New Geoeconomic Inroads With Malaysia Singapore JS-SEZ Deal

Plus BRICS entry; 2025 global risks; new nuclear body; coming interference law; quiet command changes; artificial intelligence inroads & much, much more.

Greetings to new readers and welcome all to the latest edition of the weekly ASEAN Wonk BulletBrief! If you haven’t already, you can upgrade to a paid subscription for $5 a month/$50 a year below to receive full posts by inserting your email address and then selecting an annual or monthly option. You can visit this page for more on pricing for institutions, groups as well as discounts. For current paid subscribers, please make sure you’re hitting the “view entire message” prompt if it comes up at the end of a post to see the full version.

For this iteration of ASEAN Wonk BulletBrief, we are looking at:

Assessing the geopolitical and geoeconomic significance of progress on a new cross-border special economic zone;

Mapping of regional developments, such as BRICS entry; Mekong summitry and coming UN seat bid;

Charting evolving geopolitical, geoeconomic and security trends such as new nuclear body; coming interference law and artificial intelligence inroads;

Tracking and analysis of industry developments and quantitative indicators including quiet command changes; air pact and trade agreement report card;

And much more! ICYMI, check out our review of a new book on India’s future global strategy and Southeast Asia’s role in its evolving dynamics.

This Week’s WonkCount: 2,103 words (~10 minutes)

BRICS Entry; Mekong Summitry; UN Seat & More

2025 Global Risks; Resisting Bifurcation & Growth Forecast

“[S]outheast Asian manufacturing hubs should see increased investment as supply chains shift from China….Vietnam might gain market share in electronics despite Trump’s threats,” argues the new 2025 iteration of the annual risks forecast from Eurasia Group. The forecast includes a list of top 10 risks along with red herrings covering an array of topics including the energy transition, governance as well as artificial intelligence (link).

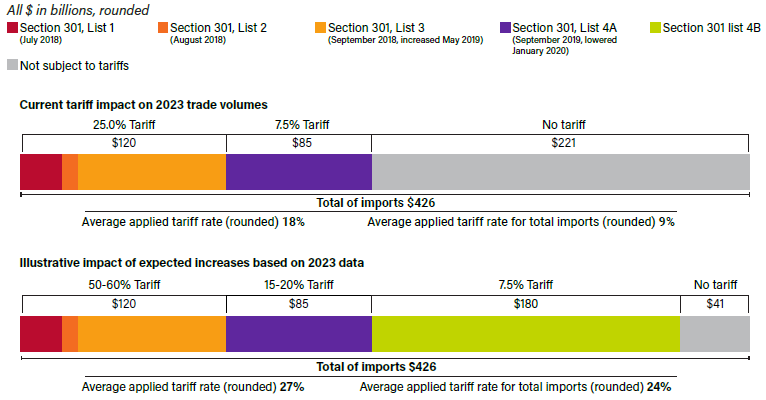

Graphical Illustration of Potential Impact of New Trump Tariff Hikes

“[A]SEAN, together with European Union, the Global South, and the rest, need to do the heavy lifting to ensure that the middle ground or the common ground is big enough to resist bifurcation,” according to the opening speech by Malaysia’s Deputy Minister Liew Chin Tong delivered at the ASEAN opinion leaders conference outlook for 2025. The speech argues that ASEAN states should try to accelerate efforts to form a more resilient regional supply chain in the face of global geopolitical headwinds and intraregional geoeconomic competition (link).

“Growth in the ASEAN economies has remained resilient…supported by robust domestic consumption, investments and improvements in net exports,” according to a new report on 2025 world economic prospects issued by the United Nations. The report cautions that despite promising trends for much of Southeast Asia, risks to the near-term outlook remain tilted to the downside (link).

Export Patterns in Select East Asian Economies

New Geoeconomic Inroads With Malaysia Singapore JS-SEZ Deal

What’s Behind It

Delayed cross-border inroads what has been hailed as a potential game-changer took shape in the past week as the premiers from Malaysia and Singapore reached agreement on a major special economic zone during an active few diplomatic weeks for both countries1. After also meeting Japan’s prime minister and Indonesia’s president, Malaysia Prime Minister Anwar Ibrahim is on a cross-continental trip which includes a stop at the World Economic Forum in Davos as the country takes up the ASEAN chairmanship2. Among other engagements, Singapore was to receive outgoing U.S. Vice-President Kamala Harris in one of the final high-level regional-related U.S. interactions before President Donald Trump is officially inaugurated on January 20 before the trip was canceled (see graphic below)3.

Select Related Geoeconomic and Geopolitical Developments Amid New JS-SEZ Inroads

The initiative bears watching within evolving regional geoeconomic conversations. As a senior Malaysian official put it this past week, this feeds into ways Southeast Asian states are collaborating in a “trade war” landscape to cultivate high-value global investment hubs of their own amidst fierce regional competition4. This is true even as exact projections on metrics like GDP contribution remain murky5. And as a former senior Malaysian diplomat who previously served as high commissioner to Singapore noted recently on our ASEAN Wonk Podcast, while most practitioners recognize that SEZs often fail to live up to their initial hype, this one bears watching as it is occurring during a promising period in historically thorny bilateral ties.

Why It Matters

The development also highlighted wider developments and details and their geopolitical and geoeconomic implications (see originally generated ASEAN Wonk table below on notable datapoints and additional specifics. Paying subscribers can also read on for more on what to expect and future implications in the rest of the “Why It Matters” and “Where It’s Headed” sections, along with remaining paid-only sections of the newsletter as usual).