Advancing the Australia-Indonesia Comprehensive Strategic Partnership in the Indo-Pacific: The Expectations Management Challenge

Plus Vietnam's approach to AI and content moderation; Japanese investment in Southeast Asia and much more.

Welcome to this week’s edition of the ASEAN Wonk BulletBrief! For this iteration, we are looking at:

Assessing the outcomes from the Indonesia-Australia leaders’ meeting this week and their significance in perspective;

Mapping of key regional developments including the China-led Mekong River patrols, U.S.-Singapore drills and Cambodia’s sparring with Meta ahead of the country’s upcoming elections;

Evolving trends related to China’s mineral investment abuse in Southeast Asia as well as ASEAN’s big digital talent gap and why it matters;

Tracking and data-driven analysis of industry developments such as Vietnam’s approach to AI and content moderation and Japanese business perceptions of Southeast Asian markets;

And much more! (ICYMI: Check out our latest deeper dive into ASEAN’s artificial intelligence landscape earlier this week).

WonkCount: 1,735 words (~ 8 minutes reading time)

Vietnam’s Barbie South China Sea Ban; Singapore-US Exercise; Cambodia-Meta Sparring & More

Assessing the Australia-Indonesia Comprehensive Strategic Partnership in the Indo-Pacific: The Expectations Management Challenge

The outcomes from this week’s Indonesia-Australia annual leaders’ meeting spotlight the ongoing expectations management challenge in ties between two significant Indo-Pacific actors, with notable progress being made within a fairly recent institutional architecture but also lingering gaps in strategic alignment as both sides deal with a mix of bilateral, regional and global changes.

What’s Behind It

The leaders of Indonesia and Australia met for the latest iteration of their annual leaders’ meeting. The meeting was held in Sydney on July 4 between visiting Indonesian President Joko “Jokowi” Widodo and Australian Prime Minister Anthony Albanese, following last year’s iteration which was held in Bogor.

The meeting is part of a fairly recent institutional architecture put in place by both sides in a historically rocky relationship that has evolved into a comprehensive strategic partnership and is not without its challenges. Though ties date back to 1949, the ongoing effort to forge a closer partnership has been taking place in the context of periods of tension not just in Cold War-era events like Indonesia’s annexation of East Timor, but also in recent developments such as the phone tapping scandal under Jokowi’s predecessor Susilo Bambang Yudhoyono or the temporary suspension of military ties in 2017 during Jokowi’s first term. The architecture within which ties are being managed today is also a relatively recent one. Indeed, this is just the eighth iteration of the annual leaders’ meeting between the two sides put in place in 2011 just three years before Jokowi took office, and the comprehensive partnership itself was jointly promulgated in 2018 (though both sides had been charting this path to various degrees dating back to the 2000s).

Select Notable Recent Bilateral Arrangements in Australia-Indonesia Relations

Why It Matters

The engagement spotlights the expectations management challenge for ties given both the trajectory of relations and the manifold issues both countries confront. On the one hand, routinizing high-level engagements and building out concrete cooperation across functional areas in the economic and people-to-people realms are themselves notable achievements given the relatively new institutional architecture of the relationship, the fragility that ties have historically demonstrated given their mixed history as well as Jokowi’s greater emphasis on domestic and economic affairs in his administration’s foreign policy. On the other hand, the pressure is also growing on capable Indo-Pacific actors like Indonesia and Australia to forge a much more global vision as some have argued within the context of a much more contested strategic environment than when Jokowi took office, with China’s continued assertiveness, escalating U.S.-China tensions, Russia’s invasion of Ukraine and the rise of minilaterals institutions such as the Quad and AUKUS which have tested the partnership.

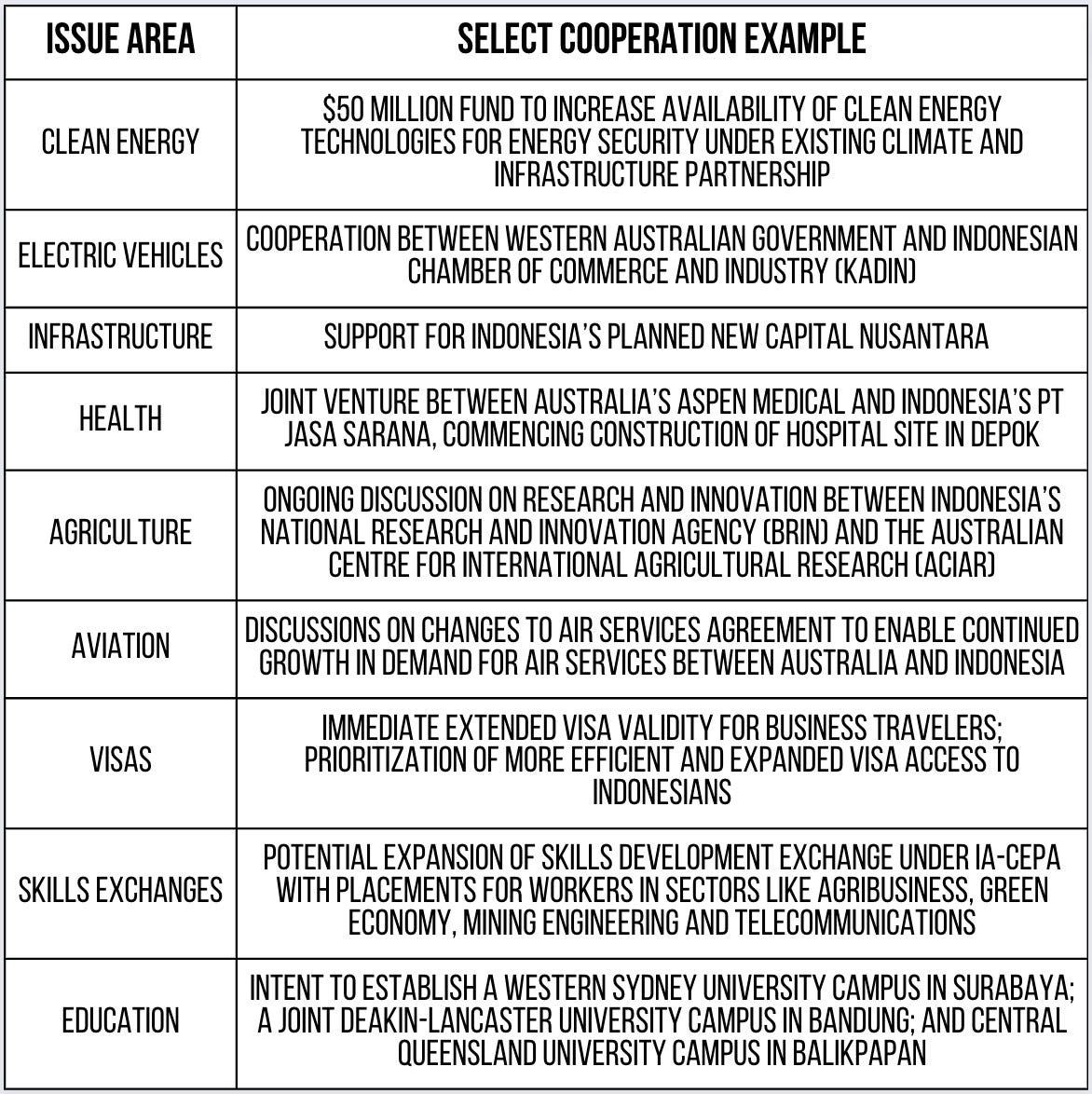

Both sides announced areas of cooperation, largely building off of avenues previously explored (see table below). Economically, notable items included a $50 million fund on clean energy technologies within a new climate and infrastructure partnership and support for Indonesia’s planned new capital Nusantara — items that dominated Jokowi’s relatively brief publicized introductory remarks at the leaders’ meeting. There were also important steps taken to boost people-to-people ties, such as improving visa access and deepening education links. Though there was relatively less publicized focus on security ties, the two countries have also been looking to upgrade the current iteration of their defense cooperation agreement, inked in 2021, to one that is a treaty level and binding under international law, with provisions on areas such as reciprocal access to training ranges and streamlined processes for joint activities.

Key Cooperation Items in 2023 Indonesia-Australia Leaders’ Meeting Joint Communique

Where It’s Headed

With the leaders’ meeting concluded, the focus will shift to follow-up work in the coming months in bilateral ties. Jokowi indicated economic areas where both sides could look to make progress on, and the next major interaction between the two leaders will be in a regional setting during Albanese’s visit to Indonesia in September when Jakarta will be chairing the next round of ASEAN summitry. Yet functional cooperation on areas such as electric vehicles or clean energy will also not be without their challenges given complicating strategic realities such as China’s role in the EV value chain, the ongoing push and pull dynamics in Indonesia’s energy transition between Jakarta’s interests and that of its partners, as well as some of Jokowi’s measures to push the country up the value chain like export bans which are seen as manifestions of economic nationalism to more market-friendly advocates.

Both sides will also be developing their regional approaches in the coming months that will have implications for ties. Most visibly, as ASEAN chair, Indonesia will be looking to help lead the grouping’s development of its Indo-Pacific Outlook, while Australia will be progressing its approach to Southeast Asia more generally as a major dialogue partner, with the expected release of its economic strategy for Southeast Asia and the convening of the ASEAN-Australia summit next March as the two sides commemorate the 50th anniversary of their dialogue relations. Yet ties will also evolve alongside the development of other partnerships and minilateral arrangements too, be it Indonesia-Australia cooperation with third countries in the Pacific which both sides have committed to within their overall partnership, or flexible, sector-specific ties like increasing U.S.-Australia-Indonesia defense cooperation, as seen through Jakarta’s participation in Exercise Crocodile Response last year which has continued on into 2023, in addition to the expanded Super Garuda Shield exercise.

Domestic political realignment will also be a key variable. Though some may have become used to Jokowi’s domestic-focused foreign policy approach over the past decade, which has lasted through four Australian prime ministers, he is term limited going into Jakarta’s next elections, and it is far from clear the extent of continuity and change we may see from his successor on foreign policy. The extent to which Australia’s shifting political dynamics spill over into foreign policy issues will also be key to watch ahead of the next election set to be held during or before 2025, as observers were reminded of with Jokowi’s meeting with Australia's Leader of the Opposition Peter Dutton during his trip.

China’s Minerals Abuse Concerns; EU-ASEAN Prospects; ASEAN’s Big Digital Talent Gap

“Indonesia has recorded the highest number of allegations of abuse,” notes a new report on the human rights impacts of Chinese overseas investment in minerals released by the Business & Human Rights Resource Center. Indonesia saw 27 cases of alleged human rights abuse, the majority of which were at nickel smelters/refiners producing ferronickel and stainless steel or EV battery materials (overall, the report notes that nickel is the mineral with the second-highest number of allegations after copper). Apart from Indonesia, Myanmar ranks fourth on the list by numbers of abuse allegations, with 11 (link).

No. of China Mineral Investment Rights Abuses

“The EU and ASEAN have a mutual need…for a relationship based on true cooperation and the realization of concrete outcomes,” concludes a report on the future of EU-ASEAN relations by the Carnegie Europe on the state of the relationship. The report looks at individual areas of ties and also acknowledges the need to manage structural issues, be it differences between the EU and ASEAN as institutions or divergences over issues such as democracy and human rights (link).

Top Non-ASEAN Investors in ASEAN, 2010-2021

“The area of digital skills and talent is ASEAN’s worst-performing indicator,” observes a piece published by the Institute of Southeast Asian studies on realizing ASEAN’s digital economy potential in this area given its relatively weak performance in the ASEAN Digital Integration Index (ADII). Recommendations are given in aspects like student mobility and digital skill advancement (link).