New Geoeconomic JS-SEZ Moves Amid Rising Protectionism Fear

Plus South China Sea Sandy Cay seizure talk; big EV major power switch; new trade agreement; foreign influence fears; quiet security pact and much, much more.

Greetings to new readers and welcome all to the latest edition of the weekly ASEAN Wonk BulletBrief! If you haven’t already, you can upgrade to a paid subscription for $5 a month/$50 a year below to receive full posts by inserting your email address and then selecting an annual or monthly option. You can visit this page for more on pricing for institutions, groups as well as discounts. For current paid subscribers, please make sure you’re hitting the “view entire message” prompt if it comes up at the end of a post to see the full version.

For this iteration of ASEAN Wonk BulletBrief, we are looking at:

Assessing the geopolitical and geoeconomic significance of a major globalizing, cross-border initiative amid wider regional dynamics;

Mapping of regional developments, such as South China Sea seizure talk; twin mainland anniversaries; U.S.-ASEAN dialogue outcomes and more;

Charting evolving geopolitical, geoeconomic and security trends such as shifting semiconductor leadership landscape; new security pact and fresh digital payment deal;

Tracking and analysis of industry developments and quantitative indicators including giant electric vehicle major power switch; shifting nuclear power futures; big aviation upgrade and more;

And much more! ICYMI, check out our new ASEAN Wonk Podcast episode with a former regional grouping chief on thinking through the geopolitical and geoeconomic future of one of the world’s longest and largest rivers.

This Week’s WonkCount: 2,236 words (~10 minutes)

South China Sea Sandy Cay Seizure Talk; US-ASEAN Dialogue Outcomes; Twin Mainland Anniversaries & More

Global Growth Outlook; Criminal Network Hedging & Critical Minerals Policy Development

“Global growth is projected to drop to 2.8 percent in 2025 and 3 percent in 2026…corresponding to a cumulative downgrade of 0.8 percentage point, and much below the historical (2000–19) average of 3.7 percent,” warns the International Monetary Fund’s new iteration of its World Economic Outlook released amid the IMF and World Bank spring meetings. Released portions of the report dive into some of the drivers of the new growth forecast, including but not limited to the ongoing U.S. tariffs (link).

Historical Evolution of US Effective Tariff Rates

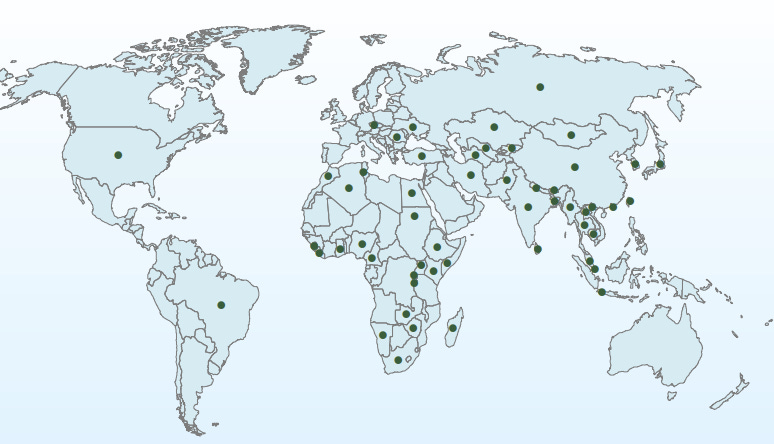

“Transnational organized crime groups in East and Southeast Asia are hedging beyond the region as crack-down pressure increases,” argues the United Nations Office on Drugs and Crime in the overview of a new report addressing scam centers and illicit networks in Southeast Asia. The report suggests that the trend has a truly global reach, with crackdowns targeting Asian-led scam centres that have been found operating in Africa, South Asia, the Middle East, and select Pacific islands, as well as related money laundering, trafficking in persons, and recruitment services discovered as far as Europe, North America, and South America (link).

Select Depiction of Origins of People Identified in Regional Scam Compounds

“Asia and the Pacific, with its rich deposits of critical minerals and dominant manufacturing base, stands at the forefront of this transition,” observes a new report on critical minerals by the Asian Development Bank. The report also notes Southeast Asia’s relevance in this transition more specifically, with the majority of countries being a source in areas such as manganese, copper, and cobalt and countries like Indonesia and the Philippines being among the ones to watch in the evolving regional regulatory landscape. It also notes that while countries are developing policies in this space, environmental-focused responses continue to lag those in other domains (link).

Recent Designated Asia-Pacific Industrial Policies on Critical Minerals — Cumulative and Compositional

New Geoeconomic JS-SEZ Moves Amid Rising Protectionism Fear

What’s Behind It

Southeast Asia’s first cross-border special economic zone of its kind saw some newly announced initiatives over the past week1. The initiatives announced by ASEAN chair Malaysia and neighboring Singapore were billed as an effort to showcase how countries can find opportunities in the face of crisis amid ongoing U.S. tariff talks. While states are certainly not lacking in agency, anxiety also continues to grip much of the region. ASEAN Wonk’s conversations with businesses in Ho Chi Minh City amid 50th anniversary reunification rehearsals this past week and after a regional geoeconomic meet in Bangkok reinforced that reality, in spite of Vietnam being early to enter talks. One supply chain leader from a Fortune 100 firm noted that an entire leadership retreat agenda had been overhauled following alerts by some suppliers that certain tariff scenarios may simply “price them out of existing contracts,” even as one internal probe suggested that making an entire iPhone in the United States would cost no less than around $6,500, higher than the floor quoted in some publicized estimates2. Concerns have also been publicized in relation to engagements this past week including the first China-Indonesia “2+2” talks and the U.S.-ASEAN dialogue3.

Select Key Recent Geoeconomic and Geopolitical Developments in Southeast Asia

The initiative bears careful watching within evolving regional geoeconomic conversations. Speaking at the forum where the new initiatives were launched, one senior official captured the public mood in some regional capitals when he mentioned that though the United States may be seen as an important “consumer of last resort,” efforts needed to be made to also strengthen regional cooperation and forge connections with the “bottom billions” of the world in South Asia, Africa and Latin America, moving away from a “made in” mentality for products to a “made by” mentality4. Yet officials also concede privately that diversification efforts will take a long time to concretize, while intra-ASEAN trade has remained low for decades and now at around 21 percent (in admittedly very different regional contexts like the European Union that rate has previously hovered on average at the 60 percent range and higher for some states)5. Many of these adjustments are also rooted in an export-oriented growth model that has powered some major Southeast Asian states to form the world’s fifth-largest economy in the face of historic intraregional rivalries and persistent competition.

Why It Matters

The new initiatives and developments also pointed to datapoints to watch in the future across key domains amid evolving regional and global dynamics (see originally generated ASEAN Wonk table below on notable areas to monitor and additional specifics. Paying subscribers can read on for more on what to expect and future implications in the rest of the “Why It Matters” and “Where It’s Headed” sections, along with paid-only sections of the newsletter as usual).