What's Next After ASEAN Navy Exercise AMNEX 2025 Display?

Plus new 2026 defense pact; new trade deal; quiet military construction; mapping future supply chains; big sectoral warning shot fired; and much, much more.

Greetings to new readers and welcome all to the latest edition of the weekly ASEAN Wonk BulletBrief! If you haven’t already, you can upgrade to a paid subscription for $5 a month/$50 a year below to receive full posts by inserting your email address and then selecting an annual or monthly option. You can visit this page for more on pricing for institutions, groups as well as discounts. For current paid subscribers, please make sure you’re hitting the “view entire message” prompt if it comes up at the end of a post to see the full version.

For this iteration of ASEAN Wonk BulletBrief, we are looking at:

Assessing the geopolitical and geoeconomic significance of a rare multilateral naval exercise and wider regional and global implications;

Mapping of regional developments, including a newly-announced 2026 defense pact and Europe-Asia “intertwined” connections spotlight;

Charting evolving geopolitical, geoeconomic and security trends such as a new trade deal announcement; mapping future supply chain trajectories and quiet military construction;

Tracking and analysis of industry developments and quantitative indicators including big sectoral warning shot fired; new green deal; measuring collateral security damage and more;

And much more! ICYMI, check out our ASEAN Wonk review earlier this week of a new book with an ex-ambassador’s future roadmap for India’s ties with Southeast Asia and the wider Indo-Pacific region.

This Week’s WonkCount: 2,347 words (~10 minutes)

New 2026 Defense Pact; Europe-Asia Connections & More

China Global South Inroads; Bottom-Up Regionalism & Shifting Imbalances

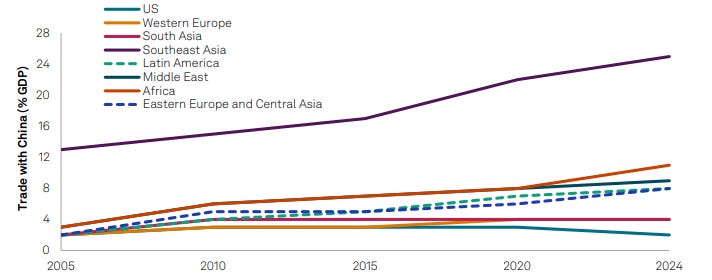

"As they continue to head to the Global South, the result could be a new order of global commerce where South–South trade becomes the new center of gravity and Chinese multinationals emerge as the new key players," notes a new report by S&P Global on the movement of Chinese companies in engaging the Global South following the imposition of U.S. tariffs. The report also notes that despite the hype around Beijing’s inroads, “potential benefits come with substantial execution risks that could challenge the degree and pace of such improvements and impact the income and profitability of Chinese as well as local stakeholders” in the Global South (link).

Southeast Asia’s Degree of Trade Integration With China Relative to Select Other World Regions

“Most civil society organizations in Southeast Asia are small and struggling, run by part-timers, not managed professionally, with very little funding,” argues a new commentary in The Jakarta Post ahead of an upcoming ASEAN for the People’s Conference scheduled for September in Jakarta and organized by the Foreign Policy Community of Indonesia. The commentary draws on initial insights from outreach to around 1,300 civil society groups in Southeast Asia and notes implications for the creation of a “geocivic” community in ASEAN following the grouping’s geopolitical and geoeconomic inroads (link).

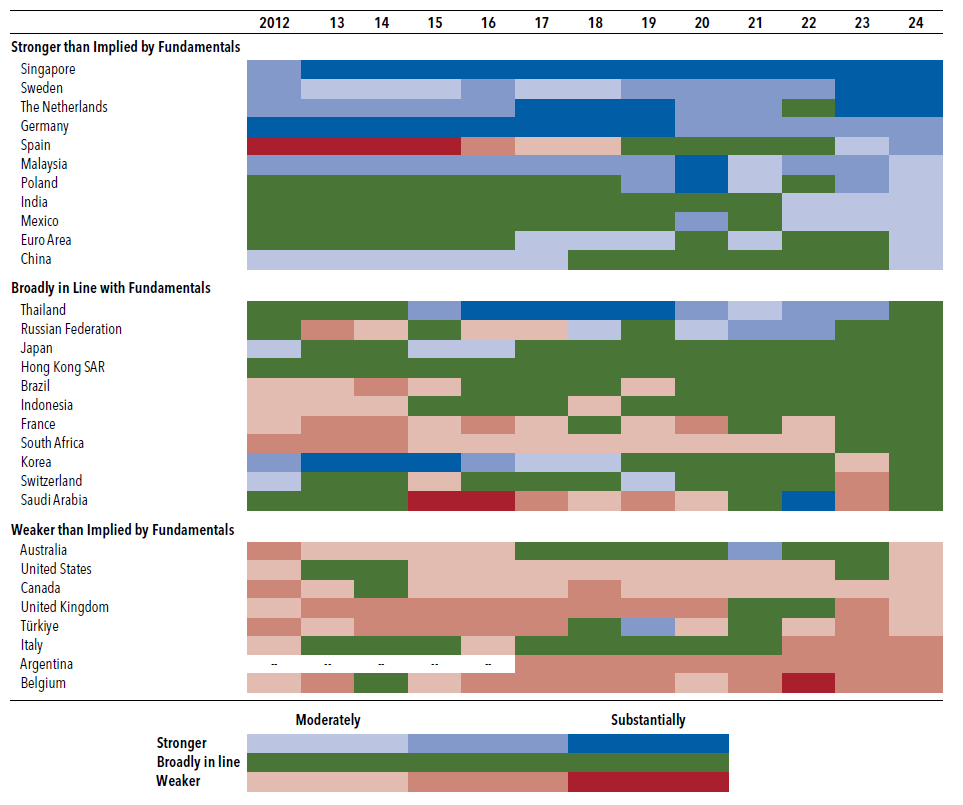

Global current account balances…widened significantly,” observes the International Monetary Fund in a new report. The report suggests that excess current account balances accounted for about two-thirds of widening global imbalances during the past year, with China, the United States and the euro area driving the increase. Of the Southeast Asian countries, notable changes were highlighted in the report for both Malaysia and Thailand in particular (link).

Graphical Depiction of Evolution of External Sector Assessments vs. Fundamentals Over Time

What's Next After ASEAN Navy Exercise AMNEX 2025 Display?

What’s Behind It

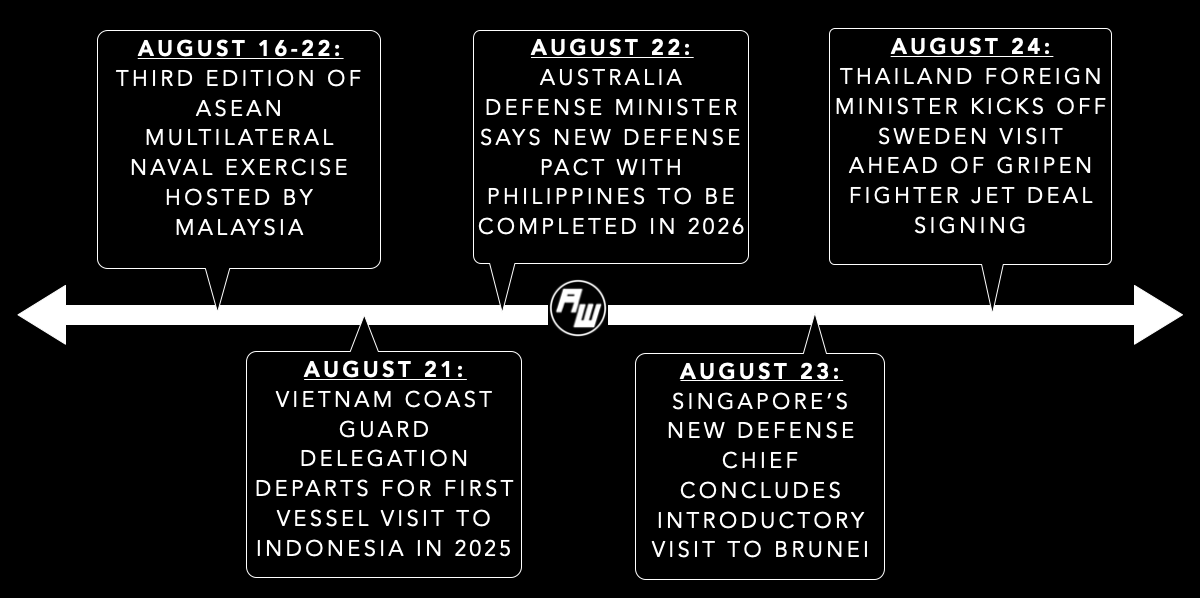

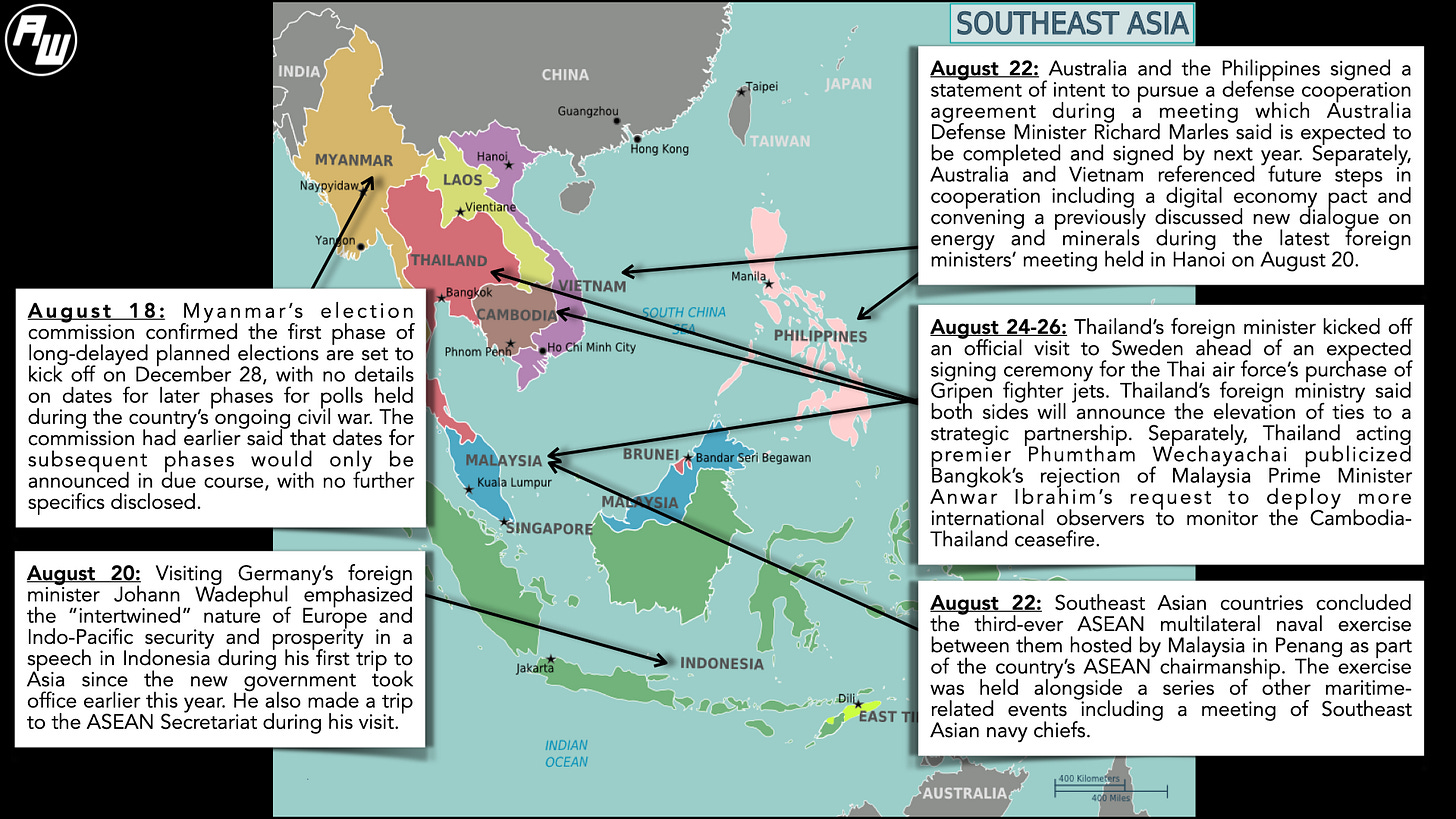

ASEAN countries took stock of maritime issues among them and with major partners during the third iteration of multilateral naval exercises between them in the grouping’s history1. One ASEAN defense official told ASEAN Wonk that apart from earlier changes including a “forwarding” of timing of the next iteration of a planned U.S.-ASEAN maritime exercise to later this year, there was nonetheless beginning to be relatively more clarity around how to sequence some of the so-called “Plus One” exercises for 2026 and 20272. The exercises also took place amid other quieter interactions that received relatively less attention in the media, including a scheduled meeting among Southeast Asian navy chiefs to take stock of the evolving regional maritime security agenda3.

Select Key Recent Defense Developments Involving Southeast Asian States Amid AMNEX 2025

Discussions did not shy away from touching on sensitive issues such as maritime coercion, even if the context was different relative to the previous iteration. The context for this year’s AMNEX was devoid of some of the controversy that had emerged during Indonesia’s holding of drills during its ASEAN chairmanship back in 2023 as we noted on ASEAN Wonk at the time, which saw some publicized divisions around aspects such as geographic location4. Nonetheless, in an indication of the level of anxiety among some practitioners in the maritime domain, explicit references were made in the deliberations to “maritime coercion” and “grey zone tactics” (which some have increasingly begun referring to instead as ICAD as an acronym for illegal, coercive, aggressive and deceptive activities by China in areas like the South China Sea)5.

Why It Matters

The developments also pointed to datapoints to watch across key areas with regional and global implications (see originally generated ASEAN Wonk table below on notable areas to monitor and additional specifics. Paying subscribers can read on for more on what to expect and future implications in the rest of the “Why It Matters” and “Where It’s Headed” sections, along with paid-only sections of the newsletter as usual).