sectoral impacts are likely to vary over time and that Indonesian governments are likely to confront several structural challenges in areas like supply-side constraints as well as complex and inconsistent regulatory frameworks (link).

Graphic Showing FDI Inflows to Indonesia vs. Select OECD and BRICS Countries

Where Next in US Philippine Alliance Post Trump Marcos Meet?

What’s Behind It

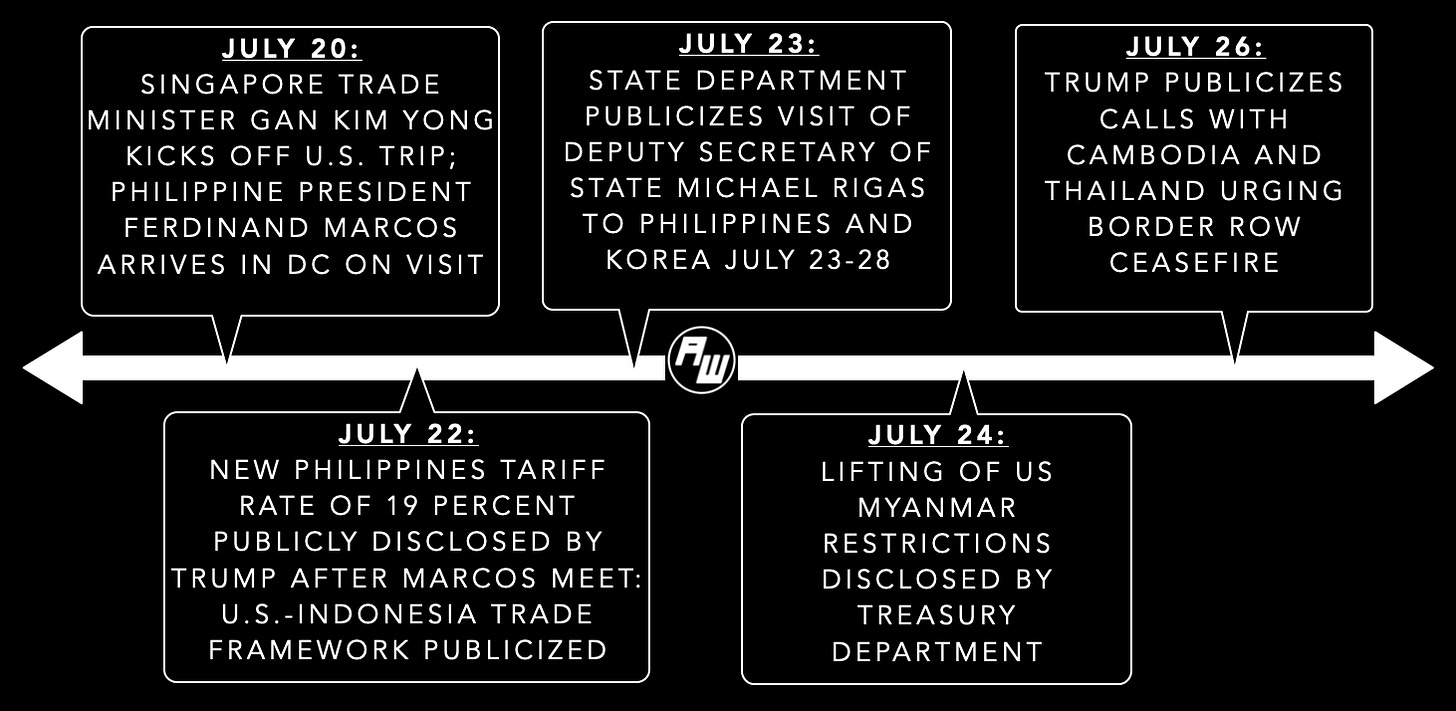

The United States and the Philippines announced new summit deliverables during an active week for U.S.-Southeast Asia relations. ASEAN Wonk understands from officials that other Southeast Asian states are still finalizing arrangements with the August 1 tariff deadline looming, even though they may fall short of what the White House has played up as Indo-Pacific “trade initiatives” with Indonesia and the Philippines1. Meanwhile, U.S. President Donald Trump’s publicization of engagement with both Thailand and Cambodia over their escalating border row and some easing of U.S. restrictions on Myanmar also point to evolving geopolitical flashpoints in mainland Southeast Asia as questions remain over the broader direction of U.S. regional policy and Trump’s overseas itinerary for the remainder of 20252.

Select Recent Developments in US-Southeast Asia Relations Under the Second Trump Administration

The engagement points to the evolving contours of U.S. policy with allies and partners. This is the first time in nearly two decades that the Philippines has secured the first White House summit meeting among Southeast Asian states under a new U.S. administration, and Manila has recorded a series of notable firsts in early engagements with the second Trump administration in calls, meetings and visits3. At the same time, as officials from early engagers like Indonesia or Singapore privately point out, there are limits and risks to that engagement. Apart from having to beat back criticism that Philippine President Ferdinand Marcos Jr. appeared to secure only a one percent tariff reduction from U.S. President Donald Trump during the trip — tying it with Indonesia at second place in the Southeast Asia tariff chart as of now and just ahead of Vietnam — officials also had to manage Trump’s multiple suggestions in public remarks alongside Marcos that he himself was responsible for Manila “untilting” itself from China to the United States — downplaying the role of the Philippines’ own fluid domestic politics just days before Marcos’s annual state of the nation address on July 284.

Why It Matters

The state of play also points to future datapoints to watch across key priority areas and pillars (see originally generated ASEAN Wonk table below on notable areas to monitor and additional specifics. Paying subscribers can read on for more on what to expect and future implications in the rest of the “Why It Matters” and “Where It’s Headed” sections, along with paid-only sections of the newsletter as usual).