New China-ASEAN Expo Kickoff Spotlights Future Trajectory in Southeast Asia's Growth Quest

Plus new US-Philippine defense site talk; air chiefs meeting dynamics; new export ban and social media regulation calls and much more.

Greetings to new readers and welcome all to this edition of the weekly ASEAN Wonk BulletBrief! For this iteration, we are looking at:

Assessing the implications of the latest China-ASEAN Expo and the wider state of ties between Beijing and Southeast Asian states;

Mapping of regional developments including U.S.-Philippine military ties; a recent ASEAN air force chief meeting and more;

Charting evolving trends such as on democratic reliance; subregional power dynamics and the treatment of environmental defenders;

Tracking and analysis of industry developments including new export ban claims; social media regulation calls; chip fab expansions and more;

And much more! ICMYI, check out our review of a new book and how it relates to the ongoing “Indo-Pacific” conversation. And if you have thoughts on books we should review, please do send them our way for consideration!

WonkCount: 1,914 words (~9 minutes reading time)

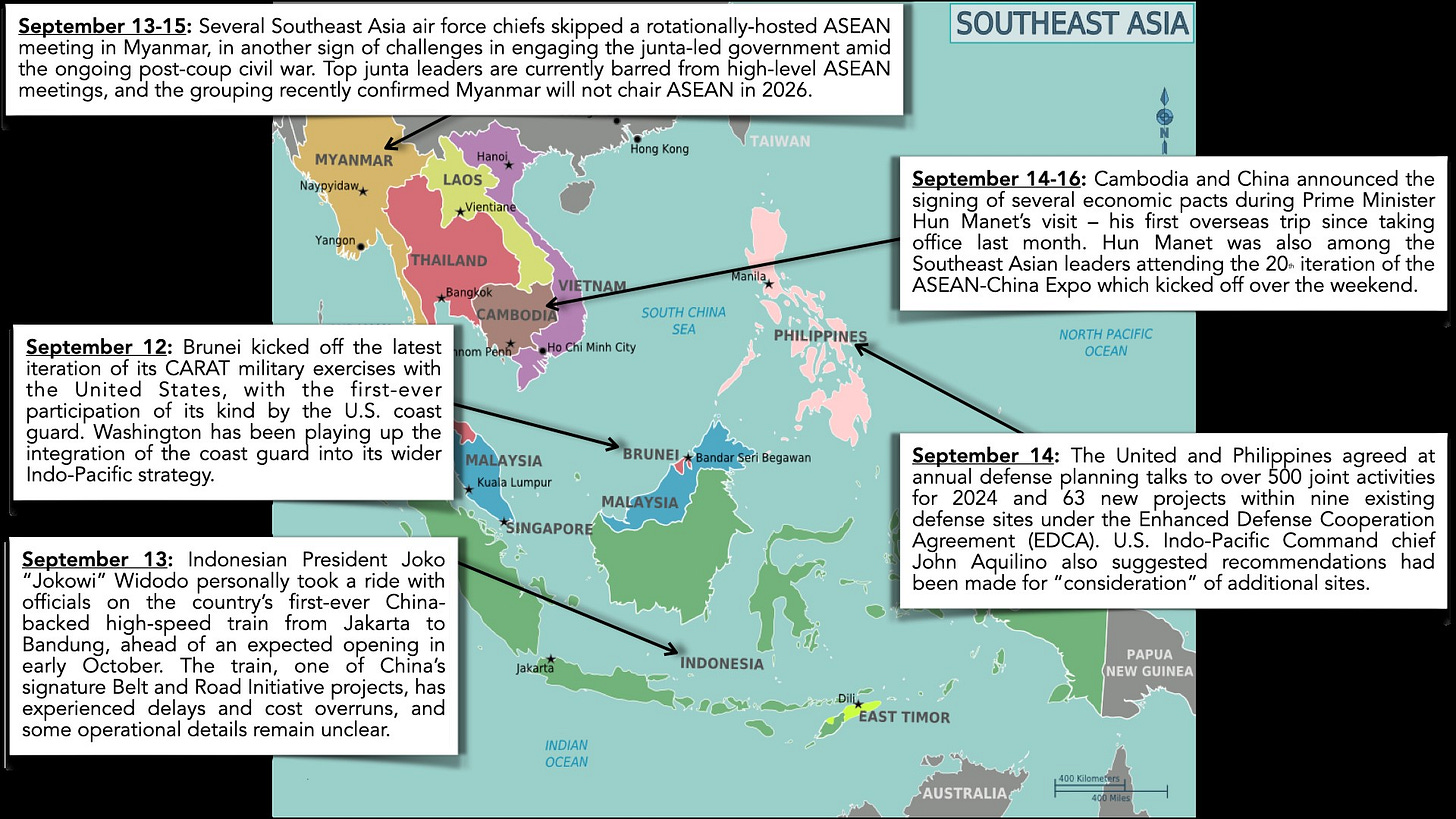

New US-Philippine Defense Sites Talk; Myanmar’s ASEAN Air Force Chief Meeting & More

New China-ASEAN Expo Kickoff Spotlights Future Trajectory in Southeast Asia's Growth Quest

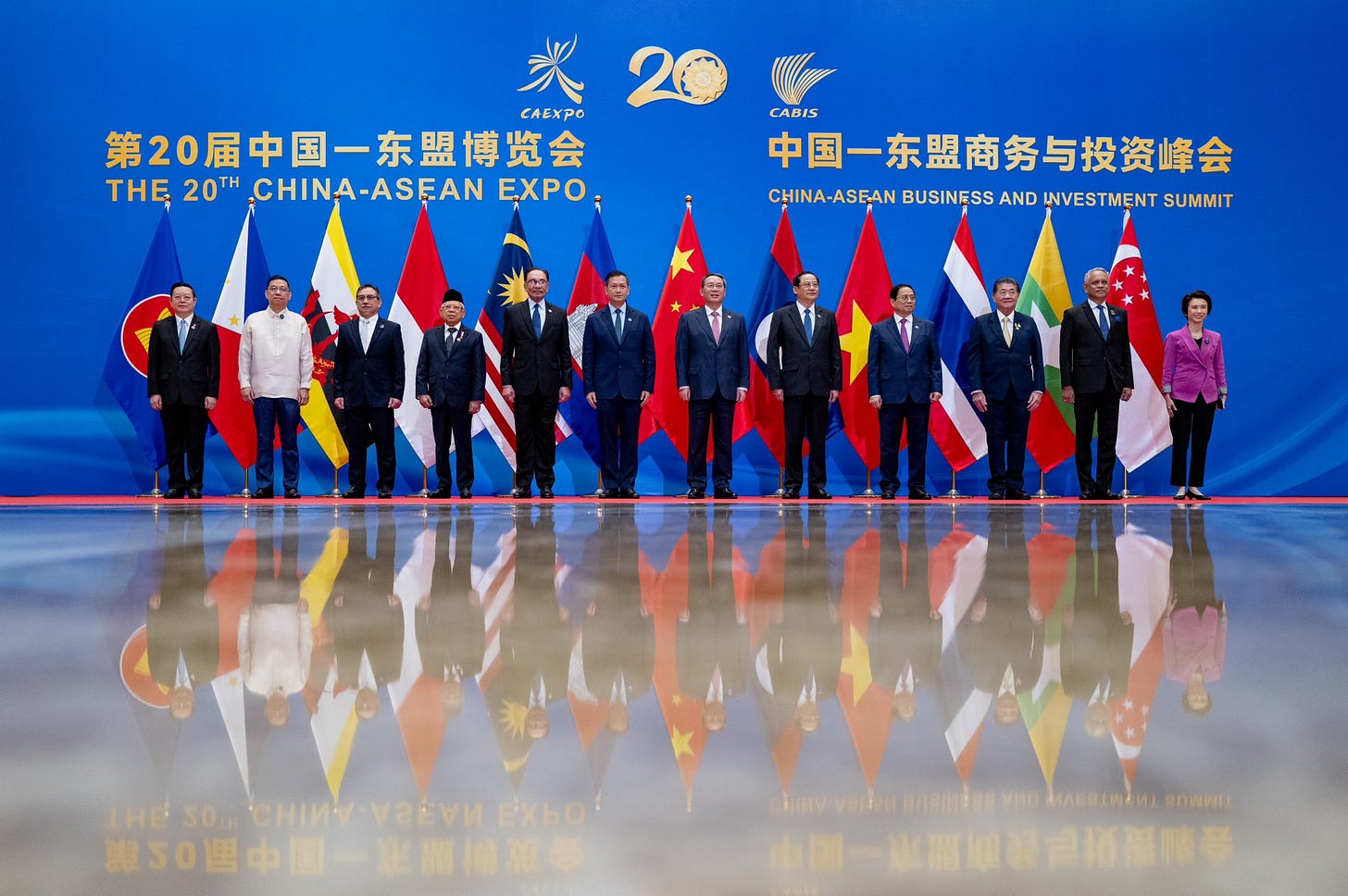

The latest iteration of the China-ASEAN Expo (CAEXPO) saw attendance from several Southeast Asian leaders and saw Beijing play up its economic ties with regional states despite challenges elsewhere in ASEAN-China ties as well as domestically.

What’s Behind It

China and ASEAN held the 20th iteration of CAEXPO, an annual trade show which aims to boost economic cooperation between the two sides. This year’s expo was held from September 16 to 19 in Nanning alongside the China-ASEAN Business and Investment Summit, and it is the first fully in-person iteration since the pandemic.

The expo kicked off amid a busy few weeks for China’s economic ties and regional diplomacy. China just held a conference in Hong Kong marking the 10th anniversary of its Belt and Road Initiative (BRI), which was partly launched in Indonesia and has had Southeast Asia as a key region since its outset. Beijing is also coming off of the latest round of ASEAN-China summitry where leaders charted out major areas of cooperation amid uncertainties over Chinese domestic personnel changes and economic challenges (see some of the select economic areas below that factored into the the China-ASEAN Summit agenda)1.

Why It Matters

China played up the 20th anniversary of the expo as part of a wider story of a positive economic trajectory in ASEAN-China ties which it is looking to build on in 2023 and onto 2024 despite challenges. At the opening ceremony, China’s Premier Li Qiang touted the positive trajectory of economic ties since the first expo was held in 2004, noted that trade had increased by over 16 times in the past two decades to around $970 billion in 2022 per China’s state statistics, and that two-way investment exceeds $380 billion (China has been ASEAN’s largest trading partner since 2009, and it was the grouping’s second largest source of foreign direct investment as of last year2). He mentioned that this trajectory of ASEAN-China relations was welcome given the backdrop of today’s weak global economy (though, unsurprisingly, he did not mention China’s own recent economic uncertainties). Ahead of the expo, Chinese state media also sought to push back against growing doubts about the country’s economy coming from U.S. officials3.

Some Southeast Asian states saw the expo as an opportunity to boost growth, albeit to different degrees. Four Southeast Asian leaders attended the meeting — Cambodian Prime Minister Hun Manet; Laos Prime Minister Sonexay Siphandone; Malaysia Prime Minister Anwar Ibrahim and Vietnam Prime Minister Pham Minh Chinh — while other countries sent officials at various levels at the engagement that sees a host of pavilions on display and interactions between officials and businesses (see select list below). Hun Manet, who had also just paid his first overseas visit to China since taking office last month, noted that the expo was a concrete example of inroads in ASEAN-China economic ties4. Anwar, who had visited China earlier this year, officiated Malaysia’s pavilion and was accompanied by over 100 Malaysian firms5. The four-day combined expo and business investment summit also sees fora across several functional areas including e-commerce, clean energy, environmental protection and the blue economy.

Select ASEAN Countries and Highest Representation Levels at CAEXPO

Where It’s Headed

Looking ahead, how CAEXPO develops as an institution within wider ASEAN-China cooperation will be notable to watch. Ahead of the expo, Chinese state media played up high levels of participation, noting that with around 750 foreign firms from 45 countries attending and the total exhibition area exceeding 100,000 square meters, potential transactions were expected to be worth over $50 billion dollars6. Yet apart from engaging China and showcasing key country projects, such engagements will also be judged on the actual tangible benefits for Southeast Asian countries. China has also attempted to shift the focus of the engagement over time to account for the evolution of ties with ASEAN, including trying to move beyond goods and into services, technology and investment.

More broadly, the focus will be on the extent to which some of the targets of ASEAN-China economic relations can be met. For example, on the trade front, while Chinese officials have said that a next milestone would be when ASEAN-China trade reaches the $1 trillion mark, it is still unclear if this can in fact be met in 2023 despite hopes for this expressed earlier this year7. China’s statistics indicate that total trade value during the first eight months of 2023 was at around $570 billion8. On infrastructure, while China has made some inroads since the BRI was first launched in 2013, some of the projects have seen their share of challenges, with a case in point being the delays and cost overruns in the Jakarta-Bandung high-speed railway.

More generally, China’s own domestic economic woes and the state of ties in non-economic dimensions also raise concerns about the future trajectory of ties and the state of the regional and global economy. Even if China does grow more slowly, it will continue to be an important economic partner (earlier this year, the IMF had forecast that China would account for about a third of all of global growth, and that a 1 percentage point increase in GDP growth in China would lead to a 0.3 percentage point increase in growth in other Asian economies on average)9. Yet the negative fallout from economic dependence in Beijing such as coercion, corruption and crime — visible in countries from the Philippines to Laos — are reminders to Southeast Asian countries about the perils of putting too many eggs in the Chinese basket. And despite Beijing’s touting of its economic inroads with ASEAN, issues in the security realm including its maritime assertiveness in the South China Sea also limit the extent of direct spillover into non-economic aspects of ties (see the two comparison charts below from the Indonesian think tank FPCI as an example). An equally notable challenge, of course, is where else these countries can turn to for quick and direct economic support to power their growth and ambitions. This is especially the case given that several Southeast Asian states have either newly-elected leaders trying to advance their priorities or transitioning regimes that will look to consolidate their positions in the coming months and years.

Democratic Reliance in Southeast Asia; Looking Beyond Great Power Competition; Environmental Defenders in the Spotlight

“Indonesia is the only country in the survey where an overwhelming majority supports democracy as the best form of government to solve the country’s problems,” notes a new survey report released by the Pew Research Center. The wide-ranging survey asks a range of questions — including some controversially-worded ones — on religious identity, beliefs, practices, diversity, national issues and politics. Within Southeast Asia, the focus is on Cambodia, Indonesia, Malaysia, Singapore and Thailand (link).

Support for Reliance on Democratic Government to Solve Country Problems

“Malaysia views itself as a land-based country, but what the Defense White Paper is trying to do is to define ourselves as a maritime nation,” Malaysia’s deputy investment, trade and industry minister (and former deputy defense minister) Liew Chin Tong said in an interview with Georgetown’s Journal of Asian Affairs. The issue, titled “Beyond Great Power Competition,” also includes contributions from other regional scholars including Evelyn Goh, Ralf Emmers, James Chin, Kuik Cheng-Chwee and Bilahari Kausikan (link).

“Global Witness documented 16 killings in Asia, 11 of which took place in the Philippines, which has topped the ranking in the region every year without exception,” notes a new report on environmental defenders published by the organization. Of the 281 cases recorded in the Philippines since 2012, a third have been linked to defenders speaking out against company operations linked to the mining sector. Of the remaining cases in the recent report, three took place in Indonesia and two in India (link).