BRICS Summit Reveals Southeast Asia Links Amid Tariff Talks

Plus coming destroyers; anti-scam law trigger; submarine deal signing talk; new regional trade restrictions chatter; giant rail pilot and much, much more.

Greetings to new readers and welcome all to the latest edition of the weekly ASEAN Wonk BulletBrief! If you haven’t already, you can upgrade to a paid subscription for $5 a month/$50 a year below to receive full posts by inserting your email address and then selecting an annual or monthly option. You can visit this page for more on pricing for institutions, groups as well as discounts. For current paid subscribers, please make sure you’re hitting the “view entire message” prompt if it comes up at the end of a post to see the full version.

For this iteration of ASEAN Wonk BulletBrief, we are looking at:

Assessing the geopolitical and geoeconomic significance of the outcomes from Southeast Asian participation at the expanding BRICS summit in Brazil;

Mapping of regional developments, including new coming destroyers talk; cross-subregional links and ongoing ASEAN membership talks;

Charting evolving geopolitical, geoeconomic and security trends such as anti-scam law trigger and new regional trade restrictions chatter;

Tracking and analysis of industry developments and quantitative indicators including submarine deal signing talk; giant rail pilot and more;

And much more!

This Week’s WonkCount: 2,247 words (~10 minutes)

Coming Destroyers; ASEAN Membership Chatter & More

Military Diplomacy Battlegrounds; Reframing “Rerouting” Worries & Preemptive Crisis Planning

“Southeast Asia has emerged as a battleground for U.S.-China competition in military diplomacy,” observes a new National Defense University report examining the trajectory of Chinese military diplomacy globally. The report notes that Southeast Asia remains China’s chief focus in Asia when it comes to military diplomatic interactions, with the subregion accounting for around 49 percent of these interactions which is almost as much as the next three subregions combined (South Asia at 25 percent and Northeast Asia and Central Asia both at 13 percent each). Overall, Asia remains the highest priority region for Chinese military diplomacy, with Europe in second place and Africa a distant third (link).

Graphic Illustrating PLA Military Diplomatic Interactions in Asia, 2002-2024

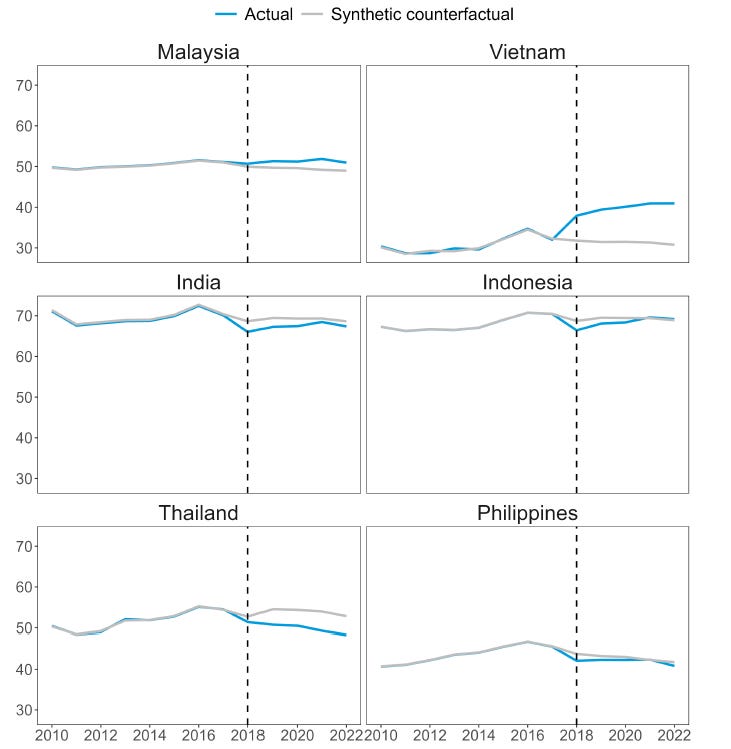

“Vietnam appears to have benefited from the trade allocation effect…rather than trade rerouting from China to circumvent tariffs,” notes a working paper released by the International Monetary Fund with a focus on six emerging market economies: India, Indonesia, Malaysia, Philippines, Thailand and Vietnam. The paper attempts to draw a distinction between trade reallocation — countries increase domestic production to substitute for declining Chinese exports to the United States—and trade rerouting— where countries serve as one-stop place for transshipment of Chinese exports to the United States (link).

Share of Domestic Value Added in Country Exports to US (Focused on Electrical and Machinery Products, in Percent; Actual vs. Synthetic Counterfactual)

“[F]irms need to be assisted to reopen as quickly as possible,” concludes a new study by the SMERU Research Institute in Indonesia on business experiences with closure, labor demand and investment levels drawing lessons from post-pandemic scarring. The report also includes recommendations for areas like preemptive firm support and technology and machinery facilitation (link).

Graphic Illustrating Proportion of Firms Experiencing Past Temporary Closure By Sector

BRICS Summit Reveals Southeast Asia Links Amid Tariff Talks

What’s Behind It

While the absence of Chinese and Russian dominated pre-BRICS summit headlines, the presence of newly participating Southeast Asian states was a key storyline in the engagements1. The influence of both Beijing and Moscow in Southeast Asia also continued to be felt despite the headlines around leader absences from BRICS summitry. Notable developments that went under the radar this week included a quiet trilateral security meet and the controversial exposure of behind the scene efforts to influence Southeast Asian state positions on the Ukraine war beyond their existing engagement efforts2. Leaks from the leaders’ declaration began circulating even before the summit sessions kicked off, even though officials pointed out to ASEAN Wonk that they did not necessarily constitute surprising datapoints around divergences within an expanded BRICS3.

Select Notable Recent Regional Developments Amid BRICS Summit

Geopolitical and geoeconomic engagement by Southeast Asian states at BRICS also occurred in the shadow of other developments such as a Quad ministerial and expiry of an initial U.S. tariff deadline. While close U.S. allies and partners had long expected the publicization this past week at the Quad ministerial of what U.S. officials have termed in briefings as a more “delivery-focused” grouping, there are questions about what exactly such “delivery” will mean even among countries like the Philippines beyond generally supportive public statements amid uncertainties in other areas of U.S. policy such as tariffs4. With respect to the BRICS more specifically, notable pre-summit cross-continental stops made by top Southeast Asian officials also pointed to the global nature of ongoing diversification searches and the pressure to measure success5.

Why It Matters

The state of play also points to future datapoints to watch within the BRICS and regional states across priority areas and pillars (see originally generated ASEAN Wonk table below on notable areas to monitor and additional specifics. Paying subscribers can read on for more on what to expect and future implications in the rest of the “Why It Matters” and “Where It’s Headed” sections, along with paid-only sections of the newsletter as usual).